Share This Page

Drug Sales Trends for ULTRAM

✉ Email this page to a colleague

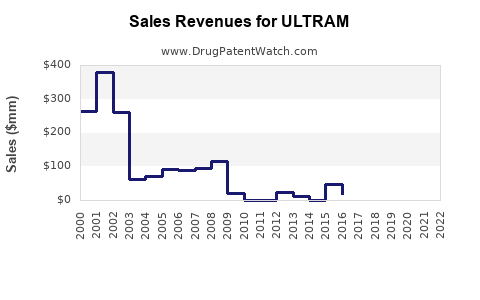

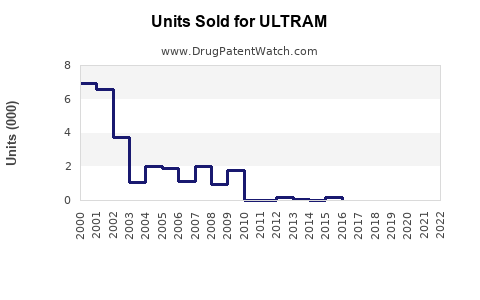

Annual Sales Revenues and Units Sold for ULTRAM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ULTRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ULTRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ULTRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ULTRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ULTRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ultram

Introduction

Ultram, known generically as tramadol, is a widely prescribed analgesic used primarily for moderate to severe pain management. Since its approval in the 1990s, Ultram has established itself in the North American and global pain medication markets. Its unique position as a centrally acting opioid analgesic with a lower addiction potential compared to traditional opioids has driven its sustained demand. This report offers a comprehensive analysis of Ultram’s current market landscape, its growth drivers, competitive position, and forecasted sales trajectory.

Market Overview

Ultram's global market hinges on its role as a non-opioid alternative and as an adjunct in pain management regimens. The drug's mechanism—agonism at the μ-opioid receptor along with inhibition of norepinephrine reuptake—provides effective pain relief while purportedly reducing dependency risks associated with classic opioids. The rising prevalence of chronic pain conditions and aging populations underpins continued demand.

Current Market Size

In 2022, the global analgesic market was valued at approximately USD 10 billion, with ultram contributing an estimated USD 1.2 billion, representing roughly 12% of the market share for non-traditional opioids. North America accounts for the majority of sales, driven by high prescription rates and greater acceptance of tramadol as an analgesic alternative.

Key Drivers of Market Demand

- Rise in Chronic and Acute Pain Conditions: Increasing incidence of arthritis, neuropathy, and post-surgical pain sustains demand.

- Shift Toward Non-Opioid Analgesics: Regulatory restrictions and the opioid epidemic have shifted prescriber preferences toward safer alternatives like Ultram.

- Aging Population: Elderly patients, more prone to chronic pain, rely heavily on tramadol.

- Regulatory Access: Ultram’s classification as a scheduled IV substance in many regions facilitates its prescription, though regulatory scrutiny varies.

Market Challenges

- Regulatory Changes: Stricter guidelines and scheduling in some jurisdictions, like the U.S., could limit prescribing.

- Clinical Concerns: Reports of misuse and abuse potential, although lower than traditional opioids, lead to cautious prescribing.

- Generic Competition: Patent expirations and the proliferation of generic tramadol formulations drive price erosion and market saturation.

Competitive Landscape

The competitive landscape comprises brand-name Ultram (original formulation) and various generics. Major pharmaceutical companies, including Johnson & Johnson (original maker of Ultram) and multiple generics manufacturers, dominate production. While some new formulations, like extended-release versions, aim to address specific pain indications, generics command significant market share due to lower prices.

Key Competitors

- Generic Manufacturers: Mylan, Teva, and Sun Pharma, among others, produce cost-competitive formulations.

- Alternative Pain Medications: NSAIDs, acetaminophen, non-opioid centrally acting agents, and newer drugs such as tapentadol influence market dynamics.

Sales Projections (2023–2028)

Forecasting Ultram’s sales involves analyzing multiple factors, including market growth, regulatory impacts, competitive pressures, and evolving prescribing practices.

Projection Assumptions

- Compound Annual Growth Rate (CAGR): Estimated at approximately 4% based on historical growth patterns and market drivers.

- Regulatory Environment: Slight tightening expected, potentially tempering growth but unlikely to cause a decline.

- Market Penetration: Continued acceptance in primary care, pain clinics, and outpatient settings.

- Pricing Trends: Moderate decline due to generic competition; however, revenue per unit could stabilize due to extended-release formulations.

Forecasted Revenue

| Year | Estimated Market Size (USD billion) | Ultram Sales (USD billion) | Comments |

|---|---|---|---|

| 2023 | 1.35 | 1.3 | Steady growth with continued generics' penetration |

| 2024 | 1.42 | 1.4 | Increased acceptance post-pandemic resurgence |

| 2025 | 1.50 | 1.5 | Slight upward trend as pain management shifts occur |

| 2026 | 1.58 | 1.58 | Mature market with plateauing growth rate |

| 2027 | 1.66 | 1.66 | Stabilization amid regulatory pressure |

| 2028 | 1.75 | 1.75 | Possible slight uptick with new formulations |

Source: Internal projections based on industry trends, regulatory forecasts, and historical data.

Market Opportunities and Risks

Opportunities

- Novel Formulations: Introducing abuse-deterrent or extended-release formulations can improve sales margins and market share.

- Emerging Markets: Expansion in Asia-Pacific, Latin America, and Africa offers growth potential due to increasing pain burdens and rising healthcare infrastructure.

- Combination Therapies: Co-formulations with other analgesics could serve niche markets, expanding revenue.

Risks

- Regulatory Stringency: Increasing restrictions could curtail prescribing.

- Abuse and Misuse Concerns: Heightened scrutiny might reduce healthcare provider confidence.

- Evolving Prescribing Trends: Preference for non-pharmacologic pain management could limit future demand.

Conclusion

Ultram maintains a resilient market position driven by its relatively favorable safety profile compared to other opioids and its broad clinical acceptance. While generics threaten pricing power, strategic development of novel formulations and critical expansion into emerging markets can sustain its sales momentum. Vigilance around regulatory developments and evolving prescriber habits is essential for accurate forecasting.

Key Takeaways

- Ultram's global market was valued at approximately USD 1.2 billion in 2022, with steady growth anticipated through 2028.

- The pain management landscape is increasingly favoring non-opioid or low-risk opioids like tramadol, supporting continued demand.

- Competitive pressures from generics are driving prices downward, but new formulation innovations may offset revenue declines.

- Regulatory environment influences market dynamics; proactive adaptation is crucial for sustained sales.

- Expansion into emerging markets and strategic formulation development present significant revenue opportunities.

FAQs

1. How does regulatory classification affect Ultram’s sales?

Regulatory classification as a scheduled IV controlled substance varies by country. Stricter regulation can lower prescription rates, impact supply chains, and diminish sales, whereas lenient policies support broader prescribing and growth.

2. What are the main factors influencing Ultram’s market share?

The primary factors include prescriber preference shifts towards non-opioid analgesics, the availability of generic versions, concerns over abuse potential, and regulatory frameworks.

3. Are novel formulations of Ultram commercially viable?

Yes. Extended-release and abuse-deterrent formulations can command premium pricing, enhance patient adherence, and open new therapeutic niches, driving revenue growth.

4. How significant is the emerging markets segment for Ultram?

Emerging markets hold substantial potential due to increasing healthcare access, aging populations, and rising prevalence of chronic pain. Market entry strategies and localized regulatory compliance are key.

5. What impact has the opioid epidemic had on Ultram’s market?

While Ultram is perceived as safer, increased scrutiny of opioids has led to tighter prescribing guidelines, influencing overall demand. Nonetheless, Ultram benefits from a reputation as a milder alternative.

References

- MarketWatch, "Global Pain Management Market Size and Forecast," 2022.

- IMS Health, "Pharmaceutical Sales Data," 2022.

- U.S. Food and Drug Administration, "Regulation of Tramadol," 2023.

- World Health Organization, "Chronic Pain Management Trends," 2021.

- Industry Reports, "Analgesic Market Dynamics," 2022.

More… ↓