UBRELVY Drug Patent Profile

✉ Email this page to a colleague

When do Ubrelvy patents expire, and what generic alternatives are available?

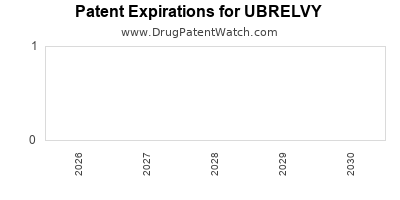

Ubrelvy is a drug marketed by Abbvie and is included in one NDA. There are sixteen patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and nine patent family members in forty-six countries.

The generic ingredient in UBRELVY is ubrogepant. One supplier is listed for this compound. Additional details are available on the ubrogepant profile page.

DrugPatentWatch® Generic Entry Outlook for Ubrelvy

Ubrelvy was eligible for patent challenges on December 23, 2023.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be January 30, 2035. This may change due to patent challenges or generic licensing.

There have been two patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There is one tentative approval for the generic drug (ubrogepant), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for UBRELVY?

- What are the global sales for UBRELVY?

- What is Average Wholesale Price for UBRELVY?

Summary for UBRELVY

| International Patents: | 109 |

| US Patents: | 16 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 34 |

| Clinical Trials: | 7 |

| Drug Prices: | Drug price information for UBRELVY |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for UBRELVY |

| What excipients (inactive ingredients) are in UBRELVY? | UBRELVY excipients list |

| DailyMed Link: | UBRELVY at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for UBRELVY

Generic Entry Date for UBRELVY*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for UBRELVY

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| AbbVie | Phase 1 |

| AbbVie | Phase 4 |

| Chicago Headache Center & Research Institute | Phase 4 |

Pharmacology for UBRELVY

| Drug Class | Calcitonin Gene-related Peptide Receptor Antagonist |

| Mechanism of Action | Calcitonin Gene-related Peptide Receptor Antagonists |

Paragraph IV (Patent) Challenges for UBRELVY

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| UBRELVY | Tablets | ubrogepant | 50 mg and 100 mg | 211765 | 4 | 2023-12-26 |

US Patents and Regulatory Information for UBRELVY

UBRELVY is protected by seventeen US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of UBRELVY is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,117,836.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Abbvie | UBRELVY | ubrogepant | TABLET;ORAL | 211765-002 | Dec 23, 2019 | RX | Yes | Yes | 12,458,632 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | UBRELVY | ubrogepant | TABLET;ORAL | 211765-001 | Dec 23, 2019 | RX | Yes | No | 8,754,096 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Abbvie | UBRELVY | ubrogepant | TABLET;ORAL | 211765-002 | Dec 23, 2019 | RX | Yes | Yes | 9,833,448 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Abbvie | UBRELVY | ubrogepant | TABLET;ORAL | 211765-002 | Dec 23, 2019 | RX | Yes | Yes | 10,117,836 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | UBRELVY | ubrogepant | TABLET;ORAL | 211765-001 | Dec 23, 2019 | RX | Yes | No | 11,717,515 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Abbvie | UBRELVY | ubrogepant | TABLET;ORAL | 211765-001 | Dec 23, 2019 | RX | Yes | No | 11,925,709 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | UBRELVY | ubrogepant | TABLET;ORAL | 211765-002 | Dec 23, 2019 | RX | Yes | Yes | 12,070,450 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for UBRELVY

When does loss-of-exclusivity occur for UBRELVY?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 15214502

Estimated Expiration: ⤷ Get Started Free

Patent: 19226239

Estimated Expiration: ⤷ Get Started Free

Patent: 21245229

Estimated Expiration: ⤷ Get Started Free

Patent: 21409718

Estimated Expiration: ⤷ Get Started Free

Patent: 23258317

Estimated Expiration: ⤷ Get Started Free

Patent: 25220825

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2016017999

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 37315

Estimated Expiration: ⤷ Get Started Free

Patent: 37942

Estimated Expiration: ⤷ Get Started Free

Patent: 06184

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5939715

Estimated Expiration: ⤷ Get Started Free

Patent: 5960397

Estimated Expiration: ⤷ Get Started Free

Patent: 2022818

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 02188

Estimated Expiration: ⤷ Get Started Free

Patent: 02210

Estimated Expiration: ⤷ Get Started Free

Patent: 02211

Estimated Expiration: ⤷ Get Started Free

Patent: 02564

Estimated Expiration: ⤷ Get Started Free

Patent: 37412

Patent: FORMULATIONS À DISPERSION SOLIDE DE COMPOSÉS ANTIVIRAUX (SOLID DISPERSION FORMULATIONS OF ANTIVIRAL COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 32218

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6828

Patent: פורמולציית טבליה לחומרים הפועלים על cgrp (Tablet formulation for cgrp-active compounds)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 91669

Estimated Expiration: ⤷ Get Started Free

Patent: 66490

Estimated Expiration: ⤷ Get Started Free

Patent: 17505306

Patent: CGRP活性化合物の錠剤製剤

Estimated Expiration: ⤷ Get Started Free

Patent: 19108366

Patent: CGRP活性化合物の錠剤製剤 (TABLET FORMULATION FOR CGRP ACTIVE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 3378

Patent: FORMULACIÓN DE TABLETA PARA COMPUESTOS ACTIVOS DE PÉPTIDO RELACIONADO CON EL GEN DE CALCITONINA. (TABLET FORMULATION FOR CGRP-ACTIVE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Patent: 16010169

Patent: FORMULACION DE TABLETA PARA COMPUESTOS ACTIVOS DE PEPTIDO RELACIONADO CON EL GEN DE CALCITONINA. (TABLET FORMULATION FOR CGRP-ACTIVE COMPOUNDS.)

Estimated Expiration: ⤷ Get Started Free

Patent: 21006790

Patent: FORMULACION DE TABLETA PARA COMPUESTOS ACTIVOS DE PEPTIDO RELACIONADO CON EL GEN DE CALCITONINA. (TABLET FORMULATION FOR CGRP-ACTIVE COMPOUNDS.)

Estimated Expiration: ⤷ Get Started Free

Patent: 23007575

Patent: TRATAMIENTO DE LA MIGRAÑA. (TREATMENT OF MIGRAINE.)

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 96578

Patent: ТЕХНОЛОГИЯ ПРИГОТОВЛЕНИЯ ТАБЛЕТОК ДЛЯ CGRP-АКТИВНЫХ СОЕДИНЕНИЙ (TABLETS PREPARATION TECHNOLOGY FOR CGRP-ACTIVE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Patent: 19123406

Patent: ТЕХНОЛОГИЯ ПРИГОТОВЛЕНИЯ ТАБЛЕТОК ДЛЯ CGRP-АКТИВНЫХ СОЕДИНЕНИЙ

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 6371613

Patent: CGRP صيغة قرص لمركبات نشطة تجاه (Tablet Formulation for CGRP-Active Compounds)

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2448369

Estimated Expiration: ⤷ Get Started Free

Patent: 160113296

Patent: CGRP-활성 화합물에 대한 정제 제제 (TABLET FORMULATION FOR CGRP-ACTIVE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Patent: 220136460

Patent: CGRP-활성 화합물에 대한 정제 제제 (CGRP- TABLET FORMULATION FOR CGRP-ACTIVE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Patent: 230107902

Patent: CGRP-활성 화합물에 대한 정제 제제 (CGRP- TABLET FORMULATION FOR CGRP-ACTIVE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering UBRELVY around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Serbia | 53610 | ANTAGONISTI PIPERIDINON KARBOKSAMID AZAINDAN CGRP RECEPTORA (PIPERIDINONE CARBOXAMIDE AZAINDANE CGRP RECEPTOR ANTAGONISTS) | ⤷ Get Started Free |

| Morocco | 34650 | ANTAGONISTES DU RÉCEPTEUR CGRP DE PIPÉRIDINONE CARBOXAMIDE AZAINDANE | ⤷ Get Started Free |

| Poland | 2821407 | ⤷ Get Started Free | |

| Taiwan | I487706 | ⤷ Get Started Free | |

| Mexico | 2021006790 | FORMULACION DE TABLETA PARA COMPUESTOS ACTIVOS DE PEPTIDO RELACIONADO CON EL GEN DE CALCITONINA. (TABLET FORMULATION FOR CGRP-ACTIVE COMPOUNDS.) | ⤷ Get Started Free |

| Canada | 2937942 | ⤷ Get Started Free | |

| New Zealand | 610468 | Piperidinone carboxamide azaindane cgrp receptor antagonists | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for UBRELVY

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2638042 | PA2023532,C2638042 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: ATOGEPANTAS ARBA FARMACINIU POZIURIU PRIIMTINA JO DRUSKA; REGISTRATION NO/DATE: EU/1/23/1750 20230811 |

| 2638042 | C20230034 | Finland | ⤷ Get Started Free | |

| 2638042 | C02638042/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: ATOGEPANT; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 69128 06.03.2024 |

| 2638042 | 301248 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: ATOGEPANT OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN; REGISTRATION NO/DATE: EU/1/23/1750 20230814 |

| 2638042 | 23C1039 | France | ⤷ Get Started Free | PRODUCT NAME: ATOGEPANT DANS TOUTES LES FORMES PROTEGEES PAR LE BREVET DE BASE; REGISTRATION NO/DATE: EU/1/23/1750 20230814 |

| 2638042 | 34/2023 | Austria | ⤷ Get Started Free | PRODUCT NAME: ATOGEPANT ODER EIN PHARMAZEUTISCH ANNEHMBARES SALZ DAVON; REGISTRATION NO/DATE: EU/1/23/1750 (MITTEILUNG) 20230814 |

| 2638042 | CR 2023 00033 | Denmark | ⤷ Get Started Free | PRODUCT NAME: ATOGEPANT OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF; REG. NO/DATE: EU/1/23/1750 20230814 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

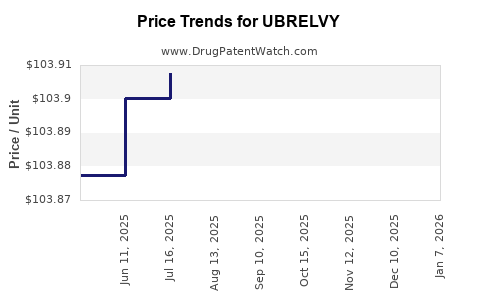

Market Dynamics and Financial Trajectory for UBRELVY

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.