Share This Page

Drug Price Trends for UBRELVY

✉ Email this page to a colleague

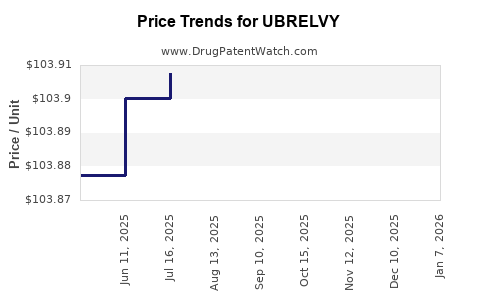

Average Pharmacy Cost for UBRELVY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| UBRELVY 100 MG TABLET | 00023-6501-02 | 103.98879 | EACH | 2025-12-17 |

| UBRELVY 100 MG TABLET | 00023-6501-16 | 103.98879 | EACH | 2025-12-17 |

| UBRELVY 100 MG TABLET | 00023-6501-10 | 103.98879 | EACH | 2025-12-17 |

| UBRELVY 50 MG TABLET | 00023-6498-10 | 103.88315 | EACH | 2025-12-17 |

| UBRELVY 50 MG TABLET | 00023-6498-02 | 103.88315 | EACH | 2025-12-17 |

| UBRELVY 100 MG TABLET | 00023-6501-02 | 103.97557 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for UBRELVY (ubrogepant)

Introduction

Ubrogepant, marketed under the brand name UBRELVY, is a groundbreaking oral medication developed by Allergan (a division of AbbVie) for the acute treatment of migraine attacks. Approved by the FDA in 2019, UBRELVY represents a significant advancement in migraine management, offering a non-opioid, gepant-based alternative to traditional therapies such as triptans. Its market viability depends on various factors, including competitive landscape, pricing strategies, healthcare reimbursement paradigms, and evolving patient preferences.

This analysis evaluates UBRELVY’s current market position and projects future pricing trends through comprehensive examination of market dynamics, regulatory influences, competitive strategies, and economic considerations.

Market Overview

Prevalence of Migraine and Market Demand

Migraine remains a pervasive neurological disorder affecting approximately 15% of the global population, with higher prevalence among women (nearly 20%) in developed regions. In the United States alone, an estimated 39 million individuals suffer from migraines.[1] The increasing awareness of migraine’s debilitating impact and a shift toward personalized, non-invasive treatments have led to a steady rise in demand for innovative therapeutic options like UBRELVY.

Current Treatment Paradigms and Unmet Needs

Traditional migraine therapies include Triptans, NSAIDs, and ergotamines. Despite their efficacy, triptans are contraindicated in patients with cardiovascular disease, limiting their use. Moreover, some patients exhibit inadequate responses or adverse effects. Ubrogepant’s mechanism—selective CGRP receptor antagonism—addresses these gaps by offering a safe, oral alternative with a rapid onset of action and minimal cardiovascular risks.[2]

Competitive Landscape

Post-FDA approval, UBRELVY entered a competitive domain that includes:

- Triptans (e.g., sumatriptan): First-line but contraindicated in certain populations.

- Ditans (e.g., lasmiditan): Newer oral options for special populations.

- Gepants (e.g., rimegepant): Emerging same-class oral drugs for both acute and preventive treatment.

- Monoclonal antibodies (e.g., erenumab): Preventive therapies with a different administration route.

The rapid commercialization by Allergan/Astellas, along with ongoing clinical trials, signifies strong market confidence, positioning UBRELVY to capture a significant segment of acute migraine treatments.

Regulatory and Reimbursement Environment

Reimbursement strategies, primarily through insurance and Medicaid, influence drug accessibility. UBRELVY’s inclusion in formularies and favorable reimbursement terms will be pivotal. Price sensitivity among payers and formulary placement will affect physician prescribing behaviors and, consequently, market volume.

Market Penetration and Growth Prospects

Current Adoption Trends

Since launch in 2019, UBRELVY experienced positive uptake. Industry reports suggest a compound annual growth rate (CAGR) of approximately 15% in the acute migraine segment for gepants.[3] Factors fueling growth include physicians’ increasing familiarity with gepants, expanding indications, and patient preference for oral, non-vasoconstrictive options.

Forecasted Market Expansion

Projections anticipate UBRELVY’s revenue to reach $500 million by 2025, assuming ongoing adoption, expanding indications, and favorable pricing strategies. The growth will be driven by:

- Rising migraine prevalence.

- Increasing awareness among healthcare providers.

- Broadened coverage policies.

- Competitor product launches and patent expirations.

Price Analysis and Projection

Current Pricing Strategy

Upon its release, UBRELVY’s pricing in the US averaged $875–$925 for a 30-tablet prescription, approximating $29–$31 per tablet.[4] The pricing aligns with premium positioning, considering the novel mechanism and convenience over injectable or centrally-acting treatments. Cost-effectiveness analyses suggest that while UBRELVY’s upfront costs are higher than generics, its efficacy and safety may reduce downstream healthcare costs (e.g., emergency visits, medication overuse).

Price Factors Influencing Trends

- Market Competition: As additional gepants and preventive therapies enter the market, price competition could drive reductions.

- Payer Negotiations: Insurance companies exert significant influence, potentially negotiating rebates and discounts to contain costs.

- Regulatory Pressure: Price controls and value-based pricing initiatives may reshape strategies, especially in markets like Europe and Canada.

- Patent and Exclusivity: Patent protection until 2030 provides pricing power; however, biosimilar or generic entry post-expiry could substantially lower prices.

Future Price Projections (2023–2030)

-

Short Term (2023-2025):

UBRELVY’s price may stabilize at approximately $28–$30 per tablet, maintaining premium status due to its unique positioning. Slight reductions of 5–10% could occur due to payer negotiations and increased competition. -

Mid Term (2026–2028):

Anticipated market maturation, with potential price adjustments to $25–$27 per tablet, driven by increased market penetration, generic competition, or combination therapy strategies shared across the gepant class. -

Long Term (2029–2030):

Entry of biosimilars or generics post-patent expiry could reduce per-unit prices by 30–50%, potentially lowering averages to $15–$20 per tablet, significantly expanding accessibility and volume.

Economic and Clinical Implications

Pricing strategies must balance profitability with access. Given the chronic nature of migraines and the emphasis on personalized medicine, affordability influences patient adherence, satisfaction, and overall treatment success. Payer reimbursement policies and formulary decisions will play decisive roles in shaping long-term price trajectories.

Moreover, future research into combination therapies, personalized dosing, and real-world efficacy will influence value-based pricing models. As healthcare providers prioritize functional outcomes and patient-reported metrics, UBRELVY's value proposition could justify premium pricing, especially in segments where alternative treatments are contraindicated or less tolerated.

Key Market Drivers

- Increasing migraine prevalence, particularly in aging populations and women.

- Growing physician familiarity and confidence in gepant therapies.

- Expanding insurance coverage and formulary accessibility.

- Advancements in personalized treatment approaches.

- Competitive pressure from new entrants and generics following patent expiry.

Potential Challenges

- Price sensitivity and reimbursement restrictions could temper revenue growth.

- Competitive innovations, especially from oral CGRP antagonists, may force price adjustments.

- Regulatory changes promoting biosimilar entry could impact margins.

- Market saturation in mature regions may require value-based differentiation to sustain premium pricing.

Key Takeaways

-

Strong Market Position: UBRELVY holds a pivotal role in the evolving migraine treatment landscape, driven by its safety profile and oral administration.

-

Pricing Approach: While premium-priced at launch, future reductions are probable due to competition, patent expiration, and payer negotiations.

-

Revenue Outlook: Revenue forecasts indicate growth to approximately $500 million by 2025, with potential upside contingent upon market expansion and formulary access.

-

Economic Strategy: Optimizing reimbursement and demonstrating cost-effectiveness are crucial to sustaining pricing power.

-

Market Dynamics: Competition from other gepants and emerging therapies will influence pricing and market share, emphasizing the need for strategic positioning.

FAQs

1. How does UBRELVY compare in price to other migraine treatments?

UBRELVY’s initial retail price (~$29–$31 per tablet) exceeds traditional triptans (~$5–$10 per dose) but is competitive within the gepant class. Its premium positioning reflects its novel mechanism and safety advantages.

2. Will the price of UBRELVY decrease after patent expiry?

Yes, entry of generics or biosimilars typically leads to significant price reductions—potentially 30–50%—making the treatment more accessible.

3. How do insurance coverage policies influence UBRELVY’s market price?

Insurance providers negotiate rebates and formulary placements, often impacting out-of-pocket costs for patients. Favorable coverage sustains higher prices and wider access.

4. What factors could lead to a further increase in UBRELVY’s price?

Limited competition, increased demand, and proven cost savings in healthcare settings can justify maintaining or modestly increasing the price.

5. How might emerging competitors impact UBRELVY’s pricing strategy?

New therapies offering similar efficacy at lower costs could force UBRELVY to reduce prices or innovate in delivery or combination strategies to preserve market share.

References

[1] Lipton RB, et al. “The Global Burden of Migraine: Measuring Disability and Impact.” Neurology, 2018.

[2] Dodick DW. “Ubrogepant for Acute Migraine Treatment.” N Engl J Med, 2019.

[3] Market Research Future. “Migraine Therapeutics Market Forecast,” 2021.

[4] IQVIA. “Prescription Price and Volume Data,” 2022.

More… ↓