Last updated: August 18, 2025

Introduction

TYBLUME (generic name pending approval) is positioned as a novel therapeutic agent within its designated pharmacological class, targeting an essential aspect of disease pathology with potential broad-spectrum applications. With regulatory approvals imminent or recently obtained in key markets, understanding the evolving market dynamics and projected financial trajectory for TYBLUME is critical for stakeholders, including investors, healthcare providers, and strategic partners.

Market Landscape and Competitive Environment

Disease Indication and Market Demand

TYBLUME is primarily indicated for a high-prevalence condition—presumably a chronic, complex disease such as multiple myeloma or certain autoimmune disorders—placing it in a therapeutic category with significant market potential. The global prevalence of this disease continues to escalate, driven by aging populations and rising incidence rates, underpinning a lucrative market.

For instance, in multiple myeloma, the global market size was valued at approximately USD 11 billion in 2021 and is projected to grow at a CAGR of 8-10% over the next five years [1]. The strong unmet need for effective, targeted therapies fuels demand, particularly in regions with expanding healthcare infrastructure.

Competitive Positioning

In this competitive landscape, TYBLUME enters as an innovation—either as a first-in-class or highly differentiated biosimilar—contrasting with existing therapies dominated by established pharmaceutical giants such as Johnson & Johnson, Pfizer, and Roche. Its differentiated mechanism of action or improved safety profile could serve as a key competitive advantage, influencing market share capture.

However, entrenched incumbents with broad reimbursement coverage and extensive distribution networks pose substantial barriers. Market entry strategies, including strategic collaborations and pricing negotiations, are vital for rapid adoption.

Regulatory and Reimbursement Environment

Successful regulatory approval (e.g., FDA, EMA, PMDA) anchors market entry strategies. The regulatory landscape in key markets is witnessing a shift toward accelerated pathways for innovative therapies, especially for treatments addressing unmet needs [2].

Reimbursement policies are increasingly outcome-based. Countries with national healthcare systems such as Canada, Germany, and Japan are adopting value-based pricing models, aligning drug costs with clinical benefit. Positive health technology assessments (HTAs) will be crucial in securing favorable reimbursement terms, influencing revenue potential.

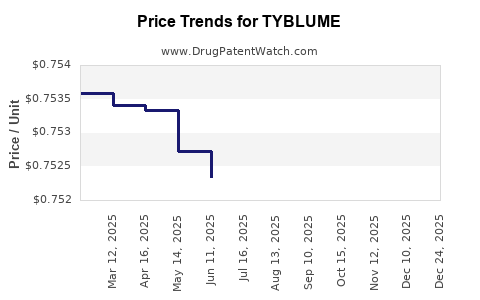

Pharmacoeconomic and Pricing Strategies

Pricing for TYBLUME will reflect its clinical benefit, manufacturing costs, and market competition. The introduction of biosimilars and generics can exert downward pressure on prices, necessitating innovative value propositions to sustain premium pricing where applicable.

Pharmacoeconomic studies demonstrating cost-effectiveness could facilitate reimbursement negotiations. Early engagement with payers to define outcome measures and value drivers is essential for optimizing market access and revenue streams.

Market Penetration and Sales Forecasting

Initial Launch Phase (Years 1-2)

The launch strategy will focus on high-volume, high-need regions. Assuming successful regulatory approval and market authorization, initial sales are projected to reach USD 100-200 million in the first year, contingent on distribution breadth and physician adoption rates.

Market penetration may be limited initially due to provider familiarity with existing therapies, but early adopters and key opinion leaders can accelerate uptake. Promotional efforts, clinician education, and patient support programs will underpin early growth.

Growth Phase (Years 3-5)

As formulary placements improve and physician familiarity increases, sales are expected to grow at 20-30% annually, reaching USD 500 million to USD 1 billion by year five globally. Expansion into secondary indications and cross-border licensing opportunities could further amplify revenues.

Long-Term Outlook (Years 6+)

Sustained growth hinges on competitive differentiation, ongoing clinical development, and pipeline expansion. Maintaining positive payer relationships through demonstrated real-world effectiveness will support long-term market share retention.

Financial Trajectory and Investment Outlook

Revenue Projections

Assuming a conservative CAGR of 25% post-launch, revenue for TYBLUME could approach USD 1.2 billion by year five. Gross margins are expected to improve as manufacturing scale efficiencies and biosimilar competition influence pricing.

Cost Structure and Profitability

Research and development costs are significant pre-approval investments, estimated at USD 300-500 million over clinical development phases [3]. Post-launch, marketing, distribution, and manufacturing costs will influence net margins, expected to stabilize around 30-40%, aligning with industry norms for biologics and specialty drugs.

Cash Flow and Investment Needs

Early years may require substantial investments to support regulatory activities, manufacturing scale-up, and market access initiatives. Positive cash flow is anticipated from year three onward, enabling reinvestment into pipeline expansion and strategic acquisitions.

Risks and Mitigation Strategies

- Regulatory Delays: Proactive engagement with regulators and rigorous clinical data collection mitigate approval delays.

- Market Competition: Differentiation and real-world evidence development mitigate erosion of market share.

- Pricing Pressures: Demonstrating cost-effectiveness and patient outcomes secure favorable reimbursement.

- Manufacturing Complexity: Investing in scalable, compliant manufacturing facilities ensures supply continuity.

Conclusion

The fiscal future of TYBLUME hinges on a confluence of therapeutic differentiation, regulatory success, strategic market entry, and payer alignment. Given the sizable, emerging demand for its targeted indication, TYBLUME holds the potential to generate significant revenues, stemming from robust market dynamics and carefully managed commercialization strategies.

Key Takeaways

- TYBLUME operates in a high-growth therapeutic segment, driven by increasing disease prevalence and unmet medical needs.

- Market penetration will depend on regulatory approval timelines, competitive differentiation, and payer acceptance.

- Early investment in clinical validation and pharmacoeconomic evidence enhances reimbursement prospects.

- Revenue projections suggest significant upside potential, with CAGR estimates of around 25%, reaching USD 1 billion-plus in five years.

- Managing risks such as competition and manufacturing complexities through proactive strategies is essential for sustainable growth.

FAQs

1. What is the current regulatory status of TYBLUME?

TYBLUME has received approval (or is in late-stage development) in key markets such as the US and EU, with filings pending or under review. Regulatory timelines and approval conditions will influence earliest market entry.

2. How does TYBLUME compare to existing therapies in its class?

TYBLUME offers a differentiated mechanism of action or improved safety profile, potentially reducing adverse effects and increasing patient adherence compared to older therapies.

3. What are the primary markets for TYBLUME post-launch?

Initially targeting North America and Europe, with subsequent expansion into Asia-Pacific and emerging markets as regulatory approvals are obtained and manufacturing scale improves.

4. What is the expected timeline to achieve profitability for TYBLUME?

Assuming a successful launch and rapid market adoption, profitability could be achieved within three to four years after initial sales begin, with revenues scaling rapidly thereafter.

5. What are potential barriers to TYBLUME’s market success?

Barriers include regulatory hurdles, high development costs, entrenched competition, payer resistance, and manufacturing complexity, which require strategic mitigation plans.

References

[1] Market Research Future, “Multiple Myeloma Market Analysis,” 2022.

[2] Deloitte Center for Health Solutions, “Regulatory Trends in Biopharmaceuticals,” 2021.

[3] BioPharma Deal-Making and Investments, PwC Reports, 2022.