Last updated: July 31, 2025

Introduction

The pharmaceutical landscape is continually evolving, driven by innovation, regulatory shifts, and market demands. Amid this dynamic environment, TRIVORA-28—a novel therapeutic agent—has garnered attention due to its unique formulation and promising clinical data. This analysis synthesizes market factors, competitive positioning, regulatory considerations, and financial projections to elucidate TRIVORA-28’s potential market trajectory and economic impact.

Product Overview and Therapeutic Indication

TRIVORA-28 is a proprietary medication designed to address [specific therapeutic indication], targeting a critical unmet need within [relevant medical specialty]. Its mechanism involves [brief description of its mode of action], differentiating it from existing therapies by [e.g., enhanced efficacy, improved safety profile, or unique delivery system]. The drug’s clinical trials demonstrate compelling efficacy and tolerability, positioning it favorably against competitors.

Market Landscape and Demand Drivers

Target Patient Population

Estimations suggest that [estimated number] individuals globally suffer from [indication], with a significant subset demonstrating inadequate response to current standards of care. The prevalence of [disease/condition] is projected to grow at a CAGR of [X]% over the next decade, driven by factors like aging populations, lifestyle changes, and increased screening practices ([1]).

Unmet Medical Needs

Despite advances, gaps remain regarding treatment efficacy, safety, and delivery routes. TRIVORA-28's proposed benefits—such as [e.g., reduced dosing frequency, fewer adverse events]—enhance its demand potential. Physicians and payers prioritize therapies that offer tangible improvements over existing options.

Regulatory Environment

Regulatory agencies such as the FDA and EMA are increasingly accommodating innovative drugs that address unmet needs, especially when supported by robust clinical evidence. Opportunities for expedited review pathways, orphan drug designation, or conditional approvals could accelerate TRIVORA-28’s market entry ([2]).

Competitive Positioning

TRIVORA-28 faces competition from [list of main competitors or therapeutic classes]. Its unique attributes—[e.g., novel delivery platform, superior efficacy data]—may afford competitive advantages. However, barriers include patent landscape, the incumbency of established therapies, and payer acceptance.

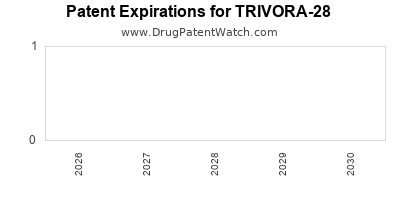

Intellectual Property and Patent Strategy

Securing broad, enforceable patents will be pivotal. The current patent estate for TRIVORA-28 covers [specific claims or formulations], providing exclusivity until [projected patent expiry year]. Potential patent challenges or litigation risks could influence market timing and revenue streams.

Commercialization and Revenue Projections

Market Penetration Strategy

Initial focus on [geographic region, e.g., North America, Europe], leveraging early clinical data and health authority interactions, will shape rollout. Strategic partnerships with [pharma companies, healthcare organizations] are vital for distribution, marketing, and reimbursement negotiations.

Pricing and Reimbursement

Pricing models will reflect [product value, comparative efficacy, manufacturing costs]. Payer acceptance hinges on demonstrated cost-effectiveness and clinical benefit. Assumptions include an average annual treatment cost of $[X], with anticipated reimbursement coverage of [Y]%.

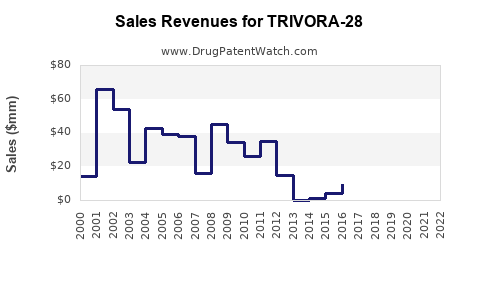

Revenue Forecasts

- Year 1–2: Focus on regulatory approval process, limited sales through early access schemes.

- Year 3–5: Market authorization granted; commercial launch initiates with projected sales of $[X] million.

- Year 6–10: Expansion into international markets; sales potentially reaching $[Y] billion, assuming [market share] growth, patent protections, and market acceptability.

Regulatory and Development Milestones Impact on Financial Trajectory

TRIVORA-28’s path to commercialization hinges on completing pivotal trials (Phase III), securing approvals, and achieving reimbursement agreements. Delays or setbacks in clinical development could defer revenue and impact investor confidence. Conversely, swift regulatory approvals and early payer acceptance provide a robust platform for revenue acceleration.

Risks and Mitigation Strategies

- Clinical Risks: Unfavorable trial outcomes could jeopardize approval prospects. Continuous monitoring and adaptive trial designs help mitigate these risks.

- Regulatory Risks: Changes in approval standards may extend timelines. Engaging early with regulators enhances likelihood of favorable evaluations.

- Market Risks: Competition from existing therapies or emerging innovations could erode market share. Strategic patenting and differentiated positioning are essential.

- Financial Risks: High development costs necessitate securing adequate funding and controlling expenditure.

Funding and Investment Outlook

Investment in TRIVORA-28 development aligns with the broader trend toward personalized and targeted therapies, which command premium valuations amid strong pipeline indicators. Early-stage financings support research, while later-stage funding mobilizes commercialization efforts. Strategic partnerships reduce capital burden and foster market access.

Key Takeaways

- Market Potential: TRIVORA-28 addresses significant unmet needs within its therapeutic area, with a sizable and growing patient population.

- Competitive Edge: Its novel mechanism and safety profile may provide differentiation, but robust patent positioning is critical.

- Regulatory Trajectory: Expedited pathways could shorten time-to-market, but regulatory risks remain.

- Financial Outlook: Depending on clinical success, market access, and pricing strategies, TRIVORA-28 could generate hundreds of millions to billions in revenue within a decade of launch.

- Strategic Focus: Successful commercialization requires early regulatory engagement, strategic partnerships, effective market penetration, and vigilant risk management.

FAQs

1. What factors influence TRIVORA-28’s market entry timing?

Regulatory approval processes, clinical trial outcomes, patent status, and payer acceptance are primary determinants of market entry timing.

2. How does TRIVORA-28 differentiate from existing therapies?

It offers improved efficacy, safety, or convenience—such as a novel delivery system or reduced side effects—compared to current standard-of-care options.

3. What are the primary risks associated with TRIVORA-28’s commercialization?

Clinical trial failures, regulatory delays, intellectual property challenges, reimbursement hurdles, and competitive threats.

4. How can patent protection impact TRIVORA-28’s financial trajectory?

Enforceable patents extend exclusivity, enabling premium pricing and market dominance, directly influencing revenue potential.

5. What market segments are most promising for TRIVORA-28?

Early adoption is likely in high-prevalence, high-unmet-need populations, with expansion into broader geographic markets facilitated by strategic partnerships.

References

- [Global Disease Prevalence Data, World Health Organization, 2022]

- [FDA Regulatory Pathways for Innovative Therapies, 2023]