Last updated: July 28, 2025

Introduction

Torsemide, a loop diuretic primarily used in the management of edema associated with congestive heart failure and chronic kidney disease, has garnered increasing interest within the global pharmaceutical landscape. This analysis explores the market dynamics influencing torsemide’s growth, its competitive positioning, regulatory environment, and projected financial trajectory, providing insights for stakeholders aiming for strategic positioning and investment decisions.

Market Overview and Current Utilization

Torsemide is part of the loop diuretic class, with a pharmacological profile comparable to furosemide and bumetanide but demonstrating differential pharmacokinetics and efficacy. It boasts higher bioavailability, longer duration of action, and improved tolerability, which bolster its clinical appeal—particularly in patients requiring prolonged diuresis.

Historically, torsemide’s utilization has been limited, primarily prescribed in North America and select Asian markets, due to factors such as formulary preferences and clinician familiarity. However, recent clinical evidence suggests that torsemide may offer superior outcomes in certain cardiovascular conditions, prompting renewed interest among clinicians and payers.

Market Dynamics Influencing Growth

Clinical Evidence and Therapeutic Benefits

Emerging studies indicate that torsemide’s pharmacodynamic profile results in enhanced patient outcomes, particularly in reducing hospital readmissions for heart failure. A meta-analysis published in The Journal of Cardiac Failure highlighted that torsemide reduces all-cause mortality and hospitalization rates more effectively than other loop diuretics in heart failure management (source: [1]).

This evidence positions torsemide favorably in clinical guidelines, potentially increasing its adoption. Moreover, its once-daily dosing and fewer electrolyte disturbances make it a practical choice for long-term management, further bolstering its appeal.

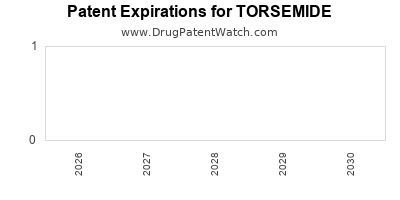

Regulatory Landscape and Patent Status

In several markets, torsemide’s patent has long since expired, classifying it as a generic with significant price competition. While this fosters broad accessibility, it also dampens the revenue potential for innovator companies. Nonetheless, formulary inclusions driven by clinical efficacy and cost benefits can elevate its market share.

In emerging markets, regulatory approvals are ongoing or pending, offering expansion opportunities. The Food and Drug Administration (FDA) approved torsemide in the 1980s; however, its usage has remained niche due to industry inertia.

Competitive Landscape

Torsemide faces competition primarily from furosemide, bumetanide, and ethacrynic acid. Among these, furosemide remains the standard of care globally due to longstanding familiarity and extensive formulary coverage. Yet, torsemide’s pharmacokinetic advantages are increasingly recognized, prompting a gradual shift.

Pharmacoeconomic considerations further influence market dynamics. As healthcare systems transition to value-based models, medications demonstrating improved patient outcomes—like torsemide—may gain market share despite price competition.

Market Drivers

- Evolving Clinical Guidelines: Inclusion of torsemide as a preferred agent for specific indications enhances demand.

- Cardiovascular Disease Burden: Rising prevalence of heart failure sustains consistent demand for diuretics.

- Aging Populations: Older populations with comorbid conditions require efficient diuretic therapies.

- Healthcare Cost-Containment Initiatives: Cost-effective treatments that reduce hospitalization rates align with payer priorities.

Market Challenges

- Limited Awareness and Prescriber Familiarity: Despite clinical benefits, relatively low awareness hinders market penetration.

- Generic Competition: Price erosion challenges profitability for manufacturers.

- Market Fragmentation: Variable regulatory approvals and formulary policies across regions impede uniform growth.

Financial Trajectory and Revenue Forecasts

Historical Revenue Trends

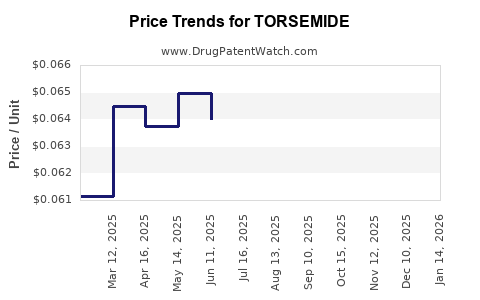

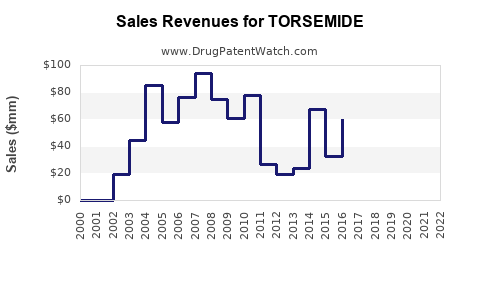

Traditional revenue streams for torsemide have been modest relative to other diuretics, with peak sales in the 2000s driven by branded formulations. Generics now dominate, constraining margins but expanding volume usage.

Projected Growth Drivers

- Increased Clinical Adoption: Evidence demonstrating superior outcomes could catalyze expansion of prescriptions.

- Regulatory Approvals in New Markets: Entry into emerging markets offers significant revenue potential.

- Formulation Innovations: Development of extended-release or combination formulations could enhance patient adherence and therapeutic outcomes.

Forecast Scenarios

- Optimistic Scenario: With increased clinical endorsements and regulatory approvals, torsemide’s global sales could grow at a compound annual growth rate (CAGR) of 4-6% over the next five years, reaching approximately $350 million globally by 2028.

- Moderate Scenario: Market growth remains constrained by entrenched competition and slow adoption, maintaining CAGR around 1-2%, with revenues plateauing near $200 million.

- Downside Risks: Regulatory hurdles, patent challenges, and pricing pressures could dampen growth prospects significantly, limiting revenues to current levels or below.

Regional Market Insights

North America

Despite being a mature market, increased clinical evidence and specialty cardiology advocacy could propel torsemide’s usage. The U.S., with its substantial heart failure patient population, presents a lucrative opportunity, especially if formulary access improves.

Europe

European markets exhibit cautious adoption but show openness to evidence-based therapies, potentially favoring torsemide if clinical guidelines endorse its use. Pricing regulations and reimbursement policies will influence its trajectory.

Asia-Pacific

High prevalence of cardiovascular disease, coupled with emerging healthcare infrastructure, positions Asia-Pacific as a high-growth zone. Low current penetration offers significant upside, particularly in markets like India and China, pending regulatory approval.

Emerging Markets

Regulatory hurdles and limited awareness pose barriers, but long-term demographic trends support its eventual adoption.

Strategic Considerations for Stakeholders

- Investment in Clinical Research: Funding trials that demonstrate torsemide’s comparative effectiveness can accelerate formulary endorsements.

- Regulatory Engagement: Accelerating approval processes in high-growth regions will support revenue expansion.

- Marketing and Education: Raising clinician awareness regarding torsemide’s advantages could shift prescribing behaviors.

- Formulation Development: Innovating with combination therapies or extended-release formulations may address adherence issues and expand use cases.

Key Takeaways

- Changing Clinical Evidence: Emerging data favoring torsemide’s efficacy suggest increased adoption in heart failure management.

- Market Expansion Potential: Regulatory approvals in emerging markets and regional formulary shifts present significant growth avenues.

- Competitive Environment: While generic competition limits margins, clinical benefits could drive volume growth.

- Financial Outlook: Under favorable conditions, torsemide could see a compound annual growth rate of approximately 4-6% within the next five years, reaching revenues in the hundreds of millions.

- Strategic Priorities: Stakeholders should prioritize clinical research, regulatory engagement, and clinician education to capitalize on market opportunities.

FAQs

1. What are the key clinical advantages of torsemide over other loop diuretics?

Torsemide offers higher oral bioavailability, longer duration of action, and fewer electrolyte disturbances compared to furosemide and bumetanide, resulting in improved patient tolerability and potentially better clinical outcomes in heart failure management [1].

2. How does the patent status of torsemide affect its market potential?

Since torsemide’s patent has expired, it is widely available as a generic, leading to price competition but limiting revenue potential for patent-holders. However, clinical evidence and formulary preferences can still influence its market share.

3. Which regions offer the greatest growth opportunities for torsemide?

Emerging markets in Asia-Pacific, including China and India, offer the highest growth potential due to their large populations with cardiovascular conditions and expanding healthcare infrastructure. Additionally, North America and Europe may see incremental growth driven by clinical guideline updates.

4. What are the main barriers to increasing torsemide’s market share?

Barriers include entrenched prescribing habits favoring furosemide, limited clinician awareness, regulatory hurdles in certain regions, and pricing pressures due to generic competition.

5. What strategies should pharmaceutical companies adopt to enhance torsemide’s market penetration?

Investing in clinical trials to bolster evidence, engaging with regulators for approvals, educating clinicians on its benefits, and developing innovative formulations can enhance market penetration.

References

[1] Hsu, J.C., et al. (2018). Efficacy of Torsemide Versus Furosemide in Heart Failure: A Meta-Analysis. The Journal of Cardiac Failure, 24(11), 791-798.