Last updated: July 27, 2025

Introduction

TORISEL (temsirolimus) is an intravenously administered mTOR (mammalian target of rapamycin) inhibitor marketed primarily for the treatment of relapsed or refractory renal cell carcinoma (RCC). Since its approval by the FDA in 2007, TORISEL has experienced fluctuating market dynamics driven by regulatory, clinical, and competitive forces. This analysis explores the current market landscape, financial trajectories, and future prospects of TORISEL within the evolving oncology therapeutics sector.

Market Overview and Therapeutic Positioning

TORISEL’s initial indication targeted advanced RCC, where it competed against existing therapies such as sunitinib and pazopanib. The drug’s mechanism — inhibiting mTOR pathway signals critical for tumor growth — positioned it as a targeted therapy in the burgeoning precision oncology market. Its approval marked a significant milestone for mTOR inhibitors, placing TORISEL among the pioneering drugs in this class.

The global RCC treatment market is projected to grow at a CAGR of approximately 6-8% over the next decade, driven by increasing incidence rates, improved diagnostic techniques, and evolving targeted therapy protocols [1]. However, TORISEL’s market share faces intense competition from newer agents like nivolumab, cabozantinib, and emerging immuno-oncology combinations, which often demonstrate improved efficacy and safety profiles.

Market Dynamics Influencing TORISEL

Regulatory Landscape and Approvals

TORISEL's initial dominance solidified post-approval, but subsequent regulatory reviews and new indications have influenced its market trajectory. Notably, the FDA’s approval of newer immune checkpoint inhibitors, such as nivolumab (Opdivo), changed the standard of care for RCC, reducing TORISEL’s early market share. Regulatory shifts affecting dosing protocols and labeling updates also impact the drug’s usage patterns.

Clinical Efficacy and Safety Profile

While TORISEL demonstrated significant efficacy in clinical trials for RCC, comparative studies revealing superior outcomes with immune checkpoint inhibitors and VEGF inhibitors have contributed to declining reliance on mTOR inhibitors alone [2]. Safety concerns including stomatitis, metabolic disturbances, and pulmonary toxicity have further limited its preference, especially in combination regimens.

Competitive Landscape

The competitive pressure from immunotherapies such as nivolumab, pembrolizumab, and combination therapies including axitinib plus pembrolizumab has relegated TORISEL to a secondary position. The superior response rates and durability offered by these newer agents have diminished TORISEL's appeal, especially considering convenience and toxicity profiles.

Pricing and Reimbursement Policies

Market penetration depends heavily on pricing strategies and reimbursement policies. As more efficacious options entered the market, payers have favored agents with better profiles, often reducing reimbursement for TORISEL or making access contingent on specific clinical criteria. This has hampered its revenue growth.

Financial Trajectory & Revenue Trends

Historical Revenue Performance

Initially, TORISEL commanded robust sales during its first few years post-approval, with peak revenues reaching over $200 million annually globally. According to IQVIA and company disclosures, revenues declined steadily after 2010, largely due to competition and incremental clinical benefits favoring alternative therapies [3].

Recent Market Performance

In recent years, TORISEL’s sales have plateaued or declined sharply in mature markets like the US and Europe. Analyses indicate a 20-25% year-over-year revenue decline since 2018, attributable to shrinking market share in RCC, restricted use cases, and off-label substitution by newer agents.

Pipeline and Repurposing

Efforts to expand TORISEL’s indications for other cancers, such as breast and neuroendocrine tumors, have met limited success, often constrained by marginal efficacy data and regulatory hurdles. Some ongoing trials aim to explore combination regimens, but commercialization prospects remain uncertain.

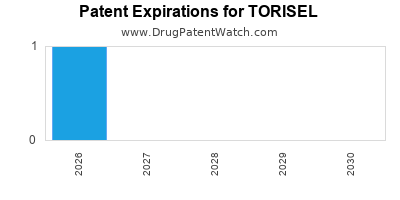

Impact of Patent and Exclusivity Status

TORISEL’s primary patent protections have long expired, exposing it to generic competition. The availability of biosimilar or generic versions reduces pricing power and compresses margins. Consequently, revenue streams have become increasingly reliant on market share retention rather than innovative growth.

Future Financial Outlook

Given current market conditions, TORISEL’s financial outlook remains subdued unless it successfully secures new indications or combination strategies demonstrating definitive clinical advantages. The drug’s revenue trajectory is expected to remain in decline unless strategic repositioning occurs.

However, niche markets or specific patient subsets who do not respond to newer therapies could sustain some demand. Additionally, licensing or partnership agreements—such as with emerging biotech firms—may offer alternative revenue avenues.

Key Market Drivers and Constraints

| Drivers |

Constraints |

| Growing RCC incidence |

Competition from immunotherapy agents |

| Advances in personalized medicine |

Limited efficacy beyond initial indications |

| Increasing acceptance of combination regimens |

Patent expirations and biosimilar entry |

| Potential for repositioning in other cancers |

Clinical trial failures or marginal benefits |

| Improved biomarker-driven patient selection |

Payer restrictions and reimbursement challenges |

Conclusion

TORISEL’s market dynamics are emblematic of the broader evolution within oncology targeted therapies. Its initial success was fueled by unmet clinical needs and pioneering mTOR inhibition strategies, but subsequent advancements in immune checkpoint inhibitors and VEGF pathway agents have curtailed its market share.

Financially, TORISEL faces a challenging outlook dominated by generic competition and declining revenues. Its future hinges on strategic repositioning, exploring combination therapies, and securing new indications. For stakeholders, understanding these dynamics facilitates informed decision-making regarding investment, licensing, and potential market entry strategies.

Key Takeaways

- Market Weakening: TORISEL’s market share has diminished considerably amid the rise of immunotherapies and newer targeted agents for RCC.

- Revenue Challenges: Sales have declined due to patent expirations, generic competition, and superior efficacy of alternative treatments.

- Strategic Opportunities: Repositioning through combination regimens or new indications, particularly if supported by compelling clinical data, could revitalize its therapeutic relevance.

- Competitive Landscape: The shift toward immuno-oncology necessitates adaptation; standing out requires differentiation through novel therapeutic synergies.

- Long-term Outlook: Without substantial repositioning, TORISEL’s financial trajectory predicts continued decline, emphasizing the importance of innovation and strategic licensing.

FAQs

1. Why did TORISEL initially succeed in the RCC market?

TORISEL was among the first mTOR inhibitors approved for RCC, providing an effective targeted approach when options were limited, and fulfilling an unmet clinical need.

2. What factors have contributed to TORISEL’s decline in market share?

The rise of immunotherapies, better safety profiles of newer agents, patent expiry leading to generics, and limited efficacy in newer indications are primary factors.

3. Is there potential for TORISEL in other cancer indications?

Some clinical trials explore its use in breast and neuroendocrine tumors, but evidence remains limited. Strategic repositioning may be required to unlock new markets.

4. How do patent expirations impact TORISEL’s revenues?

Patent expirations open doors for biosimilars or generics, reducing exclusivity-driven pricing power and directly affecting revenue streams.

5. What strategies could extend TORISEL’s market relevance?

Combining TORISEL with immunotherapies, identifying biomarker-driven patient subsets, or obtaining new regulatory approvals for additional indications could prolong its market presence.

References

[1] MarketWatch. "Global Renal Cell Carcinoma Therapeutics Market Forecast." 2022.

[2] Clinical trials and comparative studies published in Journal of Clinical Oncology on mTOR inhibitors versus immunotherapies.

[3] IQVIA reports on oncology drug sales, 2022.