TIVICAY Drug Patent Profile

✉ Email this page to a colleague

When do Tivicay patents expire, and what generic alternatives are available?

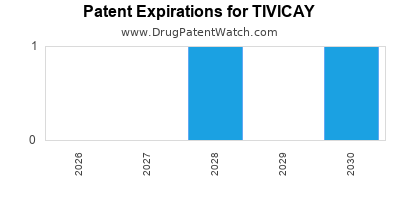

Tivicay is a drug marketed by Viiv Hlthcare and is included in two NDAs. There are two patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and fifty-seven patent family members in thirty-five countries.

The generic ingredient in TIVICAY is dolutegravir sodium. There are seventeen drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the dolutegravir sodium profile page.

DrugPatentWatch® Generic Entry Outlook for Tivicay

Tivicay was eligible for patent challenges on August 12, 2017.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be June 8, 2030. This may change due to patent challenges or generic licensing.

There have been twenty-four patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are eight tentative approvals for the generic drug (dolutegravir sodium), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TIVICAY?

- What are the global sales for TIVICAY?

- What is Average Wholesale Price for TIVICAY?

Summary for TIVICAY

| International Patents: | 157 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 135 |

| Clinical Trials: | 32 |

| Patent Applications: | 2,411 |

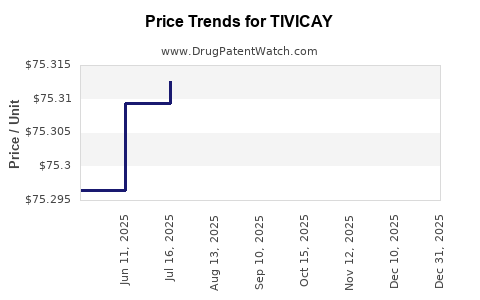

| Drug Prices: | Drug price information for TIVICAY |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for TIVICAY |

| What excipients (inactive ingredients) are in TIVICAY? | TIVICAY excipients list |

| DailyMed Link: | TIVICAY at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for TIVICAY

Generic Entry Date for TIVICAY*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for TIVICAY

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Humanis Saglık Anonim Sirketi | PHASE1 |

| Chelsea and Westminster NHS Foundation Trust | Phase 1 |

| Chelsea and Westminster NHS Foundation Trust | Phase 3 |

Pharmacology for TIVICAY

Paragraph IV (Patent) Challenges for TIVICAY

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| TIVICAY | Tablets | dolutegravir sodium | 10 mg, 25 mg and 50 mg | 204790 | 4 | 2017-08-14 |

US Patents and Regulatory Information for TIVICAY

TIVICAY is protected by two US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of TIVICAY is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Viiv Hlthcare | TIVICAY | dolutegravir sodium | TABLET;ORAL | 204790-002 | Jun 9, 2016 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Viiv Hlthcare | TIVICAY PD | dolutegravir sodium | TABLET, FOR SUSPENSION;ORAL | 213983-001 | Jun 12, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Viiv Hlthcare | TIVICAY | dolutegravir sodium | TABLET;ORAL | 204790-003 | Jun 9, 2016 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Viiv Hlthcare | TIVICAY PD | dolutegravir sodium | TABLET, FOR SUSPENSION;ORAL | 213983-001 | Jun 12, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Viiv Hlthcare | TIVICAY | dolutegravir sodium | TABLET;ORAL | 204790-002 | Jun 9, 2016 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for TIVICAY

When does loss-of-exclusivity occur for TIVICAY?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 09325128

Estimated Expiration: ⤷ Get Started Free

Patent: 14277831

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0923217

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 44019

Estimated Expiration: ⤷ Get Started Free

Patent: 55957

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2245182

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 76080

Estimated Expiration: ⤷ Get Started Free

Patent: 10603

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 43626

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 86478

Estimated Expiration: ⤷ Get Started Free

Patent: 48595

Estimated Expiration: ⤷ Get Started Free

Patent: 30891

Estimated Expiration: ⤷ Get Started Free

Patent: 12131791

Patent: SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND THEIR INTERMEDIATES

Estimated Expiration: ⤷ Get Started Free

Patent: 12511573

Estimated Expiration: ⤷ Get Started Free

Patent: 16041727

Patent: カルバモイルピリドンHIVインテグラーゼ阻害剤及びそれらの中間体の合成 (SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND THEIR INTERMEDIATES)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 1942

Patent: SINTESIS DE INHIBIDORES DE INTEGRASA DE VIH DE CARBAMOIL-PIRIDONA E INTERMEDIARIOS. (SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND INTERMEDIATES.)

Estimated Expiration: ⤷ Get Started Free

Patent: 3683

Patent: SINTESIS DE INHIBIDORES DE INTEGRASA DE VIH DE CARBAMOIL-PIRIDONA E INTERMEDIARIOS. (SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND INTERMEDIATES)

Estimated Expiration: ⤷ Get Started Free

Patent: 11006241

Patent: SINTESIS DE INHIBIDORES DE INTEGRASA DE VIH DE CARBAMOIL-PIRIDONA E INTERMEDIARIOS. (SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND INTERMEDIATES.)

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 27451

Patent: СИНТЕЗ КАРБАМОИЛПИРИДОНОВЫХ ИНГИБИТОРОВ ИНТЕГРАЗЫ ВИЧ И ПРОМЕЖУТОЧНЫХ СОЕДИНЕНИЙ (SYNTHESIS OF CARBAMOYL PYRIDONE INHIBITORS OF HIV INTEGRASE AND INTERMEDIATE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Patent: 38923

Patent: Синтез карбамоилпиридоновых ингибиторов интегразы ВИЧ и промежуточных соединений (SYNTHESIS OF CARBAMOIL-PYRIDONE INHIBITORS OF HIV INTEGRASE AND INTERMEDIATE COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Patent: 11121785

Patent: СИНТЕЗ КАРБАМОИЛПИРИДОНОВЫХ ИНГИБИТОРОВ ИНТЕГРАЗЫ ВИЧ И ПРОМЕЖУТОЧНЫХ СОЕДИНЕНИЙ

Estimated Expiration: ⤷ Get Started Free

Patent: 13153004

Patent: СИНТЕЗ КАРБАМОИЛПИРИДОНОВЫХ ИНГИБИТОРОВ ИНТЕГРАЗЫ ВИЧ И ПРОМЕЖУТОЧНЫХ СОЕДИНЕНИЙ

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 1308

Patent: SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND INTERMEDIATES

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1733625

Estimated Expiration: ⤷ Get Started Free

Patent: 1847887

Estimated Expiration: ⤷ Get Started Free

Patent: 110094336

Patent: SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND INTERMEDIATES

Estimated Expiration: ⤷ Get Started Free

Patent: 170038116

Patent: 카르바모일피리돈 HIV 인테그라제 억제제 및 중간체의 합성 (SYNTHESIS OF CARBAMOYLPYRIDONE HIV INTEGRASE INHIBITORS AND INTERMEDIATES)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 41765

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 83947

Estimated Expiration: ⤷ Get Started Free

Patent: 1030010

Patent: Synthesis of carbamoylpyridone HIV integrase inhibitors and intermediates

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering TIVICAY around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Hong Kong | 1107227 | POLYCYCLIC CARBAMOYLPYRIDONE DERIVATIVE HAVING HIV INTEGRASE INHIBITORY ACTIVITY | ⤷ Get Started Free |

| Lithuania | 3045206 | ⤷ Get Started Free | |

| European Patent Office | 1950212 | DÉRIVÉ DE CARBAMOYLPYRIDONE POLYCYCLIQUE AYANT UNE ACTIVITÉ D'INHIBITION SUR L'INTÉGRASE DU VIH (POLYCYCLIC CARBAMOYLPYRIDONE DERIVATIVE HAVING INHIBITORY ACTIVITY ON HIV INTEGRASE) | ⤷ Get Started Free |

| Eurasian Patent Organization | 200702080 | ПОЛИЦИКЛИЧЕСКОЕ КАРБОМОИЛПИРИДОНОВОЕ ПРОИЗВОДНОЕ, ОБЛАДАЮЩЕЕ ИНГИБИТОРНОЙ АКТИВНОСТЬЮ В ОТНОШЕНИИ ИНТЕГРАЗЫ ВИЧ | ⤷ Get Started Free |

| European Patent Office | 3210603 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for TIVICAY

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2465580 | C02465580/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: CABOTEGRAVIR; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 67740 08.10.2021 |

| 2465580 | 301109 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: CABOTEGRAVIR; REGISTRATION NO/DATE: EU/1/20/1481 20201217 |

| 2465580 | SPC/GB21/030 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: CABOTEGRAVIR OR A PHARMACEUTICALLY ACCEPTABLE SALT OR SOLVATE THEREOF, INCLUDING CABOTEGRAVIR SODIUM.; REGISTERED: UK EU/1/20/1481 (NI) 20201221; UK PLGB 35728/0055-57 20201221 |

| 1874117 | 1491036-8 | Sweden | ⤷ Get Started Free | PRODUCT NAME: DOLUTEGRAVIR ELLER ETT FARMACEUTISKT ACCEPTABELT SALT ELLER SOLVAT DAERAV, INKLUSIVE DOLUTEGRAVIRNATRIUM; FIRST MARKETING AUTHORIZATION NUMBER SE: EU/1/13/892, 2014-01-21; |

| 2465580 | 2190020-4 | Sweden | ⤷ Get Started Free | PRODUCT NAME: CABOTEGRAVIR OR A PHAMACEUTICALLY ACCEPTABLE SALT THEREOF; REG. NO/DATE: EU/1/20/1481 20201221 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for TIVICAY (Dolutegravir)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.