Last updated: September 24, 2025

Introduction

Tiotropium bromide, a long-acting anticholinergic agent, has established itself as a cornerstone therapy for chronic obstructive pulmonary disease (COPD) and, to a lesser extent, asthma. Its innovative delivery mechanism, predominantly via the HandiHaler and Respimat inhalers, has expanded its clinical utility since regulatory approvals in the late 2000s. As the pharmaceutical landscape evolves, understanding the market dynamics and financial trajectory of tiotropium bromide becomes imperative for stakeholders ranging from pharma companies to investors. This analysis synthesizes current trends, competitive positioning, regulatory influences, and commercialization prospects to project its future economic trajectory.

Market Overview

Tiotropium’s global market valuation reflects its role as a leading bronchodilator therapy. The Global COPD Drugs Market size was estimated at approximately $12 billion in 2022, with tiotropium accounting for roughly 45% of inhaled long-acting muscarinic antagonists (LAMAs) sales [1]. The compound is marketed by multiple pharmaceutical companies under various brand names, including Spiriva (Boehringer Ingelheim), Tiova (Sun Pharma), and others, rendering the market highly competitive but dominated by a few key players.

Increasing prevalence of COPD surges due to aging populations and rising smoking rates in emerging markets underpin continued demand. The World Health Organization estimates COPD will be the third leading cause of death globally by 2030 [2]. Consequently, the need for effective maintenance therapy like tiotropium remains high, with expanding indications and evolving treatment guidelines supporting sustained utilization.

Market Drivers

-

Clinical Guidelines and Therapeutic Positioning:

Guidelines by GOLD (Global Initiative for Chronic Obstructive Lung Disease) recommend long-acting bronchodilators like tiotropium as first-line maintenance therapy. The drug’s proven efficacy in reducing exacerbations and improving lung function solidifies its position.

-

Rising Disease Burden:

Global COPD prevalence has increased significantly, projected to affect 210 million people by 2025 [3], expanding the patient pool eligible for tiotropium.

-

Product Innovation and Formulation Expansion:

The advent of the Respimat inhaler improved ease of use, especially amongst elderly patients, expanding market reach. Orphan formulations and combination therapies augment sales potential.

-

Pricing and Reimbursement Policies:

Cost-effectiveness assessments favor tiotropium, leading to favorable reimbursement in numerous markets, bolstering sales margins.

Market Challenges

-

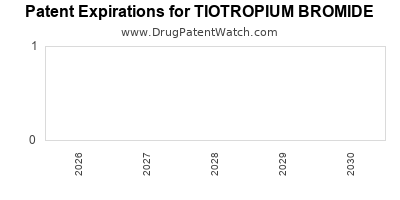

Patent Expirations and Generic Competition:

The original Spiriva (Boehringer Ingelheim) patent expired in key markets around 2018-2020, catalyzing the entry of generics, exerting downward pressure on prices and margins.

-

Emerging Competition from Biologics and Novel Therapies:

While biologic therapies like monoclonal antibodies target eosinophilic inflammation in asthma, they are less utilized in COPD. Still, novel agents and combination therapies threaten tiotropium’s dominance.

-

Regulatory and Pricing Pressures:

Stringent price controls in markets like the EU and challenges to drug reimbursement can impact revenue streams.

Financial Trajectory and Revenue Projections

Post-patent expiration, revenue decline in mature markets is expected, but this can be mitigated via strategic expansion into emerging markets, new formulations, and combination regimens.

-

Current Revenue Estimates:

Boehringer Ingelheim’s Spiriva generated approximately €3.3 billion (~$3.4 billion) globally in 2022, representing about 40% of the company's respiratory franchise [4].

-

Forecasts (2023-2028):

Analysts project a compound annual growth rate (CAGR) of 2-4% for the tiotropium segment, driven by increased COPD prevalence in Asia-Pacific and Latin America. The generic erosion is expected to reduce global revenue by approximately 15-20% over five years but can be offset by volume growth and expansion into indications like asthma and combination therapy formulations [5].

-

Potential Revenue Streams:

- Brand and Patent Sales: Continued revenue streams from branded formulations.

- Generics and Biosimilars: Entry of biosimilars and generics in major markets post-patent expiry expected to be the dominant revenue driver.

- Combination Inhalers: Fixed-dose combinations (e.g., tiotropium/olodaterol) have seen rapid uptake, projecting higher per-unit value.

Partnerships and Licensing Agreements

Several strategic alliances aim to extend tiotropium’s lifecycle:

- Combination Therapy Development: Partnerships for fixed-dose combinations boost market exclusivity.

- Regulatory Approvals in New Indications: Expanding approved uses (e.g., in bronchiectasis) can generate additional revenues.

Regulatory and Market Entry Impacts

Regulatory bodies’ acknowledgment of tiotropium’s clinical benefits fosters favorable market access, especially in emerging nations. Patent litigations and regulatory delays in some regions could temporarily hinder market penetration but typically are temporary hurdles.

Conclusion and Outlook

Tiotropium bromide remains a cornerstone in COPD therapy, leveraging its clinical efficacy, safety profile, and patient-centric delivery systems. While patent expirations introduced pricing pressures, strategic focus on emerging markets, combination therapies, and new indications are poised to sustain its financial trajectory. The market’s future will likely involve a balance: declining revenues in mature markets offset by growth in developing regions and innovation-driven offerings.

Key Takeaways

- Steady Demand in COPD: The increasing global burden ensures continuing, substantial demand for tiotropium.

- Competitive Landscape Evolution: Patent expirations and generics will challenge profitability but also prompt innovation in formulations and combinations.

- Strategic Expansion Essential: Success hinges on entering emerging markets, diversifying indications, and developing fixed-dose combinations.

- Revenue Decline Mitigation: Revenues post-patent expiration will decline in mature markets but can be countered through market expansion and new formulations.

- Investment Opportunities: Companies investing in tiotropium’s lifecycle extension and in adjacent indications are positioned for sustained growth.

FAQs

1. How have patent expirations affected Tiotropium's market revenues?

Patent expirations have allowed generic competitors to enter key markets, reducing branded drug prices and overall revenues. However, strategic formulations and expanding indications have mitigated declines.

2. What are the key growth areas for Tiotropium in the future?

Growth is anticipated in emerging markets with rising COPD prevalence, improved access, and via fixed-dose combination therapies that enhance adherence and sales.

3. Are there new formulations or delivery methods for Tiotropium?

Yes. The Respimat inhaler improved delivery, and new combination inhalers containing Tiotropium with Long-Acting Beta-Agonists (LABAs) are increasing market share.

4. How do regulatory policies influence Tiotropium’s market trajectory?

Regulatory agencies’ approval of new indications and biosimilars influences market access, pricing, and treatment guidelines, directly affecting revenues.

5. What’s the competitive outlook for Tiotropium versus emerging therapies?

While biologic agents and personalized medicine approaches are some competitors, Tiotropium’s established efficacy and long-term safety sustain its dominant role, though continuous innovation is vital for market positioning.

References

[1] MarketWatch, “Global COPD Drugs Market Size,” 2022.

[2] WHO, “Chronic Obstructive Pulmonary Disease Fact Sheet,” 2022.

[3] GINA Report, “Global Initiative for Asthma and COPD,” 2022.

[4] Boehringer Ingelheim Annual Report, 2022.

[5] PharmaConnect, “Respiratory Drugs Forecast,” 2023.