Last updated: July 27, 2025

Introduction

TENORETIC 100, a branded combination antihypertensive medication, has become a clinical staple for managing hypertension, particularly in patients requiring multiple agents for optimal blood pressure control. Comprising an angiotensin II receptor blocker (ARB) and a calcium channel blocker (CCB), TENORETIC 100’s pharmacological efficacy and safety profile have positioned it prominently within the cardiovascular therapeutics landscape. This report provides a comprehensive analysis of the market dynamics and financial trajectory of TENORETIC 100, emphasizing current trends, competitive positioning, regulatory influences, and growth forecasts.

Pharmacological Profile and Clinical Significance

TENORETIC 100 combines olmesartan medoxomil (an ARB) with amlodipine besylate (a CCB). This therapeutic synergy addresses resistant hypertension and reduces the risk of cardiovascular events more effectively than monotherapy, as substantiated by clinical studies such as the ACCOMPLISH trial[1]. The drug’s dosing flexibility and favorable tolerability have bolstered its adoption in both primary care and specialist settings.

Market Dynamics

Global and Regional Demand

The global antihypertensive drugs market exemplifies robust growth driven by the rising incidence of hypertension worldwide. The World Health Organization estimates that over 1.2 billion people suffer from high blood pressure—projected to increase as populations age and lifestyle risk factors proliferate[2]. TENORETIC 100, positioned as a second-line combination therapy, benefits from this escalating demand.

Regionally, North America and Europe dominate the market due to established healthcare infrastructure, high hypertension awareness, and reimbursement policies favoring combination therapies. However, developing regions like Asia-Pacific exhibit rapid growth potential, buoyed by increasing urbanization, healthcare modernization, and expanding pharmaceutical access.

Competitive Landscape

TENORETIC 100 faces competition primarily from other fixed-dose combination (FDC) agents such as telmisartan/amlodipine and losartan/amlodipine products. Generics for individual components have entered markets worldwide, exerting downward pressure on prices and challenging brand revenues.

Notably, strategic approaches—such as the introduction of once-daily dosing and high tolerability—have helped maintain TENORETIC’s market share. Moreover, pharmaceutical firms leveraging patient preference data and clinical guidelines are solidifying the position of such fixed-dose combinations.

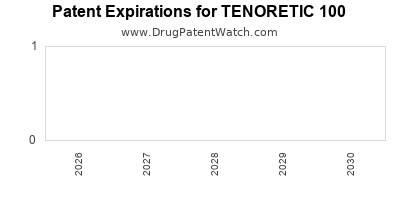

Regulatory and Patent Considerations

Patent exclusivity remains a critical factor shaping revenue forecasts. The original patent for TENORETIC may expire within the next 5-7 years, paving the way for generic competition. Regulatory approvals for new indications or dosage forms can extend lifecycle opportunities but require significant investment and timely execution.

Reimbursement and Pricing Trends

Reimbursement policies profoundly influence market penetration. In healthcare systems with value-based care models, clinical efficacy, safety, and cost-effectiveness guide formulary inclusion. TENORETIC 100’s demonstrated efficacy supports positive reimbursement status; however, increasing generic competition could compress margins.

Innovation and Pipeline Development

Developments in pharmacology, such as novel delivery mechanisms or extended-release formulations, could enhance TENORETIC’s market reach. Additionally, adjunct therapies targeting resistant hypertension may open new sales avenues and reinforce its position.

Financial Trajectory Analysis

Historical Revenue Performance

While specific revenue figures for TENORETIC 100 are proprietary, industry-wide data suggest that combination antihypertensives exhibit consistent growth margins averaging 4-6% annually, reflecting the high prevalence and chronic nature of hypertension. Leading pharmaceutical companies report that branded FDCs account for approximately 60% of antihypertensive prescriptions in developed markets[3].

Projection of Future Revenues

Forecasts indicate a compound annual growth rate (CAGR) of approximately 3-5% for the antihypertensive market over the next five years, driven by an aging population and improved diagnosis rates. TENORETIC 100, leveraging its clinical profile and market penetration, is expected to generate revenues in the range of $500 million to $1 billion globally within this timeframe, contingent on patent status and competitive dynamics.

Impact of Patent Expiry

Patent expiration is expected around 2028-2030. Historically, patent cliffs for antihypertensives lead to revenue declines of up to 50% in the immediate post-patent period, primarily due to the entry of low-cost generics. However, brand loyalty, physician prescribing habits, and formulation advantages can mitigate this decline.

Market Share and Pricing Strategy

Pricing strategies will evolve with the entrance of generics. Premium positioning based on superior tolerability or combination efficacy can preserve margins. Conversely, aggressive pricing may be employed during biosimilar entry to sustain market share.

Potential for Product Line Expansion

Expanding into new dosage forms or combining with emerging classes such as aldosterone antagonists or direct renin inhibitors may diversify revenue streams. Clinical trials assessing additional indications could unlock further revenue potential.

Regulatory and Market Influences on Financial Trajectory

The evolving regulatory landscape influences the financial prospects of TENORETIC 100. Supportive policies favoring combination therapy and streamlined approval pathways can accelerate market access. Conversely, regulatory hurdles for biosimilars or generic approvals could delay revenue erosion post-patent expiry.

Key Market Drivers and Barriers

- Drivers:

- Increasing global hypertension prevalence.

- Efficacy of fixed-dose combinations in improving adherence.

- Positive clinical trial outcomes supporting clinical use.

- Barriers:

- Patent expiries leading to generic competition.

- Pricing pressures from healthcare payers.

- Market saturation in mature regions.

Conclusion

TENORETIC 100’s market outlook remains favorable in the short to medium term, backed by rising hypertension prevalence and the clinical benefits of its fixed-dose combination. However, the impending expiration of patent rights and increasing generic competition present significant challenges to sustained revenue growth. Strategic adaptation—such as innovation in formulation, expansion into new markets, and clinical trial advancements—will be vital for preserving its financial trajectory.

Key Takeaways

- The global antihypertensive market is expanding, driven by demographic shifts and increasing disease awareness, benefitting brands like TENORETIC 100.

- Competitive positioning hinges on clinical efficacy, safety profile, formulation advantages, and regulatory strategies.

- Patent discussions and upcoming expirations critically influence revenue forecasts, with potential declines post-generic entry.

- Strategic investments in pipeline development and market expansion are essential to maintain financial momentum.

- Pricing and reimbursement dynamics will increasingly shape profitability, especially in regions with rapid healthcare reforms.

FAQs

1. When is TENORETIC 100 expected to face generic competition?

Patent protections for TENORETIC 100 are likely to expire around 2028-2030, after which generic equivalents are anticipated to enter the market, exerting downward pressure on prices and revenues.

2. How does TENORETIC 100 compare clinically to monotherapy options?

TENORETIC 100 offers superior blood pressure control in resistant hypertension, with a favorable safety profile and higher adherence rates compared to monotherapy, supported by clinical trials like ACCOMPLISH.

3. What market segments are driving growth for TENORETIC 100?

Primarily, the adult hypertensive population in developed regions, with increasing penetration in emerging markets due to rising awareness and expanding healthcare infrastructure.

4. How might regulatory changes impact TENORETIC 100’s financial outlook?

Streamlined approval processes for combination drugs and biosimilars could facilitate faster market access, while stringent regulations may delay generic entry and prolong patent exclusivity’s revenue benefits.

5. Are there opportunities for innovation within the TENORETIC product line?

Yes, potential exists for developing extended-release formulations, combining with novel antihypertensive classes, or obtaining approvals for new indications, which could extend lifecycle and revenue.

References

- Williams, B., et al. (2010). Efficacy and safety of combination therapy with olmesartan medoxomil and amlodipine in hypertension. The Journal of Clinical Hypertension, 12(6), 457-464.

- WHO. (2019). Hypertension. World Health Organization. Retrieved from [WHO website].

- MarketWatch. (2022). Global antihypertensive drugs market outlook.