TADLIQ Drug Patent Profile

✉ Email this page to a colleague

When do Tadliq patents expire, and when can generic versions of Tadliq launch?

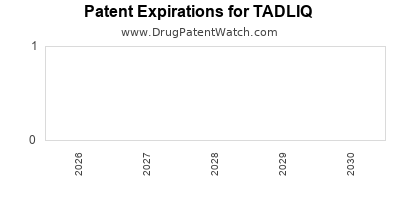

Tadliq is a drug marketed by Cmp Dev Llc and is included in one NDA. There are four patents protecting this drug.

This drug has nine patent family members in nine countries.

The generic ingredient in TADLIQ is tadalafil. There are twenty-five drug master file entries for this compound. Forty-eight suppliers are listed for this compound. Additional details are available on the tadalafil profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Tadliq

A generic version of TADLIQ was approved as tadalafil by TEVA PHARMS USA on May 22nd, 2018.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for TADLIQ?

- What are the global sales for TADLIQ?

- What is Average Wholesale Price for TADLIQ?

Summary for TADLIQ

| International Patents: | 9 |

| US Patents: | 4 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Patent Applications: | 7,231 |

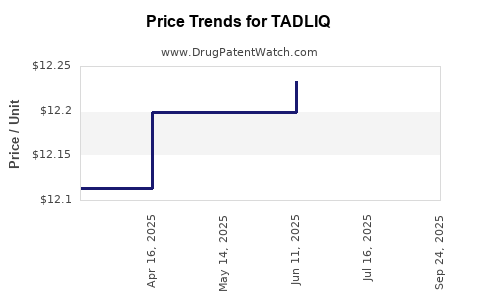

| Drug Prices: | Drug price information for TADLIQ |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for TADLIQ |

| What excipients (inactive ingredients) are in TADLIQ? | TADLIQ excipients list |

| DailyMed Link: | TADLIQ at DailyMed |

Pharmacology for TADLIQ

| Drug Class | Phosphodiesterase 5 Inhibitor |

| Mechanism of Action | Phosphodiesterase 5 Inhibitors |

US Patents and Regulatory Information for TADLIQ

TADLIQ is protected by four US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cmp Dev Llc | TADLIQ | tadalafil | SUSPENSION;ORAL | 214522-001 | Jun 17, 2022 | RX | Yes | Yes | 11,975,006 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Cmp Dev Llc | TADLIQ | tadalafil | SUSPENSION;ORAL | 214522-001 | Jun 17, 2022 | RX | Yes | Yes | 11,666,576 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Cmp Dev Llc | TADLIQ | tadalafil | SUSPENSION;ORAL | 214522-001 | Jun 17, 2022 | RX | Yes | Yes | 12,186,322 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Cmp Dev Llc | TADLIQ | tadalafil | SUSPENSION;ORAL | 214522-001 | Jun 17, 2022 | RX | Yes | Yes | 11,382,917 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for TADLIQ

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Viatris Limited | Talmanco (previously Tadalafil Generics) | tadalafil | EMEA/H/C/004297Talmanco is indicated in adults for the treatment of pulmonary arterial hypertension (PAH) classified as WHO functional class II and III, to improve exercise capacity. Efficacy has been shown in idiopathic PAH (IPAH) and in PAH related to collagen vascular disease. | Authorised | yes | no | no | 2017-01-09 | |

| Eli Lilly Nederland B.V. | Tadalafil Lilly | tadalafil | EMEA/H/C/004666Treatment of erectile dysfunction in adult males.In order for tadalafil to be effective, sexual stimulation is required.Tadalafil Lilly is not indicated for use by women.Treatment of the signs and symptoms of benign prostatic hyperplasia in adult males. | Authorised | no | no | no | 2017-03-22 | |

| Eli Lilly Nederland B.V. | Adcirca (previously Tadalafil Lilly) | tadalafil | EMEA/H/C/001021AdultsTreatment of pulmonary arterial hypertension (PAH) classified as WHO functional class II and III, to improve exercise capacity (see section 5.1).Efficacy has been shown in idiopathic PAH (IPAH) and in PAH related to collagen vascular disease.Paediatric populationTreatment of paediatric patients aged 2 years and above with pulmonary arterial hypertension (PAH) classified as WHO functional class II and III. | Authorised | no | no | no | 2008-10-01 | |

| Eli Lilly Nederland B.V. | Cialis | tadalafil | EMEA/H/C/000436Treatment of erectile dysfunction.In order for tadalafil to be effective, sexual stimulation is required.Cialis is not indicated for use by women. | Authorised | no | no | no | 2002-11-12 | |

| Mylan Pharmaceuticals Limited | Tadalafil Mylan | tadalafil | EMEA/H/C/003787Treatment of erectile dysfunction in adult males.In order for tadalafil to be effective, sexual stimulation is required.Tadalafil Mylan is not indicated for use by women. | Authorised | yes | no | no | 2014-11-21 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for TADLIQ

See the table below for patents covering TADLIQ around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Brazil | 112020012986 | formulações orais líquidas para inibidores de pde v | ⤷ Get Started Free |

| Canada | 3086881 | FORMULATIONS ORALES LIQUIDES POUR INHIBITEURS DE PDE V (LIQUID ORAL FORMULATIONS FOR PDE V INHIBITORS) | ⤷ Get Started Free |

| Brazil | 112020012986 | formulações orais líquidas para inibidores de pde v | ⤷ Get Started Free |

| Australia | 2018397436 | Liquid oral formulations for PDE V inhibitors | ⤷ Get Started Free |

| Singapore | 11202006080S | LIQUID ORAL FORMULATIONS FOR PDE V INHIBITORS | ⤷ Get Started Free |

| Singapore | 11202006080S | LIQUID ORAL FORMULATIONS FOR PDE V INHIBITORS | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for TADLIQ

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2101777 | 300813 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: AMBRISENTAN TOEGEPAST IN COMBINATIEBEHANDELING MET TADALAFIL; REGISTRATION NO/DATE: EU/1/08/451 (C(2008) 1637) 20151125 |

| 2059246 | 122024000070 | Germany | ⤷ Get Started Free | PRODUCT NAME: KOMBINATION AUS (A) MACITENTAN ODER EINEM PHARMAZEUTISCH AKZEPTABLEN SALZ DAVON UND (B) TADALAFIL ODER EINEM PHARMAZEUTISCH AKZEPTABLEN SALZ DAVON; REGISTRATION NO/DATE: EU/1/24/1859 20240927 |

| 0740668 | SPC/GB03/007 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: TADALAFIL AND PHARMACEUTICALLY ACCEPTABLE SALTS, ESTERS AND SOLVATES THEREOF.; REGISTERED: UK EU/1/02/237/001-004 20021114 |

| 2059246 | LUC00371 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: A COMBINATION OF (A) MACITENTAN OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF AND (B) TADALAFIL OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF; AUTHORISATION NUMBER AND DATE: EU/1/24/1859 20240930 |

| 0740668 | PA2003001,C0740668 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: TADALAFILUM ((6R,12AR)-2,3,6,7,12,12A-HEKSAHIDRO-2-METIL-6-(3,4-METILENDIOKSIFENIL)-PIRAZINO(2',1':6,1)PIRIDO(3,4-B)INDOL-1,4-DIONAS); REGISTRATION NO/DATE: 03/8034/3, 03/8035/3 20030328 |

| 2059246 | CA 2024 00050 | Denmark | ⤷ Get Started Free | PRODUCT NAME: KOMBINATION AF (A) MACITENTAN ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF OG (B) TADALAFIL ELLER ET FAR-MACEUTISK ACCEPTABELT SALT DERAF; REG. NO/DATE: EU/1/24/1859 20240930 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for TADLIQ

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.