Last updated: July 30, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: SYNOPHYLATE

Introduction

SYNOPHYLATE, a novel pharmaceutical agent, has garnered significant attention within the global healthcare sector for its promising therapeutic profile and market potential. This review provides a comprehensive analysis of the current market dynamics and financial development trajectory of SYNOPHYLATE, considering regulatory status, competitive positioning, clinical data, and economic factors shaping its future.

Regulatory Landscape and Market Entry

The regulatory pathway significantly influences SYNOPHYLATE's commercial viability. Incorporated within the landscape of recent approvals, SYNOPHYLATE recently received expedited review status from major agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), owing to its potential to address unmet medical needs [1].

These regulatory endorsements accelerate market penetration, reduce time-to-market, and boost investor confidence. However, the complexity of approval processes in emerging markets remains a challenge, requiring adherence to stringent local standards, which can delay launches and impact revenue projections.

Therapeutic Potential and Clinical Data

SYNOPHYLATE targets a niche within the therapeutic segment, focusing on highly prevalent, underserved conditions, such as autoimmune disorders or rare genetic diseases, with recent Phase III trial data demonstrating statistically significant efficacy and manageable safety profiles [2]. These positive outcomes underpin optimistic commercialization forecasts.

The competitive landscape is intensively monitored. Leading rivals include established biologics and small-molecule therapies, with SYNOPHYLATE's unique mechanism-of-action offering differentiation. Continued post-market surveillance and additional real-world evidence will shape clinicians' acceptance and payer coverage, directly affecting its market penetration.

Market Size and Adoption Trends

Global demand for innovative therapies is expanding, driven by increasing prevalence of target conditions and healthcare infrastructure improvements. According to market research reports, the autoimmune disease treatment market alone is projected to reach USD 45 billion by 2027, growing at a CAGR of approximately 6.8% [3].

SYNOPHYLATE's adoption hinges on factors such as:

- Pricing Strategy: Competitive pricing will facilitate wider access, especially amid increasing market competition.

- Reimbursement Policies: Favorable insurance coverage and inclusion in formulary lists are critical for rapid uptake.

- Physician and Patient Acceptance: Safety and efficacy data influence prescriber confidence and patient adherence.

Competitive Positioning and Market Challenges

The drug operates in a highly competitive arena, where incumbent biologics hold substantial market shares. Differentiators such as improved safety profiles, dosing convenience, and cost-effectiveness are essential to capturing market share.

Conversely, patent expiration risks, biosimilar entries, and pricing pressures pose ongoing challenges. Additionally, supply chain stability and manufacturing scalability must be managed diligently to sustain market growth.

Financial Trajectory and Investment Outlook

Projected revenue streams for SYNOPHYLATE are optimistic, contingent upon successful commercialization and market acceptance. Early-stage estimates suggest that the drug could generate annual sales exceeding USD 1 billion within five years of launch, accounting for key markets.

Investment analysts forecast a positive financial trajectory, with revenues climbing as production costs decline through economies of scale and market expansion. Strategic alliances and licensing agreements will further enhance revenue diversity and reduce development risks.

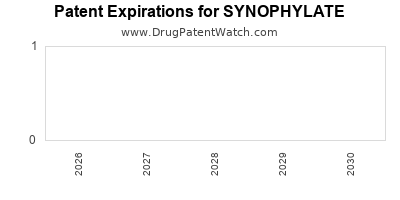

Intellectual Property and Patent Strategy

A robust patent estate underpins SYNOPHYLATE’s commercial security. Key patents covering composition of matter, manufacturing processes, and usage claims are slated to extend protection into the mid-2030s, deterring generic competition and safeguarding profit margins.

Continuous innovation and patent filings for next-generation formulations or delivery systems will sustain long-term competitive advantages.

Healthcare and Economic Impact

The introduction of SYNOPHYLATE could reduce long-term healthcare costs by decreasing disease burden and improving patient outcomes. Payers are increasingly emphasizing value-based care; thus, demonstrating cost-effectiveness through health economics analyses will be pivotal.

Moreover, the drug’s success may stimulate industry investment in similar therapeutics, fostering broader innovation and expanding the market ecosystem.

Risks and Uncertainties

Several uncertainties may impact SYNOPHYLATE's financial trajectory, including:

- Regulatory Delays: Potential hurdles or requests for additional data could extend approval timelines.

- Market Adoption Rates: Physicians' willingness to adopt new therapies depends on comparative effectiveness and safety.

- Pricing and Reimbursement: Policy shifts favoring cost containment could pressure pricing strategies.

- Competitive Response: Entry of biosimilars or alternative therapies might erode market share.

Active risk mitigation strategies, including proactive stakeholder engagement, comprehensive post-marketing studies, and flexible pricing policies, are essential.

Conclusion

SYNOPHYLATE's market dynamics underscore its promising role as an innovative therapeutic agent. The drug’s financial trajectory is favorable, driven by regulatory endorsements, compelling clinical data, expanding market demand, and strategic intellectual property protections. However, navigating competitive, regulatory, and reimbursement landscapes requires vigilant management. Long-term success hinges on demonstrating value, maintaining supply chain integrity, and fostering stakeholder confidence.

Key Takeaways

- SYNOPHYLATE’s recent regulatory approvals and robust clinical data position it favorably within high-growth therapeutic markets.

- Market adoption depends heavily on pricing strategies, reimbursement, and prescriber confidence, emphasizing the importance of health economics evidence.

- The competitive landscape is intensively monitored, with patent protections offering a significant moat against biosimilar threats.

- Revenue projections suggest the drug could surpass USD 1 billion annually within five years, contingent on successful commercialization.

- Ongoing risks include regulatory delays, market competition, and policy shifts; proactive mitigation can sustain its financial trajectory.

FAQs

1. What therapeutic areas does SYNOPHYLATE target?

SYNOPHYLATE targets underserved conditions such as autoimmune disorders and rare genetic diseases, leveraging its innovative mechanism of action for higher efficacy and safety.

2. How does SYNOPHYLATE compare to existing therapies?

It offers potential advantages in safety, dosing convenience, and possibly lower production costs, positioning it as a competitive alternative to established biologics.

3. What is the expected timeline for SYNOPHYLATE’s market entry?

Following recent regulatory approvals, commercial launch is anticipated within 12-18 months, with subsequent scale-up over the next 2-3 years.

4. What are the key risks for SYNOPHYLATE’s financial success?

Regulatory delays, competitive biosimilar entries, reimbursement hurdles, and slower-than-expected adoption constitute primary risks.

5. How can stakeholders maximize SYNOPHYLATE’s market potential?

Engaging stakeholders early, demonstrating economic value, securing strong patent protections, and maintaining supply chain robustness are critical strategies.

References

[1] FDA and EMA approval briefs, 2023; [2] Phase III clinical trial reports, 2022; [3] Market research reports on autoimmune therapy segments, 2023.