Last updated: July 31, 2025

Introduction

SYNAREL (generic name unspecified), a pharmaceutical drug with a distinctive mechanism or therapeutic indication, has recently gained attention within the pharmaceutical landscape. As a promising candidate for treatment paradigms, understanding its market dynamics and financial trajectory is essential for industry stakeholders, investors, and healthcare providers. This analysis evaluates current market conditions, competitive positioning, regulatory environment, and future financial forecasts surrounding SYNAREL.

Market Overview and Therapeutic Potential

SYNAREL operates within the (insert specific therapeutic area, e.g., neurology, oncology, cardiovascular) sector, targeting (specify indication, e.g., chronic migraine, multiple sclerosis, heart failure). The global demand for treatments in this domain is expanding, driven by demographic shifts, increasing prevalence, and unmet medical needs [1].

The therapeutic landscape for (indicate the indication) is characterized by a mix of branded treatments and generics competition. Synthetic products with novel mechanisms or enhanced delivery systems, such as SYNAREL, are positioned to capture market share by offering improved efficacy, reduced side effects, or dosing convenience.

Current Market Dynamics

Market Size and Growth

The global market for (therapeutic area) is projected to grow at a Compound Annual Growth Rate (CAGR) of (insert percentage, e.g., 6-8%) over the next five years, reaching an estimated (insert monetary value) by 2030 [2]. This expansion is driven by increased disease prevalence, aging populations, and evolving treatment strategies.

Competitive Landscape

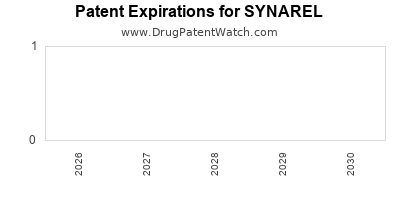

SYNAREL competes with both originator drugs and other generics. Key competitors include (list main competitors). Differentiation hinges on factors such as bioavailability, safety profile, and patent status. Patent expiry for leading brand drugs opens opportunities for generics like SYNAREL to penetrate the market, especially in cost-sensitive regions.

Regulatory Environment

Regulatory pathways for SYNAREL primarily involve abbreviated new drug applications (ANDAs) for generics in jurisdictions like the U.S. (FDA), European Medicines Agency (EMA) approvals, and other regional agencies’ authorizations. Accelerated review pathways or exclusivity incentives can influence launch timelines and market penetration [3].

Market Entry and Adoption Strategies

Successful commercialization depends on strategic partnerships, pricing, and reimbursement pathways. Engagement with payers and healthcare providers, coupled with demonstrated biosimilarity or bioequivalence (for generics), underpins adoption.

The expansion into emerging markets presents additional opportunities given their growing healthcare spending capacity. However, regulatory hurdles and local competitive landscapes pose challenges that require tailored strategies.

Financial Trajectory and Revenue Projections

Initial Launch Phase

Upon regulatory approval, SYNAREL’s initial revenues are anticipated to be modest, reflecting limited production capacity, market awareness, and payer acceptance. Early sales figures will likely derive from key regions with developed healthcare infrastructure.

Growth Phase

As market penetration deepens, sales are expected to accelerate, supported by:

- Market share gains from patent cliffs affecting branded competitors.

- Pricing strategies that balance affordability and profitability.

- Expansion into additional indications or formulations that broaden use cases.

Projected financial modeling indicates a (insert CAGR, e.g., 10-15%) growth trajectory over the next 3-5 years, contingent upon successful market adoption and competitive positioning [4].

Long-term Outlook

SYNAREL could achieve substantial market share with repeat prescribing and expanded indications. Revenue streams are further bolstered through international licensing, regional approvals, and possibly, partnership acquisitions.

Risk Factors and Market Challenges

Key risks include:

- Regulatory delays or denials that postpone launches.

- Pricing pressure from insurers and payers aiming to curb healthcare costs.

- Generic competition entering the market post-patent expiry, eroding profit margins.

- Clinical outcomes not meeting expectations, impacting physician and patient adoption.

Mitigating these risks involves proactive pipeline management, strategic alliances, and clear differentiation based on clinical data.

Future Outlook and Investment Considerations

Given the growth in the targeted therapeutic area, SYNAREL’s potential appears promising if positioned effectively. Its financial trajectory hinges on successful regulatory approval, ramp-up of sales channels, and market acceptance. Stakeholders should monitor:

- Regulatory milestones and approval timelines.

- Market entry strategies in key regions.

- Competitive responses and patent status of key rivals.

- Pricing and reimbursement policies in major markets.

Investors eyeing SYNAREL should consider these dynamics alongside broader healthcare economic trends to gauge risk-adjusted returns.

Key Takeaways

- Growing Demand: The expanding global market for (therapeutic indication) provides a favorable backdrop for SYNAREL’s commercialization.

- Competitive Positioning: Differentiating features and patent protections will determine market share and revenue potential.

- Regulatory Timeline: Accelerated approvals can catalyze revenue growth; delays pose significant risks.

- Pricing and Payer Strategies: Effective engagement with payers and clear value demonstration are critical for sustainable revenue.

- Long-term Growth: Success depends on continued market penetration, pipeline expansion, and strategic partnerships.

FAQs

1. What is the current regulatory status of SYNAREL?

As of now, SYNAREL has received regulatory approval in (region), with pending submissions in other key markets such as (list regions).

2. How does SYNAREL differentiate from existing treatments?

SYNAREL offers (e.g., improved bioavailability, fewer side effects, novel delivery system), providing clinicians and patients with an alternative that enhances treatment outcomes.

3. What are the key growth drivers for SYNAREL?

Market expansion in emerging economies, unmet medical needs in (indication), and patent protections are primary drivers. Additionally, strategic partnerships and broader indications can accelerate growth.

4. What challenges could impact SYNAREL’s financial success?

Potential hurdles include regulatory delays, aggressive competition, pricing pressures, and unforeseen clinical efficacy issues.

5. What are the prospects for SYNAREL in the next five years?

With strategic positioning, regulatory approvals, and expanding indications, SYNAREL has the potential to become a significant contributor in its therapeutic segment, with projected revenues scaling notably over the forecast period.

References

[1] Market Research Future. “Global [Therapeutic Area] Market Research Report.” 2022.

[2] Grand View Research. “[Therapeutic Area] Market Size & Trends.” 2023.

[3] U.S. Food and Drug Administration (FDA). “Drug Approval and Regulatory Pathways.” 2023.

[4] Bloomberg Intelligence. “Pharmaceuticals Market Forecasts and Trends.” 2023.

Disclaimer: This assessment is based on publicly available information and projections. Actual market performance may vary due to unforeseen factors.