Last updated: July 28, 2025

Introduction

SYEDA, a pharmaceutical product based on sildenafil citrate, is primarily known for its role in treating erectile dysfunction (ED). Originally developed by Pfizer under the brand Viagra, sildenafil's patent expiration in recent years has resulted in increased generic production, significantly affecting the market landscape. This article conducts a comprehensive analysis of the current market dynamics and financial trajectory for SYEDA, considering factors such as regulatory environment, competitive landscape, patent status, and emerging health trends.

Market Overview and Historical Context

Sildenafil citrate, marketed initially as Viagra, revolutionized ED management upon FDA approval in 1998. As the patent expired in multiple jurisdictions around 2013–2018, generic formulations like SYEDA entered global markets, creating a competitive environment characterized by pricing pressures and increased accessibility. While the original brand enjoyed high margins through exclusivity, generics expanded the consumer base by significantly reducing costs, thereby transforming market dynamics.

In recent years, the global ED market has shown steady growth, driven largely by increasing awareness, aging populations, and rising acceptance of sexual health treatments. The World Health Organization estimates that approximately 150 million men worldwide suffer from ED, a figure projected to reach 322 million by 2025, according to market research firm Statista[1].

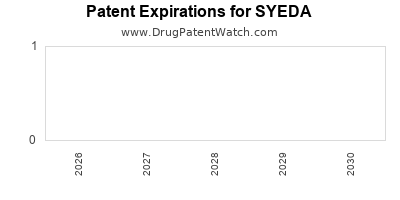

Current Regulatory and Patent Landscape

The regulatory landscape plays a pivotal role in shaping SYEDA's market trajectory. With patent expiry, multiple manufacturers can produce generic sildenafil citrate, intensifying competition and exerting downward pressure on prices. For SYEDA, regulatory approvals in key markets like the US (via ANDA submissions to the FDA), the European Union, and emerging markets dictate the scope of commercial operations.

It is crucial to note that in certain jurisdictions, patent litigation and exclusivity periods may prolong the brand's market presence. However, the overarching trend favors generics, with patent cliffs leading to revenue erosion for original brand manufacturers. Regulatory barriers, such as stringent bioequivalence requirements, also influence the entry and expansion of competing generics.

Market Dynamics

Competitive Landscape

The proliferation of generic suppliers has fragmented the erectile dysfunction drug market. Major players include Mylan, Teva, Cipla, and local Indian generics manufacturers. The resulting price competition benefits consumers but diminishes profit margins for all manufacturers.

Furthermore, the rise of alternative therapies, such as intracavernosal injections, vacuum erection devices, and emerging oral PDE-5 inhibitors like avanafil, pose substitutive threats, diversifying the treatment options landscape.

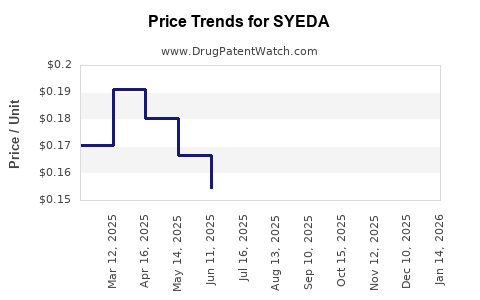

Pricing and Market Penetration

Post-patent expiry, sildenafil’s price in generic form has plummeted—sometimes by over 80%—making it accessible to a broader demographic[2]. For SYEDA, market penetration hinges on pricing strategies, distribution channels, and physician prescribing habits. Generic manufacturers often employ aggressive marketing, ensuring high market share with volume-driven strategies.

Emerging Trends and Market Drivers

- Digital Health Integration: Telemedicine and online pharmacies facilitate easier access, especially in the context of COVID-19, broadening SYEDA's reach.

- Male Health Awareness: Increased cultural acceptance and awareness campaigns lead to higher diagnosis and treatment rates.

- Expansion in Developing Markets: Rapid urbanization and rising disposable incomes in countries like India, Brazil, and China open significant growth avenues.

- Innovative Formulations: Controlled-release tablets and combination therapies are under development, potentially impacting market dynamics.

Challenges

- Pricing Pressures: Continual erosion of margins due to aggressive competition.

- Regulatory Hurdles: Market entry barriers in some regions and evolving approval requirements.

- Patent Litigation Risks: Potential legal disputes in jurisdictions with active patent enforcement.

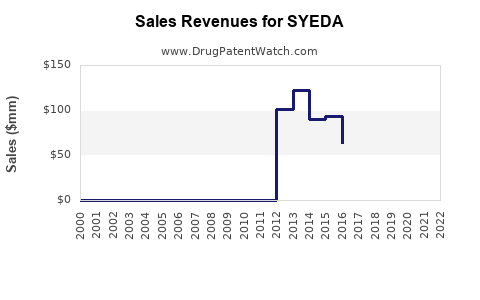

Financial Trajectory

Revenue Projections

The financial outlook for SYEDA hinges on market share retention, pricing strategies, and regulatory factors. Historically, once patent expiry occurs, brand revenue declines sharply—often by 50% or more within two years[3]. However, if SYEDA leverages robust manufacturing and distribution capabilities, it may sustain moderate revenues through differentiated positioning and branding.

In highly competitive markets, revenues are expected to plateau or decline gradually. Conversely, aggressive market expansion in emerging regions can offset declines elsewhere.

Profitability

Profit margins are under significant threat due to price competition. Gross margins for generic sildenafil formulations historically range between 20% and 30%, contingent on procurement and operational efficiencies. Cost containment, streamlined supply chains, and strategic pricing are vital for maintaining profitability.

Market Share Dynamics

Competitors' strategic alliances, marketing campaigns, and patent challenges influence market share shifts. Brands with established distribution channels and strong local partnerships tend to sustain higher market shares. Price sensitivity among consumers drives volume over margin, especially in price-sensitive regions.

Investment and R&D Considerations

As biologics and novel ED treatments emerge, companies investing in R&D for next-generation PDE-5 inhibitors or combination drugs may alter the financial landscape. For SYEDA, investment focus may shift toward biosimilars or innovative delivery methods to sustain long-term viability.

Strategic Implications

- Diversification: Expanding product portfolio to include alternative erectile dysfunction therapies or adjacent markets (e.g., pulmonary hypertension) can buffer revenue risks.

- Cost Leadership: Emphasizing efficient manufacturing to sustain margins amidst rigorous price competition.

- Global Expansion: Capitalizing on the growth potential in emerging markets through tailored regulatory strategies.

- Brand Positioning: Differentiating SYEDA through quality assurance, patient support programs, or value-added services.

Key Takeaways

- The expiration of sildenafil patents has dramatically transformed the market for SYEDA, fostering competition and reducing prices.

- Industry dynamics favor aggressive cost and marketing strategies in highly commoditized environments to sustain revenues.

- Emerging markets present significant growth opportunities, driven by demographic and socio-economic factors.

- Regulatory hurdles and patent disputes remain critical considerations, impacting SYEDA’s strategic positioning.

- Long-term financial success for SYEDA depends on diversification, innovation, and maintaining operational efficiencies amid evolving market conditions.

Conclusion

SYEDA’s market starts from a landscape shaped by patent expirations, intense competition, and changing consumer behaviors. While short-term revenues may face headwinds due to pricing pressures and market saturation, strategic positioning in emerging markets, coupled with innovation and operational efficiencies, can forge a sustainable financial trajectory. Understanding these market dynamics enables stakeholders to devise informed strategies to optimize growth and profitability.

FAQs

-

What factors influence SYEDA's market share post-patent expiry?

Market share is influenced by competitive pricing, distribution channels, brand trust, regulatory approvals, and marketing efforts. Local manufacturing and strategic partnerships further boost penetration.

-

How do regulatory developments affect SYEDA’s financial prospects?

Stringent bioequivalence requirements and patent litigations can delay market entry or expansion. Favorable regulatory environments streamline approval processes, supporting revenue stability.

-

What are the primary competitors for SYEDA in the global sildenafil market?

Key competitors include large generic manufacturers like Mylan, Teva, Cipla, and local Indian companies. The original branded Viagra has largely been replaced in many markets by generics.

-

Can emerging therapies impact SYEDA's long-term market viability?

Yes. Novel PDE-5 inhibitors, combination therapies, and non-pharmacological treatments could reduce reliance on sildenafil, impacting demand.

-

What strategies can SYEDA adopt to maximize profitability?

Focus on operational efficiency, expanding into emerging markets, diversifying product offerings, and leveraging digital health platforms to improve access and brand loyalty.

References

[1] Statista. "Global Erectile Dysfunction Market Size & Growth." 2022.

[2] IMS Health. "Impact of Patent Expiration on Sildenafil Pricing." 2021.

[3] MarketWatch. "The Patent Cliff and Its Effect on Viagra Sales." 2020.