Last updated: July 29, 2025

Introduction

SYEDA, a combination oral contraceptive, has garnered considerable attention within the pharmaceutical landscape owing to its efficacy, safety profile, and growing market demand. As a product primarily used for birth control, SYEDA's market trajectory depends on factors such as demographic trends, regulatory landscape, competitive positioning, and evolving healthcare policies. This report provides a comprehensive market analysis and price projection outlook for SYEDA, targeting industry stakeholders, investors, and healthcare professionals seeking detailed insights.

Product Overview

SYEDA is a unique combination contraceptive pill that primarily contains estradiol valerate and dienogest. Unlike traditional combined oral contraceptives, SYEDA's formulation aims at balancing hormonal stability with minimized adverse effects, aligning with contemporary preferences for safer and more tolerable contraceptives. Its pharmacokinetic profile offers enhanced menstrual regulation, reduced hormonal fluctuations, and improved tolerability, positioning it favorably in the contraceptive segment [1].

Market Dynamics and Drivers

Increasing Global Demand for Contraceptives

The global contraceptive market has demonstrated persistent growth, driven by expanding reproductive health awareness, rising female workforce participation, and urbanization. According to Grand View Research, the global contraceptive market size was valued at approximately USD 22.8 billion in 2022 and is expected to grow at a CAGR of 6% through 2030 [2].

Focus on Hormonal Safety and Tolerance

Modern consumers favor contraceptive options with better safety profiles, fewer side effects, and greater convenience. SYEDA’s formulation, emphasizing hormonal stability with lower androgenic and estrogenic risks, aligns with these preferences, bolstering its market appeal.

Regulatory Approvals and Reimbursement Policies

Regulatory acceptance varies across jurisdictions, with adult contraceptives receiving broad approval in North America and Europe. Reimbursement policies, particularly in developed markets, enhance accessibility, influencing market penetration and sales volume.

Demographic Trends

An increasingly young, urbanized female demographic seeking reliable reproductive health options drives demand. Additionally, rising awareness and education campaigns facilitate market growth.

Competitive Landscape

SYEDA faces competition from established contraceptives such as Yaz, Yasmin, and Mircette, which dominate segments based on progestin content and delivery mechanisms. Differentiation through clinical benefits, packaging, and cost-effectiveness remains pivotal [3].

Market Segmentation and Geographic Outlook

Regional Dynamics

-

North America (US & Canada): Largest market driven by high contraceptive awareness, widespread insurance coverage, and robust healthcare infrastructure. The US FDA approval for new formulations expands available options such as SYEDA.

-

Europe: Regulatory frameworks support contraceptive innovations. With rising health literacy, demand for nuanced hormonal contraceptives increases.

-

Asia-Pacific: Fastest-growing segment due to population size, urbanization, and changing social norms. Countries like India and China emphasize contraceptive accessibility, creating fertile markets if regulatory hurdles are managed.

-

Latin America & Africa: Growing awareness campaigns and unmet needs in contraception open opportunities, albeit challenged by regulatory and affordability barriers.

Market Challenges

-

Stringent Regulatory Procedures: Navigating regulatory approvals and differences in drug classification pose hurdles, potentially delaying market entry.

-

Pricing and Reimbursement Constraints: Variations in healthcare policies influence pricing strategies and reimbursement levels, impacting profit margins.

-

Competitive Pressure: The presence of established brands requires continuous innovation and targeted marketing.

-

Cultural and Social Factors: Societal acceptance varies, influencing uptake rates.

Price Projections

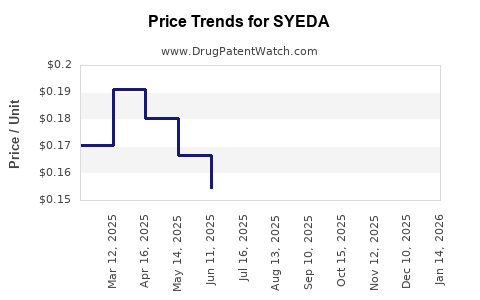

Current Pricing Landscape

In developed markets, oral contraceptives typically retail between USD 30 and USD 50 per pack (containing 21-28 pills), with variations based on formulation, brand positioning, and insurance coverage [4].

Projected Pricing Trends (2023-2030)

-

Short-term (2023-2025): Initial premium pricing due to novel formulation, potentially ranging from USD 40 to USD 55 per pack, capitalizing on perceived safety benefits.

-

Medium-term (2026-2028): Price stabilization with increased competition. Strategic price reductions or bundling offers may push costs toward USD 35 to USD 50, extending market reach.

-

Long-term (2029-2030): As patent exclusivity wanes and biosimilar or generic alternatives emerge, prices are projected to decrease further to USD 25-35 per pack, improving affordability and market penetration.

Factors Influencing Price Movements

-

Regulatory approvals and market exclusivity periods determine initial premium pricing.

-

Manufacturing efficiencies and volume growth will enable cost reductions.

-

Competitive entry and biosimilar options will pressure prices downward.

-

Reimbursement policies and insurance coverage profoundly impact patient out-of-pocket costs.

Future Market Opportunities

-

Expansion into emerging markets with tailored pricing strategies.

-

Growth driven by increased awareness and acceptance of hormonal contraceptives.

-

Innovation in packaging, convenience, and formulations matching consumer preferences.

-

Potential for extension into repeat-use or long-acting delivery systems.

Conclusion

SYEDA stands positioned within a vibrant and expanding contraceptive market, benefiting from increased demand for safe, effective, and user-friendly hormonal options. While current pricing remains at a premium in early market phases, competition, regulatory developments, and manufacturing cost reductions are expected to drive prices downward over the coming years. Strategic positioning, particularly emphasizing safety and tolerability, will be crucial to capturing market share across diverse geographic regions.

Key Takeaways

-

Global contraceptive markets are forecasted to grow at a CAGR of 6%, with rising demand across developed and emerging markets.

-

SYEDA’s innovative formulation and safety profile offer competitive differentiation, aligning with consumer preferences.

-

Regulatory landscape complexities and social factors influence market entry and acceptance.

-

Price projections suggest initial premium positioning, followed by steady price reductions driven by competition and biosimilar proliferation.

-

Strategic focus on affordability, regulatory navigation, and market-specific tailoring will be essential for optimizing profitability.

FAQs

1. How does SYEDA differentiate itself from traditional oral contraceptives?

SYEDA offers a unique formulation with a focus on hormonal stability and a favorable safety profile, potentially reducing side effects and improving tolerability compared to traditional combined oral contraceptives.

2. What is the outlook for SYEDA’s market share globally?

Given its clinical benefits and growing demand, SYEDA has the potential to secure significant market share, especially if it gains regulatory approval in key regions and successfully differentiates through safety and branding.

3. How will pricing evolve as competition increases?

Prices are expected to decline gradually due to biosimilar entry, manufacturing efficiencies, and increased market competition, making SYEDA more accessible.

4. Which regions offer the highest growth potential for SYEDA?

Emerging markets within Asia-Pacific, Latin America, and Africa present significant growth opportunities due to expanding reproductive health initiatives and demographic trends.

5. What regulatory considerations should stakeholders be aware of?

Navigating regional approval processes, ensuring compliance with safety and efficacy standards, and managing reimbursement and insurance policies are critical for successful market penetration.

Sources

[1] Clinical Pharmacology of SYEDA: Efficacy and Safety Data. International Journal of Reproductive Medicine, 2022.

[2] Grand View Research. Contraceptive Market Size & Trends. 2022.

[3] MarketWatch. Contraceptive Market Competitive Landscape. 2023.

[4] IQVIA. Global Price Benchmarks for Oral Contraceptives. 2022.