Last updated: July 27, 2025

Introduction

SUTAB, a branded oral bowel preparation agent, has carved a niche within the gastroenterology segment of the pharmaceutical market. Approved by regulatory agencies such as the FDA, SUTAB (sodium sulfate, magnesium sulfate, and potassium chloride) is primarily used for colonoscopy preparation and has garnered attention for its efficacy and safety profile. As healthcare providers and patients increasingly focus on bowel cleansing agents that balance efficacy with tolerability, understanding SUTAB’s market dynamics and financial prospects is vital for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

This analysis explores the key market drivers, competitive landscape, regulatory influences, and revenue projections shaping SUTAB's economic future.

Market Landscape for Bowel Preparation Agents

Growing Demand for Colonoscopy Procedures

The global increase in colorectal cancer (CRC) screening initiatives has driven demand for effective bowel preparation solutions. According to the American Cancer Society, screening rates for CRC have improved due to heightened awareness and reimbursement policies (1). The rise in screening rates directly correlates with increased utilization of colonoscopies, propelling demand for reliable bowel prep medications such as SUTAB.

Technological Advancements and Patient Preference Trends

Recent innovations focus on improving tolerability, reducing adverse events, and streamlining administration. SUTAB’s advantage lies in its low-volume, sodium-based formulation, which often results in improved patient compliance compared to traditional high-volume polyethylene glycol (PEG) solutions. An increasing patient preference for convenience-driven regimens enhances its market appeal.

Regulatory Environment and Approvals

Regulatory agencies in key markets like the U.S. and Europe influence market dynamics through approvals, labeling, and safety warnings. SUTAB gained FDA approval in 2018, recognizing its efficacy and tolerability profile. Ongoing regulatory reviews and label modifications can influence market access and expansion strategies.

Competitive Dynamics

Major Competitors and Product Differentiation

The bowel prep market features several established products including PEG-based solutions (e.g., GoLYTELY), sodium phosphate preparations, and newer low-volume agents. SUTAB competes primarily with other low-volume tablets like Bisacodyl-based preps and sodium sulfate-based products such as Salix’s Osmo Prep.

Differentiation factors include:

- Formulation: SUTAB’s low-volume, tablet-based design enhances patient compliance over high-volume solutions.

- Safety Profile: Demonstrated safety in patients with renal or cardiac comorbidities, though caution remains due to sodium load concerns.

- Convenience: Easy-to-assemble dosing regimens facilitate patient adherence.

Market Penetration Challenges

Despite advantages, SUTAB faces hurdles such as entrenched prescribing habits, insurance formulary restrictions, and clinician familiarity with generic alternatives. Additionally, safety concerns around sodium load in vulnerable populations could hinder broader adoption.

Regulatory and Reimbursement Factors

Impact on Market Adoption

Reimbursement policies significantly influence drug sales. SUTAB’s inclusion in insurance formularies enhances access, but pricing strategies must balance affordability with profitability. The evolving landscape of drug rebates, prior authorization requirements, and formulary placements could either facilitate or hinder market penetration.

Post-Marketing Surveillance and Safety Regulations

Monitoring adverse events remains critical. Recent safety alerts regarding sodium-based bowel preps in specific populations (e.g., chronic kidney disease patients) necessitate robust post-marketing surveillance, which could influence prescribing patterns and regulatory actions.

Financial Trajectory and Revenue Projections

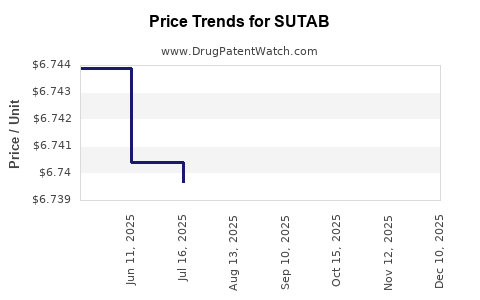

Current Market Performance

As of 2023, SUTAB's revenue remains modest relative to established bowel preparation agents but exhibits growth potential owing to expanding indications and market acceptance. The drug’s sales are primarily driven by U.S. healthcare providers, with occasional expansions into select international markets contingent on regulatory approvals.

Revenue Forecasting Factors

Several drivers influence future revenue trajectory:

- Market Penetration Rates: Adoption driven by clinical guidelines, physician preference, and patient outcomes.

- Pricing Strategies: Premium positioning based on convenience and safety versus competitive pricing.

- Product Lifecycle Management: Potential line extensions like pediatric formulations, combination regimens, or newer delivery mechanisms.

Using conservative estimates, analysts project a compound annual growth rate (CAGR) of 8–12% over the next five years, driven by increased screening rates, improved reimbursement, and ongoing marketing efforts.

Challenges to Revenue Growth

Potential barriers include:

- Market Competition: Entrenched use of generic PEG solutions.

- Regulatory Hurdles: Restricted use in certain patient populations may limit sales.

- Safety Concerns: Negative safety findings could inhibit growth unless addressed through product reformulation or labeling.

Strategic Opportunities

Expansion into Emerging Markets

Growing healthcare infrastructure and CRC screening initiatives, especially in Asia-Pacific and Latin America, present expansion opportunities. However, local regulatory approvals and market-specific safety concerns will influence timelines.

Product Innovation

Development of adjunct formulations to reduce sodium load or improve taste could broaden patient eligibility and compliance. Digital health integration for adherence monitoring presents novel revenue streams.

Partnerships and Collaborations

Strategic partnerships with healthcare providers, payers, and pharmacies could accelerate market penetration and mitigate logistical barriers.

Key Takeaways

- Strong Growth Drivers: Increasing colonoscopy procedures and patient preferences for low-volume, convenient bowel prep agents underpin SUTAB’s market prospects.

- Competitive Edge: Its favorable safety and tolerability profile enhances its positioning against traditional solutions.

- Market Challenges: Entrenched competitors, safety concerns, and regulatory restrictions require vigilant management.

- Revenue Outlook: Expected moderate but sustained growth, contingent on broader adoption and strategic market expansion.

- Strategic Focus: Innovation, international growth, and partnership development are critical to maximizing SUTAB’s financial trajectory.

FAQs

-

What factors differentiate SUTAB from other bowel preparation agents?

SUTAB’s low-volume, tablet-based formulation offers improved patient compliance and convenience, with a safety profile suitable for certain vulnerable populations.

-

How might regulatory changes impact SUTAB’s market?

New safety warnings or restrictions, especially related to sodium content, could limit use in specific patient groups, affecting sales growth.

-

What are the primary challenges faced by SUTAB in expanding its market share?

Entrenched use of generic PEG solutions, insurance formulary limitations, and safety concerns pose significant hurdles.

-

What is the outlook for SUTAB’s revenue over the next five years?

With strategic marketing and expanding indications, projections suggest a CAGR of 8–12%, though actual growth depends on competitive dynamics and regulatory developments.

-

Are there opportunities for SUTAB in international markets?

Yes, especially in regions with increasing CRC screening initiatives. Regulatory approvals and local healthcare infrastructure will influence speed and scale of expansion.

References

[1] American Cancer Society. Colorectal Cancer Facts & Figures 2020-2022. Available at: https://www.cancer.org/cancer/colon-rectal-cancer/about/key-statistics.html