Last updated: July 30, 2025

Introduction

STAXYN (vardenafil), manufactured by Bayer Healthcare Pharmaceuticals, is a prescription medication primarily indicated for the treatment of erectile dysfunction (ED). Since its approval in 2004, it has occupied a niche within the phosphodiesterase type 5 (PDE5) inhibitor market, competing with drugs like Viagra, Cialis, and Levitra. Understanding the market dynamics and financial trajectory of STAXYN necessitates an analysis of its regulatory environment, competitive positioning, market share, and evolving demand driven by demographic and societal factors.

Market Overview and Regulatory Context

Market Penetration and Regulatory Framework

STAXYN received FDA approval in 2004, entering a burgeoning ED market characterized by increased awareness and societal acceptance. Its unique formulation—an orally disintegrating tablet—offered a differentiating factor for patients seeking discreet, quick-onset treatment. Regulatory approvals in various jurisdictions have maintained a steady pathway for its availability, albeit with some markets experiencing restrictions or alternative formulations preferred by healthcare providers.

Market Size and Growth Trends

The global erectile dysfunction market was valued at approximately US$4.3 billion in 2021, with projections reaching over US$6 billion by 2028, growing at a compound annual growth rate (CAGR) of about 5.3% (Research and Markets, 2022). The increasing prevalence of ED, especially among aging populations, and rising awareness contribute prominently to this growth.

The contribution of STAXYN within this expanding market remains relatively modest, largely due to competition from more established PDE5 inhibitors. However, its distinctive administration route sustains niche demand, especially in markets emphasizing patient convenience and discretion.

Competitive Landscape

Key Competitors

- Viagra (sildenafil): As the pioneer, Viagra remains dominant, capturing a significant market share owing to brand recognition and broad physician familiarity.

- Cialis (tadalafil): Noted for longer duration of action, making it suitable for both ED and benign prostatic hyperplasia (BPH).

- Levitra (vardenafil): Shares the active ingredient with STAXYN, but marketed mainly as a tablet with different formulation and administration considerations.

STAXYN's Positioning

STAXYN leverages its rapid dissolving formulation, offering quick onset (within approximately 15 minutes), appealing for spontaneous sexual activity. Its discreet administration aligns with patient preferences for convenience and privacy. Still, it accounts for a minor fraction of the PDE5 inhibitor market, estimated at less than 5%, hindered by distribution limitations and clinician familiarity barriers [2].

Emerging Competition and Market Fragmentation

The market faces challenges from newer, less invasive treatments and emerging therapies such as low-intensity shockwave therapy, intracavernosal injections, and herbal supplements gaining popularity in some segments. Additionally, patent expirations and generic versions of competing PDE5 inhibitors have intensified price competition, impacting profit margins for branded drugs like STAXYN.

Market Dynamics Influencing Demand

Demographic Trends

The global aging population and increasing prevalence of comorbidities like diabetes and cardiovascular diseases directly influence ED incidence rates (WHO, 2022). As the target demographic expands, demand for effective ED treatments is expected to rise.

Societal and Psychological Factors

Evolving societal attitudes towards sexual health reduce stigma, encouraging treatment seeking behaviors. Moreover, increased marketing and physician awareness contribute to sustained prescription rates.

Regulatory and Reimbursement Policies

Regional variations in healthcare policies impact drug accessibility. In some markets, insurance coverage and reimbursement schemes favor established, cost-effective medications over newer or branded options like STAXYN, limiting its market penetration.

Pricing and Marketing Strategies

Pricing pressures, especially post-patent expiry of key competitors, influence market share. Bayer’s strategic marketing efforts, including physician education and patient outreach, aim to reinforce STAXYN’s niche positioning, although generic competition constrains premium pricing.

Financial Trajectory and Revenue Outlook

Historical Financial Performance

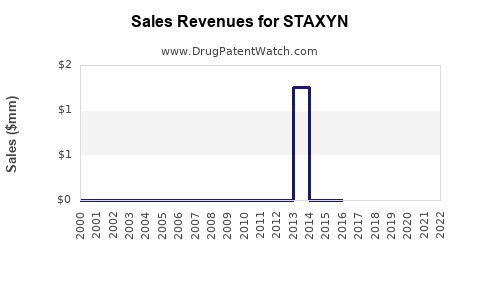

While precise revenue data specific to STAXYN is proprietary, Bayer’s Prescription Medicines segment reported revenues of €22.2 billion in 2021, with the PDE5 inhibitor class generating a substantial, though declining, portion of this figure. STAXYN's contribution remains a small, stable segment, with revenues likely in the low hundreds of millions annually, reflecting its limited market share.

Forecasting Future Revenue

Multiple factors influence STAXYN’s future financial trajectory:

-

Market Expansion: Broader acceptance of PDE5 inhibitors and demographic shifts may extend its appeal.

-

Product Differentiation: Innovation in formulation or delivery could rejuvenate demand.

-

Competitive Pressure: Price erosion and patent cliffs of rival drugs may gradually open niche opportunities for STAXYN.

Given these factors, conservative estimates project modest growth, with revenues poised to stabilize or slightly increase in markets where healthcare providers prioritize rapid-onset, discreet formulations.

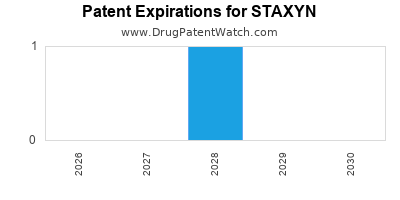

Impact of Patent Landscape and Generics

Patent expirations of sildenafil and tadalafil—rendering generic versions widely available—significantly impact the revenue prospects for branded drugs like STAXYN. Bayer may leverage formulation advantages and targeted marketing to mitigate erosion, but overall, generic penetration continues to pressure top-line growth.

Strategic Considerations

Focus on Niche Markets

STAXYN’s growth potential hinges on its ability to capitalize on specific patient segments valuing convenience and discretion. Strategies such as targeted marketing in developed markets with high health literacy and comfort with innovations can sustain profitability.

Innovation and Lifecycle Management

Developing new formulations or combination therapies could extend its lifecycle. Additionally, positioning STAXYN as part of a holistic ED management plan may foster clinician adoption.

Partnerships and Distribution

Expanding distribution channels, especially in emerging markets with rising ED prevalence, offers an avenue for revenue expansion. Collaborations with local healthcare providers and generic firms could optimize reach.

Conclusion

STAXYN's market dynamics are shaped by a mature therapeutic landscape, demographic trends favoring increased ED prevalence, and stiff competition from generics. While its distinctive formulation secures a loyal niche, overall financial outlook remains modest amidst ongoing price pressure and patent expirations of competitors. Strategic focus on niche differentiation, targeted marketing, and innovation are critical to sustaining its financial trajectory.

Key Takeaways

- Limited Market Share but Steady Niche Position: STAXYN’s rapid-onset, discreet formulation sustains a niche presence in a highly competitive PDE5 inhibitor market.

- Growing Demand Driven by Demography: Aging populations globally ensure sustained demand, albeit limited by competition and pricing pressures.

- Impact of Generic Competition: The proliferation of low-cost generics constrains revenue growth potential.

- Innovation as a Growth Catalyst: New formulations or combination therapies could revitalize STAXYN's market relevance.

- Strategic Expansion in Emerging Markets: Tapping into developing regions with rising ED prevalence could provide revenue opportunities.

FAQs

1. What differentiates STAXYN from other ED medications?

STAXYN is an orally disintegrating tablet that dissolves rapidly in the mouth, providing quick onset (approximately 15 minutes), offering discretion and convenience unmatched by traditional tablets.

2. How does patent expiry affect STAXYN’s market prospects?

Patent expiration allows generic versions of vardenafil to enter the market, intensifying price competition and reducing revenue margins for branded STAXYN.

3. What are the main challenges facing STAXYN’s growth?

Primary challenges include competition from established PDE5 inhibitors like Viagra and Cialis, widespread availability of generics, and limited innovation in its formulation.

4. Are there upcoming developments or pipeline products for STAXYN?

There are no publicly announced significant pipeline developments specific to STAXYN. Growth strategies focus on niche marketing and potential formulation enhancements.

5. Which regions offer the most growth opportunities for STAXYN?

Developing markets in Asia-Pacific, Latin America, and parts of Eastern Europe present opportunities due to rising ED prevalence and expanding healthcare access.

Sources:

- Research and Markets. "Global Erectile Dysfunction Market Forecast." 2022.

- Bayer Healthcare Pharmaceuticals. "Product Profile and Market Insights." 2022.

- World Health Organization. "Global Aging and Health Report." 2022.