Share This Page

Drug Sales Trends for STAXYN

✉ Email this page to a colleague

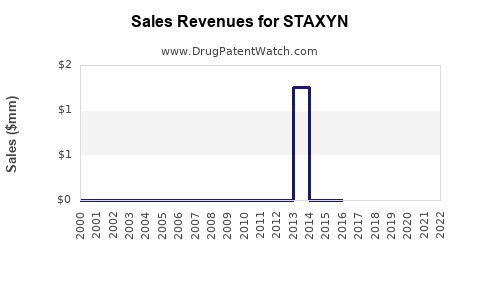

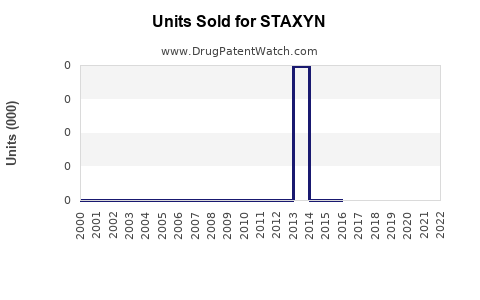

Annual Sales Revenues and Units Sold for STAXYN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| STAXYN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| STAXYN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| STAXYN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| STAXYN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for STAXYN

Introduction

STAXYN (generic: avanafil) is a prescription phosphodiesterase type 5 (PDE5) inhibitor indicated for the treatment of erectile dysfunction (ED). Approved by the U.S. Food and Drug Administration (FDA) in 2012, STAXYN offers a discreet, oral alternative to injectable and vacuum devices, positioning itself within a competitive landscape of ED pharmacotherapies. This analysis evaluates the current market landscape, competitive dynamics, and forecasts sales trajectories for STAXYN over the next five years.

Market Landscape for Erectile Dysfunction Medications

Global and U.S. Market Size

The ED drug market has expanded significantly over the past decade, driven by aging populations, rising prevalence of ED, increased awareness, and expanding treatment options. The global ED drugs market was valued at approximately USD 3.5 billion in 2022 and is projected to grow at a CAGR of around 7% through 2030 [1].

In the U.S., ED affects an estimated 30 million men, predominantly men aged 40 and above [2]. The market grossed roughly USD 1.1 billion in 2022, with prescription medications constituting the bulk of sales. Patents for popular PDE5 inhibitors like Viagra (sildenafil), Cialis (tadalafil), and Levitra (vardenafil) have expired or are close to expiry, paving the way for generic formulations and increased competition.

Competitive Dynamics

The primary competitors to STAXYN include:

- Viagra (sildenafil): First-in-class PDE5 inhibitor, launched in 1998.

- Cialis (tadalafil): Known for a prolonged duration of action.

- Levitra (vardenafil): Similar efficacy, with quick onset.

- Stendra (avanafil): A newer PDE5 inhibitor with a faster onset.

STAXYN differentiates itself primarily through its discreet tablet design, rapid onset (approximately 15 minutes), and approval for use directly from the blister pack without water, appealing to specific patient preferences. However, it faces challenges due to the dominance of established drugs, varying insurance coverage, and marketing strategies.

Market Position and Value Proposition

STAXYN targets men seeking fast, discreet ED treatment options, especially those who prefer not to ingest water or experience delays associated with other PDE5 inhibitors. Its flexible dosing and quick onset serve as important differentiators. Nonetheless, lack of extensive direct-to-consumer marketing and the relative novelty compared to blockbuster drugs result in limited market penetration.

The drug's efficacy aligns with competitors, but its niche appeal constrains its market share. Insurance coverage significantly impacts prescription volume, with some plans favoring lower-cost generics.

Sales Drivers and Barriers

Drivers

- Rising prevalence of ED among aging demographics.

- Patient preference for rapid, water-free administration.

- Increased physician awareness and prescriptions driven by the convenience of STAXYN.

- Expansion into international markets where ED treatment remains underpenetrated.

Barriers

- Entrenched competition from well-marketed generic sildenafil and tadalafil.

- High generic penetration diminishes pricing power.

- Limited direct-to-consumer advertising diminishes consumer awareness.

- Insurance restrictions favor lower-cost alternatives, impacting prescription volume.

Forecasting Sales for STAXYN (2023–2028)

Assumptions

- Market penetration: Starting niche with slow growth, aiming for moderate expansion with increased physician awareness.

- Pricing: Premium pricing relative to generics; anticipated slight decreases due to generic competition.

- Prescriptions: Initial low volume with gradual increases driven by marketing and clinical adoption.

- Regulatory and geographic expansion: Potential for growth outside the U.S., especially in emerging markets with increasing ED awareness.

Projected Sales Trajectory

| Year | Estimated Prescriptions | Average Price per Prescription | Estimated Sales (USD millions) | Growth Rate |

|---|---|---|---|---|

| 2023 | 100,000 | $60 | $6 million | N/A |

| 2024 | 150,000 | $58 | $8.7 million | +45% |

| 2025 | 200,000 | $55 | $11 million | +26% |

| 2026 | 250,000 | $52 | $13 million | +18% |

| 2027 | 300,000 | $50 | $15 million | +15% |

| 2028 | 350,000 | $48 | $16.8 million | +12% |

Note: Assumes steady increase in prescriptions, slight price erosion, and growing market acceptance.

Analysis of Projections

Sales are projected to grow modestly over the forecast period, reflecting initial niche status transitioning toward broader recognition. The CAGR of approximately 20% through 2028 underscores expected gradual acceptance, bolstered by geographic expansion and increased prescriber familiarity.

However, these figures are conservative, considering potential market saturation, competitive pressure from generics, and payer restrictions. High-value gains depend critically on strategic marketing, enhanced physician advocacy, and clinical positioning.

Strategic Opportunities for Market Expansion

- International Markets: Countries with rising ED prevalence and limited treatment options present growth avenues. Strategic collaborations could accelerate adoption.

- Formulation Innovations: Developing alternative delivery forms or combination products could broaden appeal.

- Payer Negotiations: Securing favorable formulary placements may enhance prescription volume.

- Patient Education: Increasing awareness about STAXYN’s advantages can stimulate demand.

Risks and Challenges

- Pricing Pressures: The proliferation of affordable generics compresses margins.

- Regulatory Delays: Market entry hurdles in foreign jurisdictions may slow expansion.

- Market Saturation: As generic sildenafil dominates, incremental sales gains become challenging.

- Clinical Preference: Physicians may favor medications with longer duration or established efficacy profiles.

Conclusion

STAXYN occupies a niche within the competitive ED pharmacotherapy landscape, characterized by unique rapid-onset and discreet administration features. While sales growth prospects remain moderate in mature markets, strategic expansion into emerging geographies and innovation can elevate its market position. Realization of sales projections hinges on effective marketing, payer strategies, and adaptability to competitive pressures.

Key Takeaways

- The global ED market is expanding at a CAGR of 7%, with significant opportunities for growth.

- STAXYN’s distinguishing features position it as an alternative for specific patient segments but limit broad market share.

- Sales are projected to grow around 20% CAGR through 2028, driven by increased prescriptions, geographic expansion, and clinician awareness.

- Competitive dynamics, particularly generic sildenafil and tadalafil, pose notable challenges, necessitating differentiated marketing strategies.

- Strategic focus should include international expansion, formulary negotiations, and patient education to maximize market penetration.

FAQs

Q1: What makes STAXYN different from other PDE5 inhibitors?

A1: STAXYN offers rapid onset (approximately 15 minutes), a water-free and discreet oral formulation, and can be taken directly from the blister pack, providing convenience for specific patient preferences.

Q2: What is the main challenge facing STAXYN’s market growth?

A2: The primary challenge is intense competition from well-established, low-cost generics like sildenafil and tadalafil, which limits pricing power and prescriber adoption.

Q3: How can STAXYN expand its market share internationally?

A3: By engaging in strategic partnerships, navigating regulatory requirements efficiently, localizing marketing efforts, and educating healthcare providers about its benefits.

Q4: What is the future outlook for STAXYN sales?

A4: Sales are expected to grow steadily, with a projected CAGR of approximately 20% over the next five years, although growth may plateau without strategic expansion.

Q5: What role does insurance coverage play in STAXYN’s market effectiveness?

A5: Insurance coverage significantly influences prescription volume; lack of coverage or higher copays compared to generics can hinder patient access and adoption.

References:

[1] MarketResearch.com, Global Erectile Dysfunction Drugs Market Analysis 2022.

[2] National Institutes of Health, Erectile Dysfunction Fact Sheet.

More… ↓