Last updated: July 29, 2025

Introduction

Stalevo 200 is a prescription medication used primarily in the management of Parkinson’s disease. Market dynamics surrounding it are influenced by multiple factors, including the prevalence of Parkinson’s disease, competitive landscape, patent status, regulatory environment, and evolving treatment paradigms. Understanding these drivers is essential for stakeholders analyzing its future financial trajectory.

Overview of Stalevo 200

Stalevo 200 combines levodopa, carbidopa, and entacapone, offering a comprehensive symptomatic treatment for Parkinson’s disease patients requiring higher doses of levodopa. As an extended-release formulation, it provides improved motor control with reduced fluctuations. Approved by regulatory agencies such as the U.S. Food and Drug Administration (FDA), it caters to a niche within the larger Parkinson’s therapeutic market, which is projected to grow significantly over the coming decades.

Market Landscape and Dynamics

1. Epidemiological Drivers

The global prevalence of Parkinson’s disease is growing, fueled by aging populations. According to the Parkinson’s Foundation, approximately 1 million Americans live with Parkinson’s, with incidence projected to double by 2040[1]. Similar demographic shifts are observed globally, notably in Europe and Asia. This rising prevalence directly bolsters demand for advanced pharmacotherapies like Stalevo 200, especially for patients with advanced stages requiring higher potency.

2. Therapeutic Competition and Treatment Evolution

While levodopa remains the gold standard, multiple formulations and combination therapies compete within the high-dose niche. Key competitors include:

- Combinations with different COMT inhibitors (e.g., tafluprost, tolcapone).

- Monoamine oxidase B (MAO-B) inhibitors.

- Other extended-release formulations and novel delivery systems.

The competitive landscape is intensified by ongoing research exploring neuroprotective agents and disease-modifying therapies, potentially altering long-term treatment strategies.

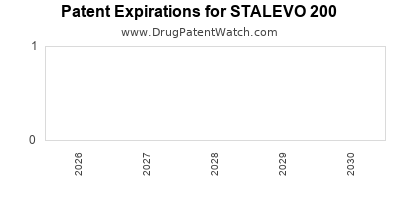

3. Patent and Regulatory Status

Patents protecting Stalevo 200's formulation and manufacturing processes are critical to its market exclusivity. As patents near expiration, generic versions are likely to enter the market, exerting downward pressure on prices and revenues[2]. Regulatory approvals are also pivotal; any formulation adjustments or new indications could influence market share and financial performance.

4. Pricing and Reimbursement Environment

Pricing strategies for Stalevo 200 are influenced by healthcare reimbursement policies in different regions. In established markets like the U.S. and Europe, payers demand cost-effectiveness data, which impacts reimbursement levels. Consequently, pricing pressures may intensify if generics or alternative therapies gain market access, reducing profit margins.

5. Market Penetration and Prescriber Adoption

Physician familiarity, clinical guidelines, and patient adherence influence prescribing patterns. While Stalevo 200 is favored for high-dose needs, competition from newer drugs or delivery methods, such as pump infusions, may inhibit broader adoption.

Financial Trajectory Analysis

1. Revenue Trends

Initial revenue growth for Stalevo 200 was driven by increased Parkinson’s prevalence and clinical preference for its efficacy. However, post-patent expiration vulnerabilities loom. Revenue forecasts depend on:

- Duration of patent protection.

- Effectiveness of patent litigation.

- Expansion into emerging markets, where Parkinson’s prevalence is rising.

- Adoption rates among neurologists and movement disorder specialists.

Historical data from similar drugs suggests a peak in revenues pre-patent expiry, followed by declines unless new indications or formulations sustain demand[3].

2. Cost Structures and Margins

Pharmaceuticals like Stalevo 200 typically boast high gross margins due to low manufacturing costs relative to pricing. However, marketing, regulatory approval processes, and litigation expenses can impact net margins. Disruption from generics could reduce price points by up to 80%, risking margin erosion.

3. R&D and Pipeline Development

Investment in R&D for Parkinson’s disease treatments indicates a strategic focus on developing next-generation therapies or formulation enhancements. A pipeline that includes disease-modifying agents could resuscitate demand and extend the product’s financial relevance.

4. Entry of Generics

Generic competition remains the primary factor in forecasting revenue declines. The timing of patent expirations and the success of generic manufacturing influence this trajectory. Historically, generic entry into Parkinson’s drugs leads to revenues declining by 70-90% within a few years[4].

Market Growth and Future Outlook

1. Regional Market Opportunities

- United States: Mature but facing impending patent cliff, emphasizing the need for lifecycle extensions.

- Europe: Similar dynamics with strong healthcare infrastructure but stringent reimbursement controls.

- Asia-Pacific: Rapidly growing markets with increasing Parkinson’s prevalence and less patent enforcement rigidity, offering substantial long-term growth opportunities.

2. Strategic Imperatives

To sustain its financial trajectory, stakeholders should consider:

- Developing or acquiring extended formulations or combination therapies.

- Navigating patent challenges successfully.

- Entering emerging markets strategically.

- Investing in real-world evidence to enhance prescriber confidence.

3. Impact of Regulatory and Scientific Advances

The advent of neuroprotective therapies or gene-based interventions could redefine treatment standards, potentially reducing reliance on high-dose levodopa formulations like Stalevo 200.

Key Takeaways

- The global rise in Parkinson’s disease prevalence underpins sustained demand; however, patent expiration poses significant revenue risks.

- Competitive pressures, including generic entry and alternative therapies, are imminent challenges, necessitating strategic lifecycle management.

- Regional market opportunities, especially in Asia-Pacific, can foster growth if navigated effectively.

- Innovations in drug delivery and formulation can serve as revenue enhancers in a mature market.

- Investing in pipeline development and real-world evidence can help sustain market relevance amid evolving therapeutic landscapes.

FAQs

Q1: When is the patent expiration expected for Stalevo 200, and how will this impact its market presence?

A1: Patent protection typically lasts 20 years from filing, with specific extensions possible. Once expired, generic manufacturers may enter, leading to substantial price competition and revenue reductions, often within 1-3 years post-expiration[2].

Q2: How does the development of disease-modifying Parkinson’s therapies threaten Stalevo 200's market share?

A2: Neuroprotective and disease-modifying agents could delay or reduce the need for symptomatic treatments like Stalevo 200, potentially shifting market demand toward these novel therapies as they gain regulatory approval and clinical acceptance.

Q3: What regional strategies can optimize Stalevo 200’s financial performance?

A3: Expanding into emerging markets with rising Parkinson’s prevalence and less mature patent regimes offers growth, while investing in reimbursement negotiations in mature markets sustains revenue streams.

Q4: How significant are regulatory hurdles for maintaining or expanding Stalevo 200’s market?

A4: Regulatory agencies prioritize safety, efficacy, and manufacturing quality. Loosening of regulations can facilitate new formulations or indications, improving market longevity; conversely, stringent policies may restrict expansion.

Q5: What role does clinician education play in the commercial success of Stalevo 200?

A5: Effective education improves prescriber familiarity, aligns therapy choices with clinical guidelines, and enhances patient adherence, directly influencing sales and market penetration.

References

[1] Parkinson’s Foundation. (2022). "2022 Parkinson’s Disease Data and Facts."

[2] U.S. Patent and Trademark Office. Patent expiration data for Parkinson’s drugs.

[3] IMS Health Data; Market Analysis Reports for Parkinson’s disease therapies.

[4] Harvard Business Review. (2017). "The Impact of Generic Entry on Pharmaceutical Revenues."