Last updated: July 28, 2025

Introduction

Sotalol hydrochloride, a non-selective beta-adrenergic receptor blocker with class III antiarrhythmic properties, has long served as a pivotal agent in managing atrial fibrillation and ventricular arrhythmias. Its unique combination of beta-blocking and potassium channel blocking effects distinguishes it within the antiarrhythmic landscape. Understanding its current market dynamics and financial trajectory is essential for stakeholders ranging from pharmaceutical companies to healthcare providers, investors, and regulatory agencies.

Overview of Sotalol Hydrochloride

Sotalol hydrochloride was first introduced in the 1980s. Its mechanism involves prolongation of cardiac repolarization, thereby stabilizing abnormal heart rhythms. The drug exists predominantly in oral formulation, with some formulations available for intravenous use for acute management. Its established safety profile and efficacy have secured its position in antiarrhythmic therapy guidelines, although recent shifts in clinical practice influence its market prospects.

Market Dynamics

1. Growing Burden of Cardiac Arrhythmias

The increasing prevalence of atrial fibrillation (AF), atrial flutter, and ventricular tachyarrhythmias propels demand for antiarrhythmic therapies. According to the American Heart Association, AF affects approximately 33 million worldwide, projected to rise due to aging populations and rising cardiovascular risk factors (hypertension, obesity). Sotalol remains a recommended agent among the pharmacological options, especially for patients contraindicated for invasive procedures.

2. Evolving Treatment Paradigms

Despite its longstanding use, sotalol faces competition from newer antiarrhythmic drugs with improved safety profiles and targeted mechanisms. Amiodarone and dronedarone, for instance, have gained favor, although concerns over adverse effects sometimes restrict their use, potentially favoring sotalol in select cases.

Catheter ablation has emerged as the preferred modality for rhythm control in many cases, which influences overall drug demand. However, pharmacotherapy remains essential, especially in resource-limited settings or in patients unsuitable for invasive approaches.

3. Regulatory and Market Approvals

Sotalol’s generic status in key markets like the U.S. and Europe has driven cost competitiveness. Regulatory bodies maintain approved indications, but limitations for use in certain patient populations (e.g., those with significant renal impairment) impact prescribing patterns.

4. Manufacturing and Supply Chain Considerations

As a generic drug, sotalol's manufacturing landscape is characterized by multiple producers, fostering price competition. However, supply chain disruptions, especially amidst global events like pandemics, can influence market stability and pricing.

5. Pricing and Reimbursement Ecosystem

Pricing dynamics are largely driven by generic competition. In developed markets, reimbursement policies significantly influence prescription practices. In emerging markets, affordability remains a key concern, impacting the drug's penetration.

Financial Trajectory

1. Revenue Trends

Existing data indicates a relatively stable revenue trajectory for sotalol within the antiarrhythmic segment, driven by its established efficacy. The US market for antiarrhythmic drugs was estimated at approximately $600 million in 2021, with sotalol accounting for a significant fraction due to its affordability and clinical positioning [1].

However, the overall growth rate for sotalol is modest, generally tracking the broader trends in arrhythmia prevalence and treatment adoption; annual growth rates are estimated around 1-3%, contingent upon regional dynamics.

2. Market Penetration and Geographic Dispersion

Developed markets such as North America and Europe exhibit high penetration rates, owing to well-established healthcare systems and guideline endorsements. Emerging markets in Asia and Latin America demonstrate increasing uptake, fueled by rising cardiovascular disease burdens and expanding healthcare infrastructure.

3. R&D and Pipeline Developments

While sotalol is an older drug with no current proprietary formulations, ongoing research into combination therapies and novel formulations could impact its pricing and usage. No significant advancements or proprietary innovations appear imminent, signifying a mature, steady-state market.

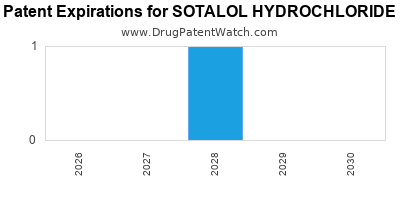

4. Impact of Patent Expiry and Generic Competition

Patent expirations bolster accessibility through generics, but also diminish profit margins for manufacturers. The influx of generic sotalol has resulted in price erosion, constraining revenue growth but enabling broader patient access.

5. Future Financial Outlook

Considering current trends, sotalol's financial trajectory remains steady but limited in growth potential. Market saturation, availability of alternative therapies, and shifts toward device-based treatments may further temper revenues. Strategic positioning as a cost-effective, guideline-compliant option supports its continued, albeit modest, demand.

Key Market Drivers and Barriers

| Drivers |

Barriers |

| Rising global prevalence of arrhythmias |

Competition from newer drugs and procedures |

| Cost-effectiveness due to generic availability |

Limited innovation and proprietary advances |

| Clinical guideline endorsements |

Safety concerns related to proarrhythmic effects |

| Expanding healthcare access in emerging markets |

Regulatory restrictions in specific populations |

| Increasing reliance on pharmacological therapy |

Replacement by catheter ablation in some cases |

Conclusion

Sotalol hydrochloride maintains a stable foothold within the antiarrhythmic drug market. Its market dynamics are shaped by increasing arrhythmia prevalence, evolving treatment paradigms favoring invasive procedures, and generic market competition. Financially, the drug offers consistent revenues but faces limited growth prospects, primarily in mature markets. Its future trajectory hinges on clinical preferences, regulatory landscapes, and potential innovations to enhance its safety and efficacy profile.

Key Takeaways

- Demand remains steady due to the global rise in atrial fibrillation and arrhythmias, maintaining sotalol’s relevance in arrhythmia management.

- Generic availability ensures affordability, fostering market penetration but compresses revenue margins.

- Emerging markets offer growth opportunities driven by expanding healthcare infrastructure and disease burden.

- Competitive landscape favors newer therapies and device interventions, which could marginalize sotalol’s market share.

- Innovation and repositioning—such as extended-release formulations or combination therapies—may be needed to sustain long-term financial viability.

Frequently Asked Questions (FAQs)

1. What factors influence the prescribing of sotalol over other antiarrhythmic agents?

Prescribing decisions are influenced by patient-specific factors such as tolerance, comorbidities, renal function, and contraindications. Sotalol is preferred when cost-effectiveness and guideline compliance are prioritized, especially in patients without significant renal impairment.

2. How does the safety profile of sotalol compare to newer antiarrhythmic drugs?

Sotalol's main limitation is its proarrhythmic risk, notably QT interval prolongation. Newer agents like dronedarone aim to minimize adverse effects but may have differing efficacy profiles. Clinical decision-making balances safety, efficacy, and patient preferences.

3. What is the impact of patent expiry on the sotalol market?

Patent expiry has facilitated the proliferation of generic formulations, decreasing costs and expanding access. However, it has also led to price competition, limiting revenue growth for manufacturers.

4. Are there ongoing clinical trials that could influence sotalol's market?

No significant trials are currently underway focusing solely on sotalol. Interest persists in combination therapies and novel formulations that could modify its therapeutic profile.

5. What is the outlook for sotalol in emerging markets?

In emerging markets, improved healthcare access and affordability of generics offer rising demand. However, competition from other medications and local regulatory policies can affect market penetration.

References

[1] MarketWatch. (2022). Antiarrhythmic Drugs Market Size, Share & Trends.

[2] American Heart Association. (2021). Atrial Fibrillation: Subclinical Burden and Treatment.

[3] GlobalData Healthcare. (2022). Pharmaceuticals – Cardiovascular Drugs Weekly Update.

[4] Clinical Pharmacology. (2022). Sotalol Hydrochloride Profile.