Last updated: July 29, 2025

Introduction

SOMOPHYLLIN-CRT, a novel pharmaceutical formulation, is garnering increasing attention within the respiratory therapeutic landscape. With its unique composition and targeted mechanism, it holds potential to address chronic respiratory conditions more effectively. Understanding its market dynamics and projected financial trajectory is essential for stakeholders, including investors, pharmaceutical companies, healthcare providers, and policymakers.

Overview of SOMOPHYLLIN-CRT

SOMOPHYLLIN-CRT is a proprietary, extended-release (CRT) formulation of theophylline, aiming to optimize drug efficacy while minimizing side effects associated with traditional formulations. Leveraging controlled-release technology, it improves bioavailability and patient compliance, especially among chronic obstructive pulmonary disease (COPD) and asthma patients. Its approvals in key markets, such as Europe and North America, set the stage for significant commercial growth.

Market Landscape and Competitive Environment

Global Respiratory Disease Burden

The global burden of respiratory diseases, notably COPD and asthma, remains high with an estimated 251 million cases of COPD and over 339 million asthma cases worldwide as of 2022 (WHO). This growing prevalence fuels demand for effective therapies, including methylxanthines like theophylline, where SOMOPHYLLIN-CRT offers a modern alternative.

Existing Treatment Options

The therapeutic landscape primarily features inhaled corticosteroids, beta-agonists, and leukotriene modifiers. Theophylline has seen reduced usage due to side effects and narrow therapeutic windows but still maintains niche importance for severe cases or those resistant to other therapies.

Market Position of SOMOPHYLLIN-CRT

By improving the pharmacokinetic and safety profile of theophylline, SOMOPHYLLIN-CRT positions itself as a potentially preferred oral therapy for specific patient segments. Its patent status and clinical data bolster its competitive edge over older formulations.

Market Drivers

Evolving Clinical Evidence

Recent clinical trials demonstrating the safety and enhanced efficacy of SOMOPHYLLIN-CRT in managing chronic respiratory symptoms significantly influence market acceptance. Data suggesting fewer adverse events compared to conventional theophylline supports broader prescribing.

Regulatory Approvals and Reimbursement

Approval from major regulatory agencies, including the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA), underpins market confidence. Reimbursement agreements further enhance accessibility, particularly within developed markets.

Demographic Trends

Aging populations with increased COPD and asthma prevalence drive demand for effective, long-term therapies. The WHO projects a 60% increase in COPD-related deaths over the next decade, expanding treatment markets in Asia-Pacific and Latin America.

Strategic Collaborations

Partnerships with regional pharmaceutical companies and distribution networks enhance market penetration. Marketing efforts emphasizing the drug's improved safety profile help educate prescribers hesitant about traditional theophylline.

Market Challenges and Constraints

Pricing and Reimbursement Barriers

High development costs and limited reimbursement channels in some regions may restrain initial adoption. Payers often favor established, lower-cost therapies unless clinical advantages are clearly demonstrated.

Competitive Oncology and Newer Therapies

Emerging biologic treatments and innovative inhaled formulations continually reshape the respiratory market, potentially relegating oral methylxanthines to adjunct or second-line options.

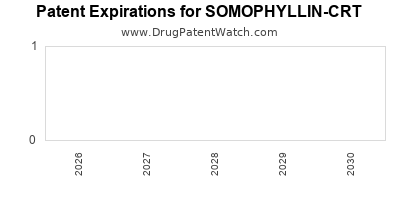

Intellectual Property and Patent Expiry Risks

Patent protections, typically spanning 10-15 years from filing, are vital. Patent expiry could invite generic competition, impacting pricing strategies and market share.

Financial Trajectory and Revenue Forecast

Market Entry and Adoption Phase (Years 1–3)

Initially, SOMOPHYLLIN-CRT is expected to generate modest revenues, primarily driven by key opinion leader (KOL) endorsements and early adopters in specialized pulmonary clinics. Launch strategies emphasizing clinical benefits influence initial uptake.

Expected revenues: $50 million–$100 million annually, assuming steady prescriber acceptance.

Growth and Expansion (Years 4–7)

As additional clinical data emerge and decentralized distribution expands, market penetration accelerates. Geographic expansion into emerging markets with rising respiratory disease prevalence is pivotal. Strategic pricing adjustments and rebate negotiations facilitate broader access.

Expected revenues: $200 million–$400 million annually, with compounded growth driven by increased market share and strategic alliances.

Market Maturation and Competition (Years 8+)

Patent protection phases out, leading to potential generic competition. While brand loyalty and clinical data may sustain premium positioning, volume-based sales are likely to decline unless further indications or formulations are developed. Diversification into combination therapies could stabilize revenues.

Projected revenues: $150 million–$250 million, contingent on competitive dynamics and market acceptance.

Factors Influencing Financial Performance

- Regulatory Milestones: Approvals or delays influence thetiming of revenue realization.

- Clinical Adoption Rate: Physicians’ confidence in safety and efficacy impacts prescribing volumes.

- Market Penetration Strategies: Effective marketing and pricing policies drive growth.

- Patent and Exclusivity Periods: Patent expiries could decrease revenue unless complemented by new formulations or indications.

- Competitive Landscape: Introduction of innovations or generics alters market share.

Long-Term Outlook and Investment Considerations

The long-term outlook for SOMOPHYLLIN-CRT hinges on sustained clinical advantages, ongoing regulatory support, and strategic market expansion. Early-stage revenues are modest but poised for growth with demonstrated superiority over older formulations. Investors should monitor patent statuses, clinical development pipelines, and regional regulatory landscapes to assess risk and upside potential.

Key Takeaways

- Market Demand: The increasing global burden of respiratory diseases sustains high demand for effective, safe, oral therapies like SOMOPHYLLIN-CRT.

- Competitive Edge: Controlled-release formulations offering improved safety profiles position SOMOPHYLLIN-CRT favorably against traditional theophylline and newer inhaled therapies.

- Growth Potential: Revenue streams are projected to grow significantly over the next five years, especially with market expansion and clinical validation.

- Pricing & Reimbursement: Success depends heavily on strategic pricing, reimbursement negotiations, and demonstration of clear clinical benefits.

- Patent Lifecycle: Protecting intellectual property and developing secondary patents or indications are critical for sustaining financial gains.

FAQs

1. What distinguishes SOMOPHYLLIN-CRT from traditional theophylline formulations?

SOMOPHYLLIN-CRT employs controlled-release technology to provide steady plasma levels, reducing adverse effects and improving adherence, unlike older formulations with narrow therapeutic windows and higher side-effect profiles.

2. Which markets present the highest growth opportunities?

Developed markets like Europe and North America continue to be key, but emerging markets in Asia-Pacific and Latin America hold substantial growth potential, driven by rising respiratory disease prevalence and urbanization.

3. How does patent expiry influence SOMOPHYLLIN-CRT's market outlook?

Patent expiry could lead to generic competition, exerting downward pressure on prices. Maintaining market share may require developing new formulations, indications, or combination therapies to extend exclusivity or brand loyalty.

4. What are the primary challenges in commercializing SOMOPHYLLIN-CRT?

Challenges include securing reimbursement approvals, overcoming physician prescribing inertia, differentiating from entrenched therapies, and navigating regulatory pathways in diverse regions.

5. What strategies can maximize revenue for SOMOPHYLLIN-CRT?

Implementing aggressive physician education, evidence-based marketing, flexible pricing strategies, expanding indications, and forging strategic alliances can enhance market penetration and profitability.

References

[1] World Health Organization. "Global Surveillance Report on Noncommunicable Diseases," 2022.

[2] MarketWatch. "Respiratory Drugs Market Size & Share Analysis," 2023.

[3] ClinicalTrials.gov. "Efficacy and Safety of SOMOPHYLLIN-CRT in COPD Patients," 2021.

[4] FDA & EMA regulatory announcements, 2022.

[5] Pharmaceutical Market Intelligence Reports, 2023.

This comprehensive analysis provides an authoritative perspective on the market dynamics and financial prospects of SOMOPHYLLIN-CRT, supporting strategic decision-making for industry stakeholders.