Last updated: July 28, 2025

Introduction

SOLU-CORTEF (hydrocortisone sodium succinate) is a potent corticosteroid injection widely used in acute and chronic conditions such as severe allergies, adrenal insufficiency, and inflammatory disorders. Its global sales, regulatory landscape, manufacturing capacity, and competitive environment shape its market trajectory. Understanding these dynamics is vital for stakeholders including pharmaceutical companies, investors, and healthcare providers seeking to capitalize on or navigate the drug's commercial potential.

Market Overview and Therapeutic Indications

SOLU-CORTEF primarily addresses inflammatory and immunologically mediated conditions. Its fast-acting injectable formulation makes it crucial in emergency settings such as adrenal crisis, septic shock, and severe allergic reactions. The drug's broad application spans hospitals, clinics, and emergency care, reflecting a steady demand driven by its efficacy profile and pharmacokinetics.

Globally, corticosteroids command a significant niche within endocrinology and emergency medicine. The pharmacological class, including SOLU-CORTEF, is projected to grow at a compound annual growth rate (CAGR) of approximately 3–5% over the next five years, rooted in an aging population, rising prevalence of inflammatory diseases, and enhanced awareness of corticosteroid therapeutics.

Regulatory Landscape and Market Access

The regulatory pathway markedly influences SOLU-CORTEF's market penetration. In the United States, the drug is available under multiple trademarks, including generic alternatives, with approvals granted by the FDA based on stringent bioequivalence and safety standards. Similar regulatory approval processes in Europe and Asia drive market access for generic and branded versions.

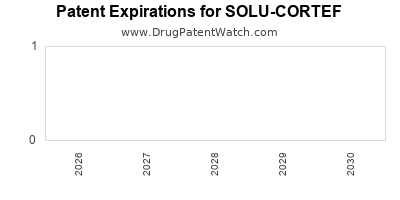

Regulatory hurdles, such as post-marketing surveillance obligations and formulary inclusion, impact sales trajectories. Patent protections, often limited for corticosteroids due to class age, create significant opportunities for generics but also heighten competitive pressure, especially as multiple manufacturers seek market share.

Manufacturing and Supply Chain Dynamics

Manufacturing capacity and raw material sourcing significantly impact SOLU-CORTEF’s availability and price stability. The active pharmaceutical ingredient (API), hydrocortisone sodium succinate, is produced globally, with key suppliers in India, China, and Europe. Supply chain disruptions—like geopolitical tensions, pandemics, or raw material shortages—could constrain production, elevating prices and affecting sales.

Quality standards, production scalability, and regulatory compliance in manufacturing facilities serve as differentiators. Companies investing in robust, compliant manufacturing capabilities can establish a competitive advantage, ensuring consistent supply amid rising demand.

Competitive Environment

SOLU-CORTEF faces competition primarily from generic hydrocortisone formulations, which offer similar efficacy at a lower price point. Major pharmaceutical companies holding patents or proprietary formulations have carved out market niches through brand recognition, reliability, and physician preference.

Emerging developments include the development of long-acting corticosteroid formulations and alternative delivery mechanisms. However, injectable forms like SOLU-CORTEF maintain a competitive edge due to their rapid action in acute care settings.

The injection market is also influenced by clinical guidelines and prescribing habits. Increased adoption of corticosteroid-sparing treatments and local regulations on corticosteroid use could modify competitive dynamics.

Market Drivers

- Aging Population: Increased prevalence of chronic inflammatory and autoimmune conditions.

- Rising Emergency Care: Growing need for fast-acting corticosteroids in critical care scenarios.

- Healthcare Infrastructure: Expansion in hospital and emergency services across emerging markets.

- Regulatory Approvals: Faster approvals for biosimilar and generic versions increase availability.

Market Challenges

- Generic Competition: Reduced profitability due to price erosion.

- Pricing Pressures: Healthcare payers demanding cost-effective therapy options.

- Regulatory Hurdles: Stringent approval and post-marketing requirements.

- Supply Chain Risks: Raw material shortages and geopolitical tensions.

Financial Trajectory: Revenue, Investment, and Growth Opportunities

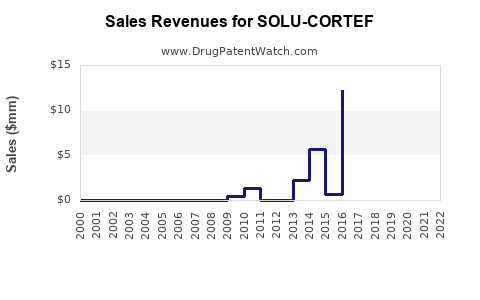

The financial outlook for SOLU-CORTEF hinges on both volume sales and pricing strategies. Data suggests that the corticosteroid market, including SOLU-CORTEF, will see moderate growth driven by incremental increases in medical emergency incidences and ongoing utilization in chronic care.

Revenue Projections:

Analysts estimate a CAGR of approximately 2–4% for corticosteroid injectable markets globally over the next five years. Well-established manufacturers are expected to maintain or increase sales through geographic expansion and lifecycle management initiatives, including line extension or improved formulations.

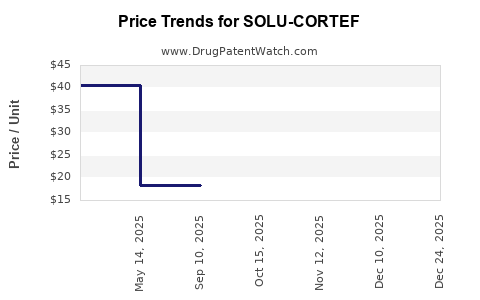

Pricing Trends:

Traditionally, corticosteroid prices have declined in lockstep with generics proliferation. Companies focusing on supply chain efficiency and operational excellence can sustain margins. Emerging markets offer growth potential, although price sensitivity remains high.

Investment Opportunities:

Opportunities abound in biosimilar development, manufacturing capacity expansion, and formulations improving bioavailability or ease of administration. Companies with robust patent portfolios or strategic alliances with health systems are better positioned for sustained revenues.

Risk Factors:

Patent expirations, regulatory delays, competitive entry, and pricing clampdowns present risks to revenue streams. Conversely, expanding indications and partnerships with healthcare providers can mitigate these risks.

Future Outlook and Market Expansion Strategies

Looking ahead, growth for SOLU-CORTEF will depend on:

- Emerging Market Penetration: Increasing healthcare infrastructure in Asia, Africa, and Latin America will drive demand.

- Product Differentiation: Developing formulations with improved stability, lower dosing frequency, or needle-less delivery could enhance market share.

- Strategic M&A: Consolidation among generic manufacturers may sharpen competitive positions.

- Regulatory Engagement: Fast-track approvals for new indications or formulations can boost sales.

Key Takeaways

- Steady but Competitive Market: The corticosteroid injectable segment including SOLU-CORTEF is characterized by moderate growth, intense generic competition, and price sensitivity.

- Regulatory and Manufacturing Robustness: Ensuring compliance and production efficiency are critical for maintaining market presence.

- Expansion in Emerging Markets: Growth opportunities exist outside mature markets, contingent on affordability and healthcare infrastructure development.

- Innovation as a Differentiator: Product enhancements and new formulations can support market share growth.

- Risk Management: Supply chain resilience, cost controls, and active lifecycle management are vital to maximizing financial performance.

FAQs

1. How does patent expiry influence SOLU-CORTEF’s market?

Patent expirations make generic versions more available, increasing competition and exerting downward pressure on prices, leading to potential revenue declines for branded formulations unless differentiated or protected via regulatory exclusivity.

2. What are the primary revenue drivers for corticosteroid injectables?

Emergency care settings, critical illnesses, and chronic inflammatory conditions drive demand, with hospital institutions and emergency services as major purchasers.

3. How do regulatory differences across regions affect SOLU-CORTEF sales?

Regional approval processes, reimbursement policies, and clinical guidelines influence market access. Faster approvals and favorable reimbursement policies can enhance sales growth in emerging markets.

4. What role do biosimilars play in the future of SOLU-CORTEF?

While biosimilars are less common for small molecules like hydrocortisone, generic competition acts similarly, increasing market options and pressuring prices.

5. What strategic moves can companies undertake to enhance SOLU-CORTEF’s market share?

Investing in manufacturing efficiencies, expanding into underserved markets, developing novel formulations, and fostering partnerships with healthcare systems are effective strategies.

Sources:

- [1] Pfizer Investors: Solu-Cortef Overview and Market Dynamics.

- [2] Global Market Insights. Corticosteroid Market Trends and Forecasts.

- [3] FDA Drug Approval Database.

- [4] World Health Organization. Global Disease Burden and Emergency Care Trends.

- [5] Industry Reports: Competitive Landscape of Corticosteroid Injectables.