SLYND Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Slynd, and what generic alternatives are available?

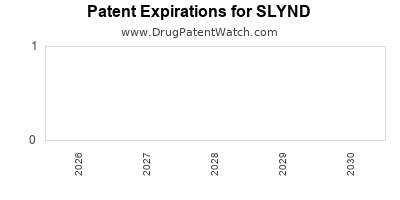

Slynd is a drug marketed by Exeltis Usa Inc and is included in one NDA. There are fifteen patents protecting this drug and one Paragraph IV challenge.

This drug has sixty-nine patent family members in thirty-one countries.

The generic ingredient in SLYND is drospirenone. There are eleven drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the drospirenone profile page.

DrugPatentWatch® Generic Entry Outlook for Slynd

There have been three patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are two tentative approvals for the generic drug (drospirenone), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for SLYND?

- What are the global sales for SLYND?

- What is Average Wholesale Price for SLYND?

Summary for SLYND

| International Patents: | 69 |

| US Patents: | 15 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 79 |

| Patent Applications: | 2,466 |

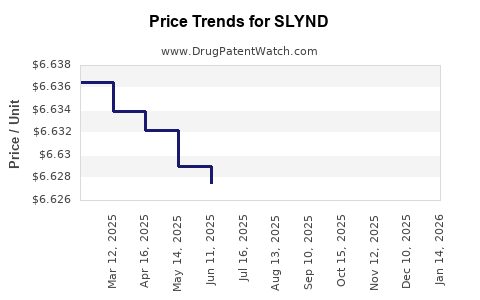

| Drug Prices: | Drug price information for SLYND |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for SLYND |

| What excipients (inactive ingredients) are in SLYND? | SLYND excipients list |

| DailyMed Link: | SLYND at DailyMed |

Paragraph IV (Patent) Challenges for SLYND

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| SLYND | Tablets | drospirenone | 4 mg | 211367 | 1 | 2022-01-07 |

US Patents and Regulatory Information for SLYND

SLYND is protected by fifteen US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exeltis Usa Inc | SLYND | drospirenone | TABLET;ORAL | 211367-001 | May 23, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Exeltis Usa Inc | SLYND | drospirenone | TABLET;ORAL | 211367-001 | May 23, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Exeltis Usa Inc | SLYND | drospirenone | TABLET;ORAL | 211367-001 | May 23, 2019 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for SLYND

When does loss-of-exclusivity occur for SLYND?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 1670

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 11273605

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2012033391

Estimated Expiration: ⤷ Get Started Free

Patent: 2019008317

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 03721

Estimated Expiration: ⤷ Get Started Free

Patent: 03062

Estimated Expiration: ⤷ Get Started Free

Patent: 61421

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 12003685

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 40328

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0200155

Estimated Expiration: ⤷ Get Started Free

Patent: 0220332

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 22544

Estimated Expiration: ⤷ Get Started Free

Patent: 25061

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 88114

Estimated Expiration: ⤷ Get Started Free

Patent: 32448

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 12012359

Estimated Expiration: ⤷ Get Started Free

Patent: 15032906

Estimated Expiration: ⤷ Get Started Free

Patent: 15032911

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 8680

Estimated Expiration: ⤷ Get Started Free

Patent: 1291372

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 88114

Estimated Expiration: ⤷ Get Started Free

Patent: 32448

Estimated Expiration: ⤷ Get Started Free

Patent: 56186

Estimated Expiration: ⤷ Get Started Free

France

Patent: C1020

Estimated Expiration: ⤷ Get Started Free

Patent: C1031

Estimated Expiration: ⤷ Get Started Free

Guatemala

Patent: 1200336

Estimated Expiration: ⤷ Get Started Free

Patent: 1200336A

Estimated Expiration: ⤷ Get Started Free

Patent: 1200336B

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 47689

Estimated Expiration: ⤷ Get Started Free

Patent: 58176

Estimated Expiration: ⤷ Get Started Free

Patent: 000016

Estimated Expiration: ⤷ Get Started Free

Patent: 200018

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 10159

Estimated Expiration: ⤷ Get Started Free

Patent: 13529665

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 2021523

Estimated Expiration: ⤷ Get Started Free

Patent: 2022513

Estimated Expiration: ⤷ Get Started Free

Patent: 88114

Estimated Expiration: ⤷ Get Started Free

Patent: 32448

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 9952

Estimated Expiration: ⤷ Get Started Free

Patent: 4971

Estimated Expiration: ⤷ Get Started Free

Patent: 12014629

Estimated Expiration: ⤷ Get Started Free

Patent: 19004393

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5176

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 20015

Estimated Expiration: ⤷ Get Started Free

Patent: 22030

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 130780

Estimated Expiration: ⤷ Get Started Free

Patent: 161410

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 012502499

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 88114

Estimated Expiration: ⤷ Get Started Free

Patent: 32448

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 88114

Estimated Expiration: ⤷ Get Started Free

Patent: 32448

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 02000063

Estimated Expiration: ⤷ Get Started Free

Patent: 02200129

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 826

Estimated Expiration: ⤷ Get Started Free

Patent: 027

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 88114

Estimated Expiration: ⤷ Get Started Free

Patent: 32448

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1209743

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2164693

Estimated Expiration: ⤷ Get Started Free

Patent: 2210982

Estimated Expiration: ⤷ Get Started Free

Patent: 2539030

Estimated Expiration: ⤷ Get Started Free

Patent: 130048227

Estimated Expiration: ⤷ Get Started Free

Patent: 170085604

Estimated Expiration: ⤷ Get Started Free

Patent: 190073598

Estimated Expiration: ⤷ Get Started Free

Patent: 210013663

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 77886

Estimated Expiration: ⤷ Get Started Free

Patent: 08657

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering SLYND around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| France | 22C1031 | ⤷ Get Started Free | |

| Lithuania | PA2021523 | ⤷ Get Started Free | |

| Canada | 3003062 | COMPOSITION PHARMACEUTIQUE CONTENANT DE LA DROSPIRENONE ET KIT CONTRACEPTIF (PHARMACEUTICAL COMPOSITION COMPRISING DROSPIRENONE AND CONTRACEPTIVE KIT) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for SLYND

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2588114 | 2020C/518 | Belgium | ⤷ Get Started Free | PRODUCT NAME: DROSPIRENON; AUTHORISATION NUMBER AND DATE: BE548284 20191107 |

| 3632448 | CA 2022 00016 | Denmark | ⤷ Get Started Free | PRODUCT NAME: DROSPIRENON; NAT. REG. NO/DATE: 61678 20191016; FIRST REG. NO/DATE: DK 61678 20191016 |

| 0398460 | 04C0022 | France | ⤷ Get Started Free | PRODUCT NAME: ESTRADIOL ANHYDRE DROSPIRENONE; REGISTRATION NO/DATE IN FRANCE: NL 28661 DU 20040316; REGISTRATION NO/DATE AT EEC: RVG 27505 DU 20021211 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for SLYND (Allylestrenol Capsules)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.