Last updated: July 28, 2025

Introduction

Siponimod, marketed under the brand name Mayzent, is a selective sphingosine-1-phosphate receptor modulator developed by Novartis. Approved by the U.S. Food and Drug Administration (FDA) in 2019 for secondary progressive multiple sclerosis (SPMS), siponimod represents a pivotal advancement in the treatment landscape for multiple sclerosis (MS). As a relatively new entrant, understanding the market dynamics and financial trajectory of siponimod requires a close examination of its clinical positioning, competitive landscape, regulatory status, and commercialization strategies.

Market Overview and Key Drivers

Growing Global Prevalence of Multiple Sclerosis

The primary market driver for siponimod remains the rising prevalence of MS worldwide. According to the Multiple Sclerosis International Federation (MSIF), an estimated 2.8 million people globally live with MS, with increasing diagnosis rates due to improved awareness and diagnostic capabilities. MS predominantly affects young adults, creating a substantial long-term market for disease-modifying therapies (DMTs)[1].

Unmet Medical Needs in Secondary Progressive MS

Existing MS therapies predominantly target relapsing-remitting MS (RRMS). However, secondary progressive MS (SPMS), characterized by gradual neurological deterioration, has limited treatment options. Siponimod's approval addresses this unmet need, positioning it favorably among specialized DMTs. Its demonstrated efficacy in slowing disability progression enhances its clinical value and market potential.

Pharmacological Profile and Differentiation

Siponimod's selective mode of action offers a more favorable safety profile compared to first-generation sphingosine-1-phosphate (S1P) modulators like fingolimod. Its rapid onset and reversibility further differentiate it, potentially attracting prescribers seeking personalized treatment options. These pharmacological advantages support competitive positioning within the MS market.

Competitive Landscape

The MS drug market comprises established therapies such as interferons, glatiramer acetate, and newer agents including ocrelizumab, cladribine, and ponesimod. For SPMS specifically, options are limited, with siponimod competing primarily against ocrelizumab and potentially off-label use of other DMTs. The evolving pipeline and ongoing research into combination therapies could influence its market share over time.

Financial Trajectory and Commercial Performance

Revenue Generation and Sales Trends

Since its approval, siponimod has exhibited promising sales figures, driven by increasing diagnosis rates and its unique position in the SPMS space. Novartis reported global sales of Mayzent exceeding USD 1 billion in 2022, with double-digit growth percentages reflecting expanding adoption[2]. Growth is propelled by broader geographic availability, particularly in Europe and emerging markets, and increasing physician familiarity.

Market Penetration Strategies

Novartis has adopted targeted marketing campaigns emphasizing siponimod's efficacy and safety profile. Strategic collaborations with healthcare providers and key opinion leaders (KOLs) facilitate physician education and bolster prescription rates. Additionally, securing reimbursement approvals and inclusion in treatment guidelines in major markets accelerates access to therapy.

Regulatory and Reimbursement Dynamics

Global regulatory agencies like the European Medicines Agency (EMA) approved Mayzent in late 2019, further expanding its market. Reimbursement negotiations in various countries continue to influence uptake; favorable coverage policies translate directly into revenue growth. However, pricing pressures and healthcare policy shifts pose challenges that could temper long-term financial expansion.

Pipeline and Future Outlook

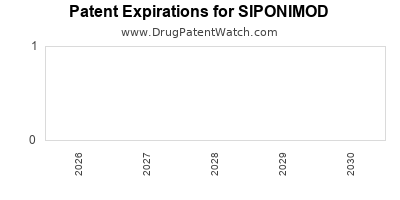

Siponimod's pipeline includes ongoing clinical trials exploring its efficacy in other indications such as primary progressive MS (PPMS) and cardiology-related diseases. Positive trial results could unlock additional revenue streams. Moreover, patent protections extending into the late 2020s provide a window of exclusivity that supports sustained market share and revenue.

Challenges and Market Risks

Competitive Pressure

Emerging therapies, especially monoclonal antibodies like ocrelizumab, pose threats to siponimod's market dominance. The availability of alternative oral agents and biosimilars intensifies competition, potentially affecting pricing and market share.

Safety and Tolerability Concerns

Adverse events such as cardiac effects and infection risks require monitoring and may influence prescribing behaviors. Insurance coverage decisions can be contingent on safety profile perceptions, thereby impacting sales.

Regulatory and Policy Risks

Changes in healthcare policies, reimbursement frameworks, or approval standards can modify the competitive landscape. The introduction of generic versions post-patent expiry could erode revenue streams.

Strategic Recommendations

To sustain and enhance the financial trajectory, Novartis should pursue the following strategies:

- Broaden Indication Approvals: Extend siponimod's use to other MS subtypes and related neurological disorders.

- Invest in Clinical Research: Support new trials that validate additional benefits or combinations, positioning siponimod at the forefront of personalized medicine.

- Enhance Patient Access: Collaborate with payers to ensure favorable reimbursement and reduce barriers to therapy initiation.

- Maintain Differentiation: Highlight clinical advantages and safety profile through continuous medical education and scientific dissemination.

Key Takeaways

- The global MS market, especially for SPMS, presents significant growth opportunities, driven by increasing disease prevalence and limited existing treatments.

- Siponimod's unique pharmacological attributes and regulatory approval have enabled it to capture a growing market share, with sales exceeding USD 1 billion in 2022.

- Competitive dynamics, safety considerations, and policy pressures will influence its long-term financial performance.

- Strategic diversification into new indications, clinical innovation, and payer collaborations are crucial for maintaining revenue momentum.

- As a high-value niche therapy, siponimod's market trajectory will depend on ongoing clinical success, competitive positioning, and regulatory support.

FAQs

1. What factors contributed to siponimod's rapid market growth post-approval?

Its targeted approval for SPMS, unique pharmacological profile, unmet clinical need, and strategic commercialization facilitated swift adoption and sales growth.

2. How does siponimod compare to other MS therapies in terms of safety and efficacy?

Siponimod offers a more selective receptor profile with a favorable safety profile and comparable or superior efficacy in slowing disability progression in SPMS compared to existing options.

3. What are the key challenges facing siponimod’s long-term market sustainability?

Market challenges include emerging competitors, safety management, patent expiration risks, and evolving healthcare reimbursement policies.

4. Are there potential new indications that could expand siponimod’s market?

Yes, ongoing trials explore its use in primary progressive MS and cardiovascular conditions, which could significantly broaden its application.

5. How important is geographic expansion to siponimod's financial outlook?

Very important; expanding into emerging markets and securing reimbursement approvals globally are critical for sustaining growth beyond established markets.

References

[1] Multiple Sclerosis International Federation. "Atlas of MS." 2020.

[2] Novartis. "Mayzent (siponimod) sales report." 2022 Financial Statements.