Last updated: July 29, 2025

Introduction

SINEMET, a combination medication comprising levodopa and carbidopa, remains a cornerstone in the treatment of Parkinson’s disease. With increasing global prevalence of neurodegenerative disorders, continued demand forecasts for SINEMET are relevant for manufacturers, healthcare providers, investors, and policymakers. This article presents a comprehensive market analysis, exploring key factors influencing its landscape and providing price projections grounded in current data and trends.

Market Overview

Global Prevalence and Demand Drivers

Parkinson’s disease affects an estimated 6 million individuals worldwide, a figure projected to double by 2040 due to aging demographics (1). SINEMET, being the most prescribed levodopa-based therapy, commands significant market share in both developed and emerging markets. Its efficacy, established over decades, cements its position as first-line therapy, particularly in early to mid-stage disease management.

Therapeutic Landscape

Although newer agents like dopamine agonists, MAO-B inhibitors, and deep brain stimulation techniques are available, SINEMET remains preferred because of its proven efficacy, tolerability, and cost-effectiveness. The emergence of combination therapies and tailored regimens has maintained its relevance, though generic versions have notably impacted pricing.

Market Segmentation and Geographic Trends

Developed Markets

In North America and Europe, SINEMET benefits from well-established healthcare infrastructure and high diagnosis rates of Parkinson’s disease. The prevalence in these regions sustains steady demand, supported by aging populations. The market here is largely driven by generic availability, leading to significant price competition.

Emerging Markets

In Asia-Pacific and Latin America, rising healthcare access, awareness, and increased diagnosis of neurodegenerative disorders expand demand. Moreover, economic growth facilitates greater procurement of standard therapies like SINEMET. However, price sensitivity and regulatory challenges shape market dynamics significantly.

Competitive Landscape

Generic vs. Branded Versions

The patent expiry of Sinemet’s original formulation in many territories has led to widespread generic substitution, exerting downward pressure on prices. Major pharmaceutical companies remain competitors in branded segments, often emphasizing formulation advantages or supply reliability.

Regulatory Influences

Regulatory approvals and pricing regulations vary globally. Countries with price control measures, such as in parts of Europe and Latin America, generally showcase lower average prices for SINEMET. Conversely, unregulated markets permit higher nominal prices but with vigorous competition among generic producers.

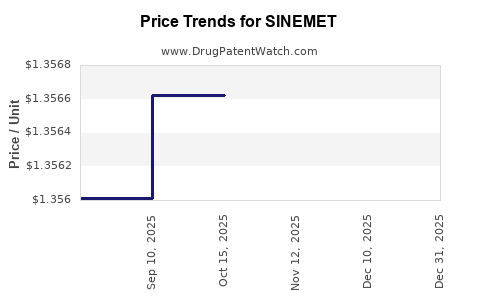

Pricing Dynamics and Trends

Current Price Benchmarks

Prices for SINEMET vary markedly by region and formulation (tablet or extended-release). For instance:

- United States: A typical 30-count bottle of generic SINEMET can range from $10 to $30, depending on dosage and pharmacy arrangements (2). Branded Sinemet CR often commands a higher price, approximately $40–$60 nominally.

- Europe: Prices are comparatively lower, often €5–€10 per pack for generics, influenced by national price controls.

- Emerging Markets: Prices can be as low as $2–$5 per pack, reflecting intense price competition and differential purchasing power.

Factors Influencing Price Trends

- Patent expirations continue to accelerate generic entry.

- Manufacturing costs, notably raw material prices, influence pricing stability.

- Regulatory policies and reimbursement schemes directly impact consumer prices.

- Supply chain factors, including distribution logistics and manufacturing capacity, affect availability and pricing.

Price Projection Analysis

Short-term Outlook (1–3 Years)

Given the extensive patent expirations and rising generics availability, prices for SINEMET are expected to remain under downward pressure. Wholesale and retail prices could decline by 10–20%, especially in mature markets with fierce competition. Importantly, manufacturing costs, particularly for raw ingredients like levodopa, may exert inflationary pressures contrary to overall price trends.

Medium to Long-term Outlook (3–5 Years)

Forecasts suggest stabilization of generic prices due to market saturation, though regional disparities will persist. Innovative formulations, such as extended-release variants or combo modifications, may command premium pricing, particularly if they demonstrate enhanced patient adherence or efficacy. Price competition will likely intensify in emerging markets as local producers expand.

Impact of Regulatory and Market Developments

Potential introduction of biosimilar or alternative therapies could disrupt current pricing, favoring more competitive pricing models. Additionally, government policies promoting affordability could further compress prices, especially in lower-income regions.

Market Drivers and Inhibitors

| Drivers |

Inhibitors |

| Rising prevalence of Parkinson’s disease |

Patent barriers in innovator products |

| Established demand in aging populations |

Stringent regulatory environments |

| Cost-effective generic competition |

Market entry barriers in some regions |

| Growing awareness and diagnosis rates |

Potential shortages of raw materials |

| Development of improved formulations |

Increased regulatory scrutiny |

Strategic Implications for Stakeholders

- Manufacturers should leverage regional pricing strategies and invest in formulation innovations to maintain competitive advantages.

- Investors must monitor patent expiration timelines and regional market liberalization trends to optimize portfolio allocations.

- Healthcare policymakers should consider pricing policies balancing affordability and sustainable supply, easing access to essential therapies.

Key Takeaways

- The global SINEMET market is driven predominantly by aging demographics, Parkinson’s disease prevalence, and established medical protocols.

- Patent expirations have catalyzed the proliferation of generic alternatives, exerting downward price pressures across geographies.

- Prices are expected to decline modestly in the short term, with stabilization and regional variability in the medium to long term.

- Regional economic factors, regulatory environments, and healthcare infrastructure significantly influence pricing and market access.

- Innovation in formulation and better understanding of patient adherence may foster premium pricing segments amid increasing competition.

FAQs

1. What factors most significantly influence SINEMET prices globally?

Factors include patent status, regional regulatory policies, the availability of generics, raw material costs, and healthcare reimbursement frameworks.

2. How will patent expirations affect SINEMET price trends?

Expirations typically lead to increased generic competition, driving prices downward, especially in mature markets.

3. Are there upcoming formulations of SINEMET that could impact the market?

Yes, extended-release variants and combination therapies are under development and may command premium pricing if proven superior in adherence or efficacy.

4. How do regulatory policies impact SINEMET pricing in different regions?

Regions with strict price controls or government negotiations tend to have lower prices; unregulated markets often see higher, more variable prices.

5. What is the outlook for SINEMET in emerging markets?

Demand is expected to grow due to rising Parkinson’s diagnoses, with prices remaining relatively low because of high competition and price sensitivity.

References

- World Health Organization. Parkinson’s disease fact sheet. (2022).

- Healthcare Cost and Utilization Project. National estimates for prescription prices. (2022).