Last updated: July 27, 2025

Introduction

SEREVENT, known generically as salmeterol, is a long-acting beta2-adrenergic receptor agonist (LABA) primarily indicated for managing asthma and chronic obstructive pulmonary disease (COPD). Since its initial market launch, SEREVENT has experienced fluctuating demand driven by evolving regulatory guidelines, competing therapies, and demographic trends. This analysis delineates the current market environment, key drivers influencing its financial trajectory, and future outlook informed by recent market developments.

Pharmacological Profile and Therapeutic Positioning

SEREVENT (salmeterol) was introduced in the late 1990s and gained prominence due to its sustained bronchodilation effects, offering patients longer relief compared to short-acting beta2-agonists. It is marketed predominantly as a combination therapy with inhaled corticosteroids (ICS), such as Advair (salmeterol/fluticasone), and often deployed as a maintenance medication for long-term management of asthma and COPD (1).

Its pharmacokinetic profile confers advantages over shorter-acting counterparts, providing 12-hour efficacy. However, concerns regarding potential increased risks of asthma-related death emerged early in its marketing phase, prompting cautious prescribing and regulatory scrutiny. Over the past decade, clinical guidelines have refined the positioning of salmeterol, emphasizing its use within combination therapies, which influences its market landscape.

Market Dynamics

Regulatory and Safety Considerations

Regulatory agencies, notably the FDA, initially issued warnings regarding increased asthma-related mortality associated with LABAs, including salmeterol. Consequently, product labeling evolved to recommend its concurrent use with inhaled corticosteroids and limited standalone use. These safety concerns direct prescribing behaviors, marginalizing monotherapy applications and constraining market expansion (2).

Recent real-world evidence has nuanced risk perceptions, leading to adaptive regulatory guidance. However, the residual caution continues to influence clinician adoption, especially in regions with stringent prescriber practices.

Competitive Landscape

The therapeutic market for asthma and COPD is crowded, with multitudes of inhaler options:

- Inhaled corticosteroids (ICS): Fluticasone, budesonide

- Long-acting muscarinic antagonists (LAMA): Tiotropium

- Other LABAs: Formoterol, vilanterol

- Combination inhalers: Advair, Symbicort, Breo Ellipta

Notably, newer combination products with improved delivery devices and once-daily dosing have gained strong market share. The advent of biologic therapies targeting eosinophilic inflammation in asthma further complicates the landscape, particularly for severe cases.

Market Penetration and Geographic Trends

North America remains the largest market segment, driven by high disease prevalence, advanced healthcare infrastructure, and broad insurance coverage. The U.S. dominates due to significant prescribing volume, although growth rates are stabilizing given saturation.

Emerging markets such as Asia-Pacific depict burgeoning demand attributable to urbanization and increased COPD prevalence. However, affordability and regulatory approvals are layered barriers to rapid market penetration for SEREVENT.

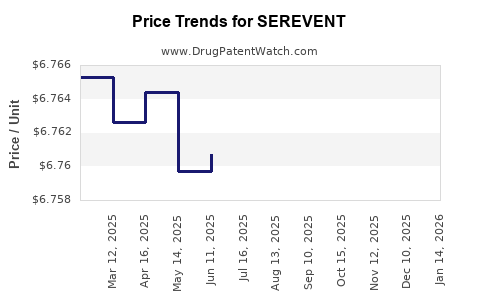

Pricing, Reimbursement, and Market Access

Pricing pressures, especially in competitive markets, have suppressed profit margins. Reimbursement policies are pivotal; in the U.S., formulary restrictions impact prescribing choices, favoring more cost-effective or newer therapies. Internationally, government-managed healthcare systems impose formulary limitations, constraining sales.

Pharmaceutical companies prioritize demonstrating cost-effectiveness and safety profiles to secure favorable reimbursement status, influencing SEREVENT’s market competitiveness.

Patent Status and Generic Competition

SEREVENT's original patent protection expired in many regions by the early 2010s. Consequently, generic salmeterol formulations entered the market, exerting downward pricing pressure. Brand-name formulations retain premium positioning primarily in combination products or specific markets, but generics substantially erode exclusive revenue streams.

Financial Trajectory Analysis

Historical Revenue Trends

In its early years, SEREVENT generated robust revenues, benefiting from a lack of generic competition. Its introduction into combination therapies, notably Advair, further amplified sales. However, sales plateaued as market saturation emerged and safety concerns tempered growth.

Post-patent expiration, the revenue declined markedly due to generics. According to industry reports, the global inhaled bronchodilator market, including SEREVENT, experienced a compound annual decline in brand-name sales of approximately 4-6% over the last five years (3).

Current Market Position

While the standalone salmeterol monotherapy sales have substantially diminished, formulations incorporated into combination inhalers continue driving revenue, particularly in markets where branded combination products retain premium pricing. Nevertheless, intense competition from newer devices and biologics restricts overall growth prospects.

Future Revenue Projections

The outlook indicates a continued decline in SEREVENT monotherapy sales. However, strategic repositioning through biosimilars or patent extensions for specific formulations could mitigate erosion. Market analysts project the inhaled LABA market as a whole will grow modestly at 2-3% annually, primarily fueled by COPD prevalence in aging populations [4]. SEREVENT’s contribution is expected to wane further, with revenue focus shifting to combination formulations and emerging alternatives.

Innovation and Portfolio Diversification

Pharmaceutical manufacturers are investing in next-generation inhalers with improved delivery technology, faster onset, and reduced side effects. Additionally, biologic therapies targeting eosinophilic inflammation aim for severe asthma subsets, although these are less likely to impact SEREVENT's market volume directly. Nevertheless, pipeline diversification is critical for sustaining long-term revenues.

Market Challenges and Opportunities

Challenges

- Regulatory hurdles: Safety concerns enforce prescribing restrictions, limiting monotherapy use.

- Generic competition: Price erosion cuts into sales margins.

- Market saturation: In developed markets, most eligible patients are already on inhaled medications.

- Emerging therapies: Biologics; device innovations influence switching decisions.

Opportunities

- Combination therapy innovations: Developing fixed-dose combinations with newer molecules.

- Personalized medicine: Identifying patient subpopulations benefiting most from LABAs.

- Developing markets: Expanding access where COPD and asthma prevalence escalate.

- Regulatory pathways: Streamlining approval for biosimilar developments could reduce costs and foster market share.

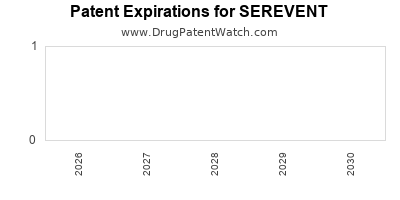

Regulatory and Patent Outlook

Patent expirations are a decisive factor shaping SEREVENT’s financial viability. Until the lifecycle protections lapse entirely, market share maintained by brand-specific formulations is likely to remain stable. Patent extensions or formulation patents may provide temporary revenue boosts, but long-term growth is contingent on innovation and market adaptation strategies.

Conclusion

The market dynamics for SEREVENT reveal a landscape largely characterized by mature, competitive, and regulated environments. While early dominance has waned due to safety alerts, generics, and stiff competition, combination inhalers continue to sustain its revenue base in specific markets. The future trajectory tilts towards steady decline unless manufacturers innovate through combination therapies, biosimilars, or novel delivery systems. Companies with adaptive strategies and a focus on emerging markets are positioned to optimize residual market potential.

Key Takeaways

- Safety scrutiny and regulation have significantly constrained SEREVENT’s standalone use, favoring combination inhalers.

- Generic competition post-patent expiry has diminished profitability, highlighting the importance of IP management.

- Market saturation in mature regions limits growth, prompting a shift towards emerging markets.

- Innovation in inhaler technology and combination formulations offers growth avenues amid challenging market conditions.

- Long-term revenue stability hinges on strategic diversification, regulatory navigation, and addressing unmet needs in personalized respiratory therapy.

FAQs

1. How does safety data impact SEREVENT’s market prospects?

Safety concerns, notably the risk of asthma-related mortality, led to regulatory caution, limiting monotherapy use and influencing clinician prescribing practices, thereby constraining market expansion.

2. What role do combination inhalers play in SEREVENT’s current market relevance?

Combination inhalers incorporating salmeterol and corticosteroids sustain revenue streams by providing long-acting, effective management options, especially in COPD and asthma treatment, though competition from newer brands persists.

3. How significant is generic competition for SEREVENT?

Generic salmeterol formulations have eroded brand-name sales substantially, especially after patent expirations, making pricing pressures and market share loss central to its financial trajectory.

4. What future innovations could influence SEREVENT’s market position?

Next-generation inhalers with enhanced delivery, fixed-dose combinations with novel agents, and biosimilar developments could revitalize its market prospects if strategically pursued.

5. Which regions offer the most growth potential for SEREVENT?

Emerging markets in Asia-Pacific and Latin America present opportunities driven by rising COPD and asthma prevalence, provided affordability and regulatory approvals align.

References:

- Reddel, H. K., et al. (2017). Management guidelines for asthma. The Lancet.

- U.S. Food and Drug Administration. (2005). An Advisory Committee Meeting on LABAs.

- Market Research Future. (2022). Inhaled Bronchodilators Market Analysis.

- GlobalData. (2022). Respiratory Disease Treatment Market Outlook.

Disclaimer: This analysis offers an informed overview based on current market data and literature. For investment or clinical decisions, consult relevant experts and authoritative sources.