Last updated: July 27, 2025

Introduction

Sapropterin dihydrochloride, marketed primarily under the brand name Kuvanse, is a synthetic form of tetrahydrobiopterin (BH4), a cofactor essential for the enzymatic hydroxylation of phenylalanine. Approved by the U.S. Food and Drug Administration (FDA) in 2007, it primarily treats phenylketonuria (PKU), a rare autosomal recessive metabolic disorder resulting from deficient phenylalanine hydroxylase activity. The drug's unique mechanism and niche market have significantly influenced its market dynamics and financial prospects. This analysis explores the key drivers, challenges, and future trajectories shaping the commercial landscape of sapropterin dihydrochloride.

Market Landscape and Growth Drivers

1. Rare Disease Therapeutics and Niche Market Focus

PKU affects approximately 1 in 10,000 to 15,000 newborns globally, with higher prevalence in certain populations such as Turkey and Ireland. As a rare disease (orphan condition), PKU's market benefits from regulatory incentives, including market exclusivity, tax credits, and expedited approval pathways. These advantages incentivize pharmaceutical companies to develop and commercialize PKU treatments like sapropterin dihydrochloride.

2. Evolving Diagnostic Landscape and Early Intervention

Enhanced newborn screening, especially in developed countries, facilitates early PKU detection, enabling timely intervention with pharmacologic agents like sapropterin. Such early treatment aligns with a shift from solely dietary management to targeted pharmacotherapies, expanding the drug’s potential patient base.

3. Regulatory Approvals and Indications Expansion

While initially approved for PKU patients with documented BH4 responsiveness, ongoing clinical trials explore broader indications, including potential use in hyperphenylalaninemia and adjunct therapies. Regulatory bodies are increasingly approving expanded indications based on emerging evidence, contributing to increased sales potential.

4. Personalized Medicine and Pharmacogenomics

PKU response to sapropterin varies according to genetic mutations affecting BH4 responsiveness. Advances in genetic testing and personalized medicine enhance patient stratification, improving treatment efficacy and optimizing market penetration for responsive subpopulations.

5. Competitive Landscape and Market Share

The primary competitor, Pegvaliase (Palynziq by BioMarin), is an enzyme substitution therapy targeting adult PKU patients. Pegvaliase’s approval in 2018 introduced competition, particularly in the adult subset, but sapropterin maintains a strong foothold in pediatric and BH4-responsive populations, where its oral administration is advantageous.

Market Challenges and Limitations

1. Limited Efficacy and Responsiveness

Sapropterin’s effectiveness is confined to BH4-responsive patients, approximately 20-50% of the PKU population. This limited responsiveness constrains the target patient population and overall market size. Accurate pretreatment BH4 responsiveness testing is essential but may pose logistical barriers.

2. Cost and Reimbursement Issues

High manufacturing costs and the drug’s premium pricing, driven by orphan status, pose reimbursement challenges, especially in healthcare systems with budget constraints. Insurance approval hinges on demonstrating health economic value and traditional diagnostic testing.

3. Long-term Safety and Efficacy Data

While approved applications demonstrate safety and effectiveness, long-term data remain limited. Pharmaceutical companies face pressures to generate robust post-marketing evidence to support ongoing reimbursement and market confidence.

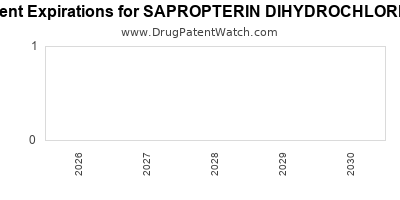

4. Patent Protection and Generic Competition

Patent expirations or challenges can erode exclusivity, inviting generic entrants that threaten revenue streams. As of 2023, patent protections are under review, with potential biosimilar development possibly impacting future sales.

Financial Trajectory and Market Forecast

1. Revenue Trends and Historical Data

According to market reports, sapropterin dihydrochloride generated approximately $300–400 million annually globally in recent years, with the U.S. accounting for over 70% of revenues. The initial growth phase has plateaued slightly due to the stable prevalence of PKU (around 10,000–15,000 patients globally) and the limited BH4-responder subset.

2. Future Growth Opportunities

- Market Expansion via Indication Broadenings: Ongoing trials aiming to extend indications and refine patient selection could expand treatable populations.

- Enhanced Prescriber Adoption: Increased awareness and diffusion of testing protocols for BH4 responsiveness will improve patient stratification, potentially increasing treated patient numbers.

- Global Market Penetration: Emerging markets, such as parts of Asia and Latin America, exhibit growing capacities for neonatal screening and specialty drugs, offering new revenue streams.

3. Impact of Competitive Dynamics

The potential entrance of biosimilars and other novel therapies poses a significant threat. Moreover, innovations offering more comprehensive management of PKU may enervate sapropterin's market share.

4. Market Outlook and Revenue Projection

Analysts project moderate growth in the next 5–7 years, averaging 3-5% annually, driven by increased diagnostic capacity and healthcare reforms. Total revenues could reach approximately $450–500 million by 2028 under optimistic scenarios, assuming successful indication expansions and higher prescriber acceptance.

Regulatory and Economic Influences

Regulatory agencies continue to endorse orphan drugs like sapropterin through accelerated pathways. Health authorities increasingly emphasize cost-effectiveness, with payers demanding rigorous pharmacoeconomic assessments before reimbursement approvals. Market access strategies focus on demonstrating value through clinical benefits, reduced dietary burden, and improved quality of life metrics.

Strategic Implications for Stakeholders

Pharmaceutical companies should prioritize robust diagnostics to identify BH4 responsiveness, harness real-world evidence to demonstrate long-term benefits, and explore combination therapies. Conversely, payers and healthcare systems should recognize the drug’s role in improving patient outcomes, potentially leading to broader coverage and favorable formulary positioning.

Conclusion

The financial trajectory and market dynamics of sapropterin dihydrochloride are shaped by a confluence of regulatory incentives, diagnostic advancements, and therapeutic positioning within the rare disease landscape. While current revenues are stable, future growth hinges on expanding indications, improving patient access, and mitigating competitive threats. Strategic focus on personalized medicine and evidence-based positioning will be pivotal in maintaining its market relevance.

Key Takeaways

- Sapropterin dihydrochloride remains a cornerstone therapy for BH4-responsive PKU, with stable but modest market revenues.

- Expanding diagnostic tools, early detection, and personalized treatment strategies are critical for market growth.

- Competitive pressures from enzyme therapies and biosimilars could challenge future sales.

- Regulatory incentives and orphan drug protections support sustained market presence, but economic considerations influence access.

- Companies should invest in long-term efficacy data and patient stratification tools to optimize market potential.

FAQs

1. What is the primary patient population for sapropterin dihydrochloride?

It is indicated mainly for PKU patients confirmed as BH4-responsive through diagnostic testing, representing approximately 20-50% of the PKU population.

2. How does sapropterin differ from other PKU treatments?

Unlike enzyme substitution therapies like pegvaliase, sapropterin is an oral cofactor supplement that enhances residual phenylalanine hydroxylase activity, primarily benefiting BH4-responsive patients.

3. What are the key challenges facing the commercial success of sapropterin?

Limited efficacy to responsive patients, high costs, reimbursement hurdles, and impending generic competition are primary challenges.

4. Are there ongoing efforts to expand the drug’s indications?

Yes, clinical trials are underway to evaluate its use in broader hyperphenylalaninemia cases and adjunct combinations, potentially enlarging the target demographic.

5. What strategies can pharmaceutical companies adopt to maximize sales?

Investing in genetic diagnostics, real-world evidence generation, expanding indications, and optimizing market access pathways are essential strategies.

References

[1] FDA. (2007). FDA approval letter for Kuvanse (sapropterin dihydrochloride).

[2] Market Research Future. (2022). Global PKU treatment market analysis.

[3] BioMarin. (2018). Palynziq (pegvaliase-pqpz) approval announcement.

[4] National Institutes of Health. (2021). PKU management guidelines.

[5] EvaluatePharma. (2023). Orphan drug market forecasts.