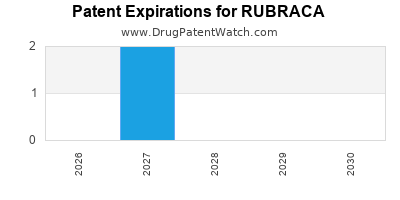

RUBRACA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Rubraca, and when can generic versions of Rubraca launch?

Rubraca is a drug marketed by Pharmaand and is included in one NDA. There are nine patents protecting this drug.

This drug has two hundred and forty patent family members in forty-four countries.

The generic ingredient in RUBRACA is rucaparib camsylate. One supplier is listed for this compound. Additional details are available on the rucaparib camsylate profile page.

DrugPatentWatch® Generic Entry Outlook for Rubraca

Rubraca was eligible for patent challenges on December 19, 2020.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be August 17, 2035. This may change due to patent challenges or generic licensing.

There have been six patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for RUBRACA?

- What are the global sales for RUBRACA?

- What is Average Wholesale Price for RUBRACA?

Summary for RUBRACA

| International Patents: | 240 |

| US Patents: | 9 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 70 |

| Clinical Trials: | 21 |

| Drug Prices: | Drug price information for RUBRACA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for RUBRACA |

| What excipients (inactive ingredients) are in RUBRACA? | RUBRACA excipients list |

| DailyMed Link: | RUBRACA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for RUBRACA

Generic Entry Date for RUBRACA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for RUBRACA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Rhode Island Hospital | Phase 1/Phase 2 |

| Brown University | Phase 1/Phase 2 |

| Bayer | Phase 1/Phase 2 |

Pharmacology for RUBRACA

| Drug Class | Poly(ADP-Ribose) Polymerase Inhibitor |

| Mechanism of Action | Poly(ADP-Ribose) Polymerase Inhibitors |

US Patents and Regulatory Information for RUBRACA

RUBRACA is protected by nineteen US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of RUBRACA is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-002 | Dec 19, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-002 | Dec 19, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-002 | Dec 19, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-001 | Dec 19, 2016 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-002 | Dec 19, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for RUBRACA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-001 | Dec 19, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-003 | May 1, 2017 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-002 | Dec 19, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-003 | May 1, 2017 | ⤷ Get Started Free | ⤷ Get Started Free |

| Pharmaand | RUBRACA | rucaparib camsylate | TABLET;ORAL | 209115-002 | Dec 19, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for RUBRACA

When does loss-of-exclusivity occur for RUBRACA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 15305696

Patent: High dosage strength tablets of rucaparib

Estimated Expiration: ⤷ Get Started Free

Patent: 19272064

Patent: High dosage strength tablets of rucaparib

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2017000865

Patent: comprimidos de rucaparibe de concentração de dosagem alta

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 55495

Patent: COMPRIMES DE RUCAPARIB A DOSAGE ELEVE (HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 6794185

Patent: Rucaparib的高剂量强度片剂 (High dosage strength tablets of rucaparib)

Estimated Expiration: ⤷ Get Started Free

Patent: 3209033

Patent: Rucaparib的高剂量强度片剂 (High dosage strength tablets of rucaparib)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 82975

Patent: COMPRIMÉS DE RUCAPARIB À DOSAGE ÉLEVÉ (HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 9946

Patent: טבליות רוקפריב בחוזק מינון גבוה (High dosage strength tablets of rucaparib)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 74477

Estimated Expiration: ⤷ Get Started Free

Patent: 97980

Estimated Expiration: ⤷ Get Started Free

Patent: 27101

Estimated Expiration: ⤷ Get Started Free

Patent: 17525712

Patent: ルカパリブの高投与力価錠剤

Estimated Expiration: ⤷ Get Started Free

Patent: 20002149

Patent: ルカパリブの高投与力価錠剤 (HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB)

Estimated Expiration: ⤷ Get Started Free

Patent: 21038242

Patent: ルカパリブの高投与力価錠剤 (HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 7260

Patent: TABLETAS DE RUCAPARIB DE DOSIFICACIÓN ELEVADA. (HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB.)

Estimated Expiration: ⤷ Get Started Free

Patent: 17001540

Patent: TABLETAS DE RUCAPARIB DE DOSIFICACION ELEVADA. (HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 8392

Patent: High dosage strength tablets of rucaparib

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 05156

Patent: ТАБЛЕТКИ, СОДЕРЖАЩИЕ БОЛЬШУЮ ДОЗУ РУКАПАРИБА (HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB)

Estimated Expiration: ⤷ Get Started Free

Patent: 17109139

Patent: ТАБЛЕТКИ, СОДЕРЖАЩИЕ БОЛЬШУЮ ДОЗУ РУКАПАРИБА

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201700265V

Patent: HIGH DOSAGE STRENGTH TABLETS OF RUCAPARIB

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 170043597

Patent: 루카파립의 고 용량 강도 정제 (High Dosage Strength Tablets of Rucaparib)

Estimated Expiration: ⤷ Get Started Free

Patent: 230097211

Patent: 루카파립의 고 용량 강도 정제 (High Dosage Strength Tablets of Rucaparib)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering RUBRACA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Ecuador | SP056094 | DERIVADOS DE FTALAZINONA | ⤷ Get Started Free |

| Croatia | P20191944 | ⤷ Get Started Free | |

| Japan | 5848728 | ⤷ Get Started Free | |

| New Zealand | 601445 | ⤷ Get Started Free | |

| Ukraine | 94209 | ПРИМЕНЕНИЕ ИНГИБИТОРОВ РЕПАРАЦИИ ПОВРЕЖДЕНИЙ ДНК ДЛЯ ЛЕЧЕНИЯ РАКА;ЗАСТОСУВАННЯ ІНГІБІТОРІВ РЕПАРАЦІЇ ПОШКОДЖЕНЬ ДНК ДЛЯ ЛІКУВАННЯ РАКУ (DNA DAMAGE REPAIR INHIBITORS FOR TREATMENT OF CANCER) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for RUBRACA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2534153 | CR 2018 00041 | Denmark | ⤷ Get Started Free | PRODUCT NAME: RUCAPARIB CAMSYLAT; REG. NO/DATE: EU/1/17/1250 20180529 |

| 2534153 | 2018/043 | Ireland | ⤷ Get Started Free | PRODUCT NAME: RUCAPARIB CAMSYLATE; REGISTRATION NO/DATE: EU/1/17/1250 20180524 |

| 2534153 | SPC/GB18/043 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: RUCAPARIB CAMSYLATE; REGISTERED: UK EU/1/17/1250 20180529; UK PLGB 50731/0001 20180529; UK PLGB 50731/0002 20180529; UK PLGB 50731/0003 20180529 |

| 2534153 | 18C1049 | France | ⤷ Get Started Free | PRODUCT NAME: CAMSYLATE DE RUCAPARIB; NAT. REGISTRATION NO/DATE: EU/1/17/1250 20180529; FIRST REGISTRATION: - EU/1/17/1250 20180529 |

| 1633724 | C300726 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: OLAPARIB, EN ZOUTEN EN; REGISTRATION NO/DATE: EU/1/14/959/001 20141216 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: RUBRACA (Rucaparib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.