Last updated: July 29, 2025

Introduction

Roxicodone, a widely recognized oral formulation of oxycodone, is a potent prescription opioid predominantly used for managing moderate to severe pain. As a Schedule II controlled substance, Roxicodone's market environment has been shaped by regulatory scrutiny, evolving medical guidelines, and the broader opioid crisis. This analysis examines the current market dynamics, anticipated financial trajectories, and factors influencing Roxicodone’s future positioning within the pharmaceutical landscape.

Market Landscape and Global Demand

The global opioid analgesics market was valued at approximately USD 18.5 billion in 2022 and is projected to reach USD 25.7 billion by 2028, growing at a compound annual growth rate (CAGR) of around 5.4% [1]. Roxicodone remains a significant product within this segment, especially in North America, which dominates the opioid market due to high prevalence rates of chronic pain, cancer-related pain, and postoperative analgesia.

In the United States, Roxicodone’s sales historically comprised a significant portion of oxycodone prescriptions. However, regulatory actions have led to a decline in prescriptions since the opioid epidemic's intensification in the late 2010s. Despite this, opioids—including oxycodone formulations—continue to serve as critical components in pain management protocols, especially for patients with limited alternatives.

Regulatory and Legal Influences

The market for Roxicodone is substantially impacted by regulatory measures. The U.S. Food and Drug Administration (FDA) and Drug Enforcement Agency (DEA) have imposed restrictions, including rescheduling efforts and prescribing guidelines, to curb misuse and diversion.

Recent legislative initiatives include the implementation of Prescription Drug Monitoring Programs (PDMPs), mandated limits on prescription quantities, and increased scrutiny over manufacturing and distribution channels. These measures have contributed to declining prescription volume trends, with some producers reducing supply or reformulating products to include abuse-deterrent features [2].

Legal actions against pharmaceutical companies for their role in opioid epidemic litigation have led to substantial settlements, sometimes involving price adjustments and voluntary recalls, further complicating revenue projections.

Market Competition

Roxicodone faces intense competition from both branded and generic oxycodone products. The entrance of abuse-deterrent formulations (ADFs) like OxyContin with abuse-deterrent properties affected the market share of traditional formulations. Concurrently, non-opioid analgesics (NSAIDs, anticonvulsants, antidepressants) and emerging modalities have increasingly served as alternatives, driven by safety concerns associated with opioids.

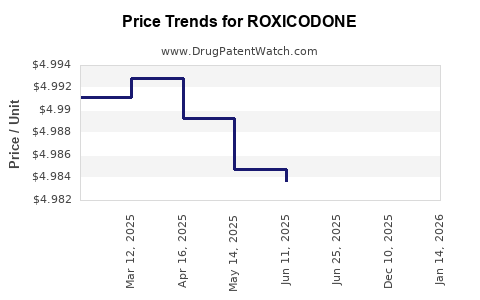

Additionally, growing adoption of multimodal pain management strategies has diminished reliance on opioids, especially in outpatient settings. The entry of generic formulations has exerted downward pressure on prices, further impacting revenue.

Pharmacological and Formulation Innovations

Innovation within opioid formulations continues, focusing on minimizing abuse potential while maintaining efficacy. Developments include matrix-based formulations, innovation in delivery systems, and combination products with naloxone to reduce misuse.

While Roxicodone’s original formulation remains a mainstay, the market’s future trajectory may depend on the pharmaceutical industry’s ability to innovate safer and more efficacious products aligned with regulatory standards.

Financial Trajectory and Revenue Outlook

Previously, Roxicodone was a high-revenue product for producers like Purdue Pharma (before bankruptcy proceedings) and other generic manufacturers. However, current sales figures are declining in the wake of regulatory restrictions, legal actions, and shifts toward alternative therapies.

Analysts project that in the next five years, Roxicodone's revenue could decline by approximately 10-15% annually if current trends persist. The decline is further influenced by the overall shrinkage of the opioid market due to increased awareness of addiction risks and legislative limitations.

Conversely, pharmaceutical companies investing in pain management innovation, abuse-deterrent technology, or non-opioid alternatives could see growth in adjacent markets, potentially offsetting declines for traditional oxycodone products.

Emerging Market Opportunities

Despite regulatory headwinds, some regions outside North America, such as parts of Asia-Pacific and Latin America, exhibit increasing demand due to expanding healthcare infrastructure and higher acceptance of opioid analgesics. Regulatory landscapes in these regions are also less restrictive, offering potential growth opportunities.

Furthermore, the rising prevalence of chronic pain conditions linked to aging populations and lifestyle factors may sustain demand for potent analgesics, including oxycodone formulations, through diversified market strategies.

Risks and Challenges

- Regulatory suppression: Tightening restrictions and scheduling changes are likely to continue, constraining supply and sales.

- Litigation and legal exposure: Ongoing lawsuits could result in substantial financial liabilities and reputational damage.

- Public perception: Negative perceptions surrounding opioids can deter prescribers and patients.

- Market saturation with generic alternatives and competing formulations limits pricing power.

- Shift towards non-opioid modalities: As alternative therapies become mainstream, demand for oxycodone products like Roxicodone may diminish significantly.

Conclusion

The market dynamics for Roxicodone are characterized by a convergence of regulatory restrictions, legal challenges, and shifting prescribing behaviors, culminating in a constrained yet still meaningful market presence. The financial trajectory indicates a continued decline in revenue within traditional markets, offset partly by emerging international opportunities and innovations in pain management. Stakeholders must navigate a landscape marked by strict controls, public health imperatives, and technological advances to optimize their strategic positioning.

Key Takeaways

- The global opioid market is growing but is increasingly constrained by regulatory and public health measures, impacting Roxicodone’s market share.

- Legal actions and settlements related to opioid litigation pose financial risks for manufacturers.

- Innovation in abuse-deterrent formulations and non-opioid alternatives will influence future demand.

- Geographic diversification offers growth potential outside North America due to evolving regulations and healthcare infrastructure.

- Companies should realign portfolios toward safer pain management solutions and technologies to sustain competitiveness.

FAQs

1. How has the opioid epidemic affected Roxicodone’s market prospects?

The epidemic has led to increased regulation, prescribing restrictions, and public scrutiny, resulting in declining demand for traditional opioid formulations like Roxicodone.

2. Are there any regulatory changes expected to influence Roxicodone’s future?

Yes. Anticipated regulatory actions include further opioid scheduling, tighter prescribing guidelines, and stricter manufacturing controls, all likely to reduce market size.

3. What are the key innovations shaping the future of oxycodone products?

Developments include abuse-deterrent formulations, combination products with antagonists like naloxone, and non-opioid alternatives in multimodal pain management.

4. How do international markets present opportunities for Roxicodone?

Regions with less restrictive regulations and expanding healthcare systems show potential for increased demand, although local regulatory landscapes must be considered.

5. Will Roxicodone remain significant amid the shift toward non-opioid therapies?

While its dominance is declining, Roxicodone may sustain niche use in specific patient populations, but long-term growth prospects are limited unless innovations improve safety profiles.

Sources

[1] MarketsandMarkets. "Pain Management Market by Product, Application, Route of Administration, and Region," 2022.

[2] U.S. Food and Drug Administration. "Opioid Analgesics: Policy updates and regulations," 2023.