Last updated: July 29, 2025

Introduction

RELENZA (zanamivir) is aneurally administered neuraminidase inhibitor developed for the treatment and prophylaxis of influenza. Since its approval by the U.S. Food and Drug Administration (FDA) in 1999, RELENZA has played a notable role in influenza management. This analysis examines the current market dynamics affecting RELENZA and projects its financial trajectory amidst evolving healthcare landscapes, competitive pressures, and regulatory considerations.

Market Landscape and Key Drivers

Influenza Epidemiology and Treatment Demand

Influenza remains a persistent global public health challenge, with seasonal epidemics causing significant morbidity and mortality. According to the World Health Organization (WHO), annual influenza epidemics result in approximately 3 to 5 million severe cases and up to 650,000 respiratory deaths globally [1]. The demand for antiviral drugs like RELENZA correlates directly with influenza prevalence, especially during peak seasons.

Therapeutic Profile and Competitive Positioning

RELENZA, administered via inhalation, offers rapid symptom alleviation when given early in infection. Its mechanism targets viral neuraminidase, inhibiting viral replication. However, the emergence of oral neuraminidase inhibitors like oseltamivir (Tamiflu) and newer antivirals such as baloxavir marboxil (Xofluza) has intensified competition.

Advantages of RELENZA:

- Reduced systemic side effects owing to localized delivery

- Efficacy in both treatment and prophylaxis

Limitations:

- Inhalation delivery complicates administration, requiring patient education

- Limited data on efficacy against resistant strains [2]

Given these factors, RELENZA's market share appears constrained relative to oral antivirals, especially in outpatient settings.

Regulatory Environment

The regulatory landscape influences market access and profitability. Recent regulatory developments, including emergency use authorizations during influenza pandemics and coronavirus outbreaks, occasionally expand or restrict antiviral indications. Although RELENZA has maintained its approval, antimicrobial stewardship initiatives and resistance monitoring could impact its future use.

Manufacturing and Supply Chain Considerations

Global production capacity and supply chain resilience are critical. Influenza antivirals face manufacturing constraints during pandemic surges, as observed during the H1N1 outbreak in 2009 and COVID-19. Ensuring steady supply influences revenue stability.

Market Dynamics Shaping RELENZA's Financial Trajectory

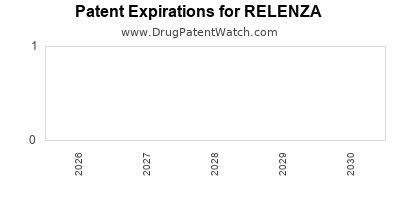

Patent Status and Lifecycle

Relenzal retains method-of-use patents in various jurisdictions, with some expirations approaching. Patent cliffs typically lead to generic entry, reducing prices and market share.

Pricing Strategies and Reimbursement

Pricing is contingent on healthcare systems' reimbursement policies. In the United States, antiviral coverage varies, but government programs like Medicare and Medicaid influence distribution channels. Market penetration depends on negotiated pricing and formulary inclusion.

Pipeline Developments and Future Innovations

Research into novel delivery mechanisms (such as dry powder inhalers) and combination therapies could influence RELENZA's relevance. Additionally, development of resistance strains necessitates continuous innovation and surveillance.

Impact of Pandemics and Outbreaks

Pandemic scenarios elevate demand for effective antivirals. RELENZA’s inhaled form might face challenges during such events due to infection control concerns. Conversely, heightened awareness and stockpiling can temporarily boost sales.

Competitive Landscape

Major competitors include:

- Oseltamivir (Tamiflu, Roche/Genentech)

- Zanamivir (RELENZA, GlaxoSmithKline)

- Baloxavir marboxil (Xofluza, Shionogi/AbbVie)

Emerging agents targeting different viral mechanisms or longer-acting formulations threaten RELENZA’s market position. Market entrants with easier administration routes and broader efficacy profiles might displace RELENZA in certain segments.

Financial Trajectory Projections

Revenue Prospects

Projections for RELENZA’s revenue suggest a gradual decline over the next five years, driven by patent expirations, competitive pressures, and evolving treatment guidelines. Several industry analysts estimate that sales could decrease by 10-15% annually post-patent expiry, barring new approvals or significant pandemic-driven demand.

However, during influenza outbreaks or pandemics, short-term revenue spikes could occur, contingent on stockpiling and emergency use authorizations. The ability to capitalize on such events depends heavily on manufacturing agility and regulatory agility.

Market Penetration Strategies

To sustain revenues, manufacturers may pursue strategies such as:

- Diversifying indications, including prophylactic applications for high-risk populations

- Partnering with public health agencies for stockpiling contracts

- Developing novel formulations that improve administration convenience

Cost Management and Profitability

Relenza’s production costs are relatively stable, but margins are under pressure as generic competitors emerge. Companies must optimize manufacturing efficiencies and negotiate favorable reimbursement terms to maintain profitability.

Long-Term Outlook

In the long term, RELENZA’s market share is predicted to diminish unless offset by clinical innovations or strategic positioning in pandemic preparedness. Firms focusing on personalized antivirals or combination therapies could influence the competitive landscape, emphasizing the need for continued R&D investment.

Implication of Regulatory and Market Trends for Stakeholders

Stakeholders, including pharmaceutical companies, healthcare providers, and investors, should remain vigilant to:

- Patent expirations and impending generic entrants

- Regulatory shifts favoring new antiviral agents

- Emerging resistance patterns necessitating new drug development

- Public health policies prioritizing mass vaccination over antiviral stockpiling

Collaboration between industry and health agencies can facilitate the development of next-generation antivirals or delivery mechanisms, securing future revenue streams.

Key Takeaways

- RELENZA maintains a niche position in influenza management, primarily used where inhalation delivery is preferred.

- The competitive landscape increasingly favors oral antivirals with ease of administration and broader efficacy profiles.

- Patent expirations and rising generic competition will likely lead to revenue erosion over time.

- Pandemic scenarios and public health initiatives may offer short-term revenue opportunities but are unpredictable in the long term.

- Strategic innovation, including novel formulations and indications, is essential for sustained financial performance.

Conclusion

The future financial trajectory of RELENZA hinges on a complex interplay of epidemiological trends, regulatory policies, competitive dynamics, and technological innovation. While current market conditions suggest gradual revenue decline amid intensifying competition, targeted strategic efforts can prolong its relevance. Stakeholders must adopt a forward-looking approach, emphasizing diversification, pipeline development, and collaborations to navigate an evolving influenza antiviral market.

Sources:

[1] World Health Organization. Influenza (Seasonal). 2022.

[2] Centers for Disease Control and Prevention. Antiviral Drugs for Seasonal Influenza. 2021.