Last updated: July 28, 2025

Introduction

Regorafenib, marketed primarily under the brand name Stivarga, is an oral multikinase inhibitor developed by Bayer AG. Approved by the U.S. Food and Drug Administration (FDA) in 2012 for metastatic colorectal cancer (mCRC), its indications have expanded to include gastrointestinal stromal tumors (GIST) and hepatocellular carcinoma (HCC). As a targeted therapy with a unique mechanism of action, regorafenib has become a significant player within the oncology drug space. This report examines the current market dynamics and projects the financial trajectory of regorafenib, considering competitive, regulatory, and technological factors shaping its future.

Market Overview

The global oncology therapeutics market is poised for sustained growth, driven by increasing cancer incidence, technological advancements, and a shift towards precision medicine. The multikinase inhibitor segment, to which regorafenib belongs, remains competitive but holds distinct value due to its broad kinase inhibition spectrum targeting angiogenic, stromal, and oncogenic receptor tyrosine kinases.

Regorafenib's rapid entry into multiple indications has established it as a commercially viable agent. The drug’s approved indications include mCRC post-failure of standard therapies, unresectable GIST, and advanced HCC. The diversity of indications broadens its market potential but also introduces challenges related to tailored regulatory pathways and competing therapies.

Market Drivers

Increasing Incidence of Targeted Cancers

The rising prevalence of colorectal, GIST, and liver cancers directly amplifies regorafenib’s market presence. For instance, colorectal cancer is the third most common cancer globally, with an estimated 1.9 million new cases annually [1]. The increasing incidence correlates with aging populations and lifestyle risk factors, fueling demand for advanced treatments like regorafenib.

Therapeutic Positioning in Refractory Cancers

Regorafenib is often positioned as a third-line or later option, catering to patients with limited treatment options. Its oral administration enhances patient compliance and facilitates management outside specialist centers, broadening its market penetration.

Regulatory Approvals and Expedited Pathways

Beyond initial FDA approval, regorafenib has secured approvals across regions, including the European Union, Japan, and China, through various regulatory pathways. Such approvals extend access and enable Bayer to capitalize on emerging markets.

Technological Advancements in Precision Oncology

Advances in biomarker research and molecular profiling could improve patient selection for regorafenib therapy, optimizing outcomes and justifying premium pricing in targeted subpopulations.

Market Challenges

Intensified Competition

Regorafenib faces competition from other multikinase inhibitors like sunitinib and cabozantinib, as well as immune-oncology agents gaining ground across similar indications. The rapidly evolving therapeutic landscape necessitates continuous differentiation and real-world evidence generation.

Patents and Market Exclusivity

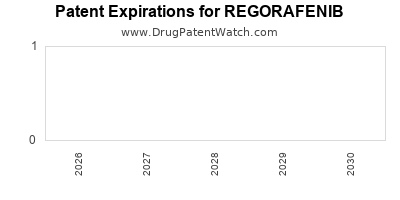

Bayer’s patent protections and data exclusivity influence pricing and market share. Patent expirations can open avenues for generic manufacturing, potentially eroding revenues.

Side Effect Profile

Adverse effects such as hypertension, hand-foot skin reactions, fatigue, and diarrhea impact patient quality of life and adherence. Managing toxicity remains essential to maintaining its marketability.

Emerging Trends and Opportunities

Combination Therapies

Combination regimens pairing regorafenib with immunotherapies or other targeted agents are under investigation. Early clinical trial data suggests potential synergies, which could expand regorafenib's role and enhance its revenue stream.

Biomarker-Driven Approaches

Developing predictive biomarkers for response could refine patient selection, improve outcomes, and command premium pricing. This aligns with the broader shift towards personalized oncology care.

Geographical Expansion to Emerging Markets

Expanding access in Asia-Pacific, Latin America, and Africa offers growth opportunities. Local manufacturing, pricing strategies, and partnerships can facilitate market entry amid diverse healthcare infrastructures.

Financial Trajectory Analysis

Revenue Projections

Bayer’s oncology portfolio, including regorafenib, generated approximately €917 million in 2022, with regorafenib constituting a significant share [2]. Market analysts project a compound annual growth rate (CAGR) of 4-6% for regorafenib through 2030, contingent on label expansions, pipeline progress, and competitive landscape.

Impact of Patent Expiry

The patent landscape for regorafenib is critical. Patent expiry in key markets by 2027–2028 could lead to generic entry, substantially reducing pricing and revenues. Bayer’s strategic patent filings and formulations may extend exclusivity periods.

Pricing Strategies and Market Access

Pricing remains sensitive to reimbursement policies and competitive pressures. Offering value-based pricing, disease management programs, and demonstrating cost-effectiveness can enhance market access, supporting revenue stability.

Pipeline Development and Expanded Indications

Bayer’s ongoing trials exploring regorafenib in gastrointestinal, renal, and rare cancers could open new revenue streams. Successful approval for additional indications could boost revenue growth, offsetting patent-related declines.

Cost Considerations

Production costs for digital formulations, companion diagnostics, and post-market surveillance influence profitability. Bayer’s focus on operational efficiencies and strategic partnerships can reduce costs and sustain margins.

Regulatory and Market Risk Factors

- Regulatory Uncertainties: Changes in approval criteria or label restrictions could impact prescribing practices.

- Competitive Disruption: Emergence of novel therapies (e.g., CAR-T cells, novel immunotherapies) may threaten regorafenib’s market share.

- Market Access Dynamics: Reimbursement fluctuations and pricing pressures, especially in cost-conscious emerging markets, could constrain revenue growth.

Competitive Landscape

Regorafenib competes with several agents, including:

- Sunitinib and Cabozantinib: For GIST and HCC, these drugs offer alternative mechanisms of action.

- Immune Checkpoint Inhibitors: Nivolumab and pembrolizumab increasingly penetrate indications like HCC.

- Emerging Novel Agents: New kinase inhibitors and targeted therapies are under development, promising shifts in treatment algorithms.

Continuous surveillance of competitive developments and strategic positioning remains vital for regorafenib’s market sustainability.

Conclusion

Regorafenib’s market dynamics are characterized by consistent demand driven by its application in refractory cancers, technological advances in personalized medicine, and geographic expansion. However, challenges such as competitive pressures, patent expiries, and toxicity management impact its financial trajectory. Through strategic pipeline development, combination therapies, and targeted market expansion, Bayer can augment regorafenib’s revenue potential. Nonetheless, the expiration of exclusivity rights post-2027 presents significant risks, emphasizing the importance of innovation and differentiation.

Key Takeaways

- The global oncology market’s growth supports regorafenib’s continued revenue contributions, especially in colorectal and liver cancers.

- Patent protections and pipeline expansion are crucial for maintaining profitability; patent expiries pose potential revenue declines.

- Emerging therapies and combination regimens threaten regorafenib’s market share but also open avenues for integration within broader treatment protocols.

- Market access strategies and biomarker-driven personalization can optimize revenue potential.

- Strategic investments in emerging markets and pipeline diversification are vital for long-term growth.

FAQs

1. What are the primary indications for regorafenib?

Regorafenib is approved for metastatic colorectal cancer (mCRC), gastrointestinal stromal tumors (GIST), and hepatocellular carcinoma (HCC), particularly in patients who have progressed after standard treatments [3].

2. How does regorafenib compare to other multikinase inhibitors?

While similar to sunitinib and cabozantinib, regorafenib offers broader kinase inhibition with distinct indications. Its efficacy and safety profiles are comparable, but treatment decisions often depend on patient-specific factors and tumor characteristics [4].

3. What is the patent expiration timeline for regorafenib?

Patent protection in major markets is anticipated to expire around 2027–2028, after which generic versions may enter the market, impacting revenues.

4. Are there ongoing trials that could expand regorafenib’s use?

Yes, Bayer is exploring regorafenib in additional cancers, including renal cell carcinoma and rare tumors, with early-phase trials underway that could lead to new indications.

5. What strategies can Bayer adopt to sustain regorafenib’s market position?

Developing combination therapies, investing in biomarker research, expanding geographically, and pursuing pipeline expansion are key strategies for sustaining growth amid competitive and patent challenges.

References

[1] International Agency for Research on Cancer. Global Cancer Statistics 2020.

[2] Bayer AG Annual Report 2022.

[3] U.S. FDA Stivarga Approval Documentation.

[4] Clinical Oncology Reports. Comparative analyses of multikinase inhibitors.