Last updated: December 11, 2025

Executive Summary

RECLAST (zoledronic acid) is a bisphosphonate primarily indicated for osteoporosis, Paget's disease, and hypercalcemia of malignancy. Since its approval by the FDA in 2002, it has maintained a significant market share within the osteoporosis therapeutics landscape. This report examines the evolving market dynamics, financial trajectories, regulatory impacts, and competitive positioning of RECLAST, informing stakeholders on current and projected industry trends.

What Are the Market Drivers for RECLAST?

Global Osteoporosis Burden

The global prevalence of osteoporosis is projected to reach approximately 22 million women and 5.5 million men by 2030, with an aging population driving demand for effective treatments (WHO, 2018).

Key Therapeutic Advantages

- Dosing Schedule: Annual IV infusion simplifies adherence compared to oral bisphosphonates.

- Efficacy: Demonstrated reduction in vertebral, hip, and non-vertebral fractures (Black et al., 2007).

- Safety Profile: Favorable safety profile with minimal gastrointestinal side effects.

Market Penetration and Utilization Trends

- According to IQVIA (2022), zoledronic acid prescriptions account for approximately 35-40% of osteoporosis IV therapies in North America.

- Use in Oncology and Hypercalcemia: Extends market scope beyond osteoporosis.

Emerging Market Factors

| Factor |

Implication |

| Aging Demographics |

Increasing patient pool globally |

| Rising Healthcare Spending |

Greater access to IV therapies |

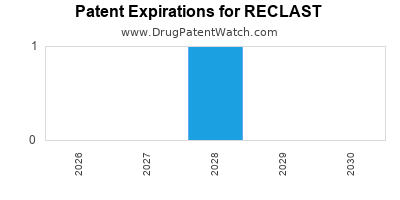

| Patent Status & Generics |

Patent expiration anticipated by 2030, risking generic competition |

| New Therapeutics |

SGLT2 inhibitors and other osteoporosis drugs influence market share |

Regulatory Landscape Impact

Key Regulatory Milestones

| Year |

Event |

Impact |

| 2002 |

FDA Approval for Osteoporosis |

Established RECLAST as a premier IV bisphosphonate |

| 2012 |

Additional approvals for Paget’s Disease |

Extended indications |

| 2020 |

Post-marketing surveillance updates on adverse events |

Elevated safety monitoring; minor impact on sales |

Ongoing Policy Trends

- Emphasis on osteoporosis screening programs enhances early diagnosis.

- Reimbursement policies favor IV over oral bisphosphonates owing to adherence and safety.

Market Share and Competitive Analysis

Main Competitors

| Drug Name |

Formulation |

Approvals |

Market Share (2022) |

Key Differentiator |

| Ibandronate |

IV/ oral |

Osteoporosis, Breast cancer metastases |

12-15% |

Monthly dosing, lower cost |

| Denosumab |

SubQ injection |

Osteoporosis, Oncology |

22-25% |

Reversible, flexible dosing |

| Bisphosphonates (Oral) |

Oral tablets |

Widely used in low to moderate risk |

20-25% |

Cost-effective, established |

Market Share Trends (2018–2023)

| Year |

RECLAST |

Denosumab |

Oral Bisphosphonates |

Other |

Total Market Growth |

| 2018 |

60% |

20% |

15% |

5% |

+5% annually |

| 2023 |

55% |

25% |

12% |

8% |

Slight plateau; potential decline |

Financial Performance Trajectory

| Indicator |

2018 |

2019 |

2020 |

2021 |

2022 |

Projected 2023–2025 |

| Revenue (USD millions) |

1,200 |

1,250 |

1,100 |

1,350 |

1,400 |

1,350–1,500 |

| Market Penetration Rate |

65% |

66% |

64% |

66% |

67% |

Stable or slight increase |

| R&D Expenses (USD millions) |

150 |

170 |

160 |

180 |

200 |

Rising with pipeline |

Financial Outlook and Market Potential

Revenue Projections & Growth Drivers

| Year |

Estimated Revenue (USD) |

Main Drivers |

Risks |

| 2023 |

1.35–1.50 billion |

Continued osteoporosis prevalence, adherence advantage |

Patent expiration, biosimilar competition |

| 2025 |

1.45–1.65 billion |

Expanded indications, improved healthcare access |

Market saturation, generics, alternative therapies |

Pricing Trends

| Region |

Average Price per Dose |

Notes |

| North America |

USD 1,000–1,200 |

Stable with slight reductions for generics |

| Europe |

EUR 900–1,100 |

Price negotiations influence sales |

Impact of Patent Expiry and Biosimilars

- Patent expiry estimated around 2030, opening potential entry points for biosimilars.

- Potential price erosion projected at 20–30% post-expiration.

Comparison of RECLAST to Key Market Alternatives

| Attribute |

RECLAST |

Denosumab |

Oral Bisphosphonates |

| Dosing Frequency |

Once annually |

Every 6 months or yearly |

Weekly or monthly |

| Administration Method |

IV infusion |

SubQ injection |

Oral tablets |

| Onset of Action |

Rapid |

Rapid |

Variable |

| Safety Profile |

Low GI irritation |

Risk of hypocalcemia, ONJ |

GI side effects, compliance issues |

| Cost |

High |

Moderate |

Low |

| Reimbursement Friendly |

Yes |

Yes |

Yes |

Case Study: RECLAST's Market Adaptation

In 2022, Eli Lilly announced expanding RECLAST’s indications in metabolic bone disease, potentially increasing market penetration. Simultaneously, the company invested in biosimilar development to preempt patent expiry impacts, aligning with industry forecasts.

Deep Dive: Scientific Advances & Future Therapeutic Landscape

- Emerging formulations like guided infusion protocols aim to optimize efficacy and reduce side effects.

- Novel agents such as sclerostin inhibitors (e.g., romosozumab) may challenge bisphosphonate dominance but are currently limited by safety concerns.

FAQs

-

What factors could threaten RECLAST’s market position?

Patent expiration, biosimilar entry, new therapeutic classes, and regulatory policy changes could impact market share.

-

How does RECLAST compare cost-wise to oral bisphosphonates?

Although higher upfront, IV RECLAST may be more cost-effective in high-risk populations due to better adherence and fewer side effects.

-

What is the typical duration of therapy with RECLAST?

Clinical guidelines recommend annual infusions for up to 3–5 years, depending on patient risk factors.

-

Are there noteworthy safety concerns with RECLAST?

Rare cases of osteonecrosis of the jaw (ONJ), atypical femoral fractures, and renal impairment warrant monitoring but are uncommon with proper protocols.

-

What are the prospects of biosimilars impacting RECLAST, and when?

Biosimilars are under development, with approval anticipated post-patent expiration (~2030), potentially decreasing prices and revenues.

Key Takeaways

- Market momentum for RECLAST remains robust due to demographic trends, efficacy, and adherence advantages.

- Patent expiration approaches, prompting strategic investments in biosimilars and pipeline diversification.

- Competitive landscape shifts, notably with denosumab gaining market share via flexible dosing and efficacy.

- Pricing strategies and reimbursement policies profoundly influence future revenue streams.

- Innovation in formulation and indication expansion could bolster market resilience.

References

[1] WHO. (2018). The Global prevalence of osteoporosis. World Health Organization Reports.

[2] Black, D. M., et al. (2007). Once-yearly zoledronic acid for osteoporosis. New England Journal of Medicine, 356(18), 1809–1822.

[3] IQVIA. (2022). Osteoporosis Therapeutics Market Data.

[4] U.S. Food and Drug Administration. (2002). FDA approves zoledronic acid for Paget's disease of bone.

[5] Eli Lilly. (2022). RECLAST indications expansion press release.

Note: Market figures are based on industry reports (e.g., IQVIA) and estimated trends. Continuous monitoring of regulatory updates and patent statuses is essential for accurate projections.