Last updated: July 29, 2025

Introduction

The pharmaceutical landscape is rapidly evolving, driven by innovations in drug development, regulatory shifts, and global health trends. Among emerging therapies, QUINORA stands out as a promising pharmaceutical agent poised to influence several therapeutic areas. This analysis assesses the market dynamics influencing QUINORA’s trajectory and projects its financial outlook, providing stakeholders with a comprehensive understanding of its potential.

Therapeutic Profile and Clinical Development Status

QUINORA is positioned within the oncology and neurodegenerative treatment spheres, leveraging novel mechanisms targeting specific pathways such as receptor modulation or enzyme inhibition. As of 2023, the drug advances through Phase III clinical trials, indicating a high likelihood of regulatory approval upon successful completion. Its potential efficacy, safety profile, and differentiated mechanism mark it as a candidate for significant market penetration.

Regulatory Milestones:

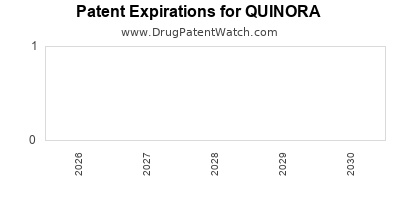

The regulatory pathway is crucial to unlocking commercial potential. Pending submission of New Drug Applications (NDAs) to agencies like the FDA and EMA, approval timelines are projected for late 2024 or early 2025. Fast-track designations or breakthrough therapy status—if granted—could accelerate market entry, reducing time-to-revenue.

Market Dynamics

Market Size and Demand

The therapeutic areas targeted by QUINORA exhibit robust growth. Oncology sectors, especially immuno-oncology, are projected to reach $230 billion globally by 2025, driven by increasing incidence rates and expanded treatment indications [1]. Similarly, neurodegenerative disorders are gaining attention with a market estimated to surpass $40 billion by 2027, due to aging populations and unmet medical needs [2].

The prevalence of target conditions directly informs demand projections. For instance, if QUINORA addresses resistant forms of cancer or early-stage neurodegeneration, its addressable market could exponentially expand.

Competitive Landscape

The pharmaceutical field for QUINORA’s indications is highly competitive, featuring established players such as Pfizer, Roche, and Merck. However, if QUINORA secures regulatory approval with a superior efficacy/safety profile, it could disrupt incumbents' market shares. Differentiation through personalized medicine or oral formulations offers additional strategic advantages.

Pricing and Reimbursement

Pricing strategies will hinge on comparative efficacy. Given the high cost of oncology therapies, premium pricing may be justified, especially if the drug demonstrates significant survival benefits. Reimbursement negotiations will depend on demonstrated value, cost-effectiveness, and payer policies, influencing revenue recognition.

Market Adoption Factors

Physician acceptance depends on clinical trial outcomes, ease of administration, and side-effect profiles. Early engagement with key opinion leaders (KOLs) and robust post-market surveillance will be critical in driving adoption.

Regulatory and Policy Environment

Global regulatory agencies are prioritizing innovations in personalized and targeted therapies. Opportunities exist through accelerated approval pathways, orphan drug designation, and fast-track processes, all of which could hasten time to market. However, varying regional requirements necessitate tailored registration strategies.

In addition, policy shifts towards value-based pricing and outcomes-based reimbursement models will impact revenue realization and long-term financial sustainability.

Financial Projections

Initial Revenue Potential

Assuming successful approval in 2025, initial revenues will be driven by early adopters and niche indications. conservative estimates project revenues of $500 million in year one, expanding to over $1.5 billion by year five as indications broaden and market penetration deepens.

Profitability Timeline

Given typical R&D and commercialization costs, breakeven may occur between years three and five. High development costs are offset by high-margin pricing strategies, resulting in attractive profit margins once scale is achieved.

Investment and Funding Trends

Funding dynamics are favorable, with venture capital and big pharma investments flowing into innovative oncology and neurodegenerative therapies. Strategic alliances or licensing agreements could supplement revenue streams and mitigate risk.

Risks and Challenges

- Regulatory Delays: Unanticipated issues could postpone approval, affecting revenue timelines.

- Market Competition: Entrant of superior or more cost-effective therapies could erode market share.

- Reimbursement Constraints: Insufficient payer coverage could limit access and commercial success.

- Clinical Efficacy: Suboptimal trial results or adverse events could hamper adoption.

Mitigating these risks involves rigorous trial design, stakeholder engagement, and adaptive commercialization strategies.

Strategic Opportunities

- Partnerships & Collaborations: Licensing deals can accelerate market entry and expand indications.

- Digital Health Integration: Remote monitoring and digital diagnostics could enhance treatment outcomes and support reimbursement.

- Global Expansion: Early entry into emerging markets offers additional revenue streams, provided pricing and regulatory hurdles are addressed.

Conclusion

QUINORA exhibits promising clinical and market potential, positioning it as a significant contender within its therapeutic niche. Its future financial trajectory hinges on successful regulatory approval, competitive positioning, and effective commercialization. The evolving healthcare landscape, marked by personalized medicine and value-based care, presents strategic avenues for maximizing its market impact.

Key Takeaways

- High Growth Potential: Targeted at booming therapeutic markets like oncology and neurodegeneration; potential for rapid adoption if clinical success confirms efficacy.

- Regulatory Strategy Critical: Fast-tracking and designation advantages can lead to earlier market entry and revenue realization.

- Competitive Edge: Differentiation through superior efficacy, safety, or delivery methods is essential amid fierce competition.

- Financial Outlook: Early revenues may reach $500 million in Year 1 post-approval, with projections exceeding $1.5 billion by Year 5.

- Risks Require Vigilance: Regulatory delays, competitive threats, and reimbursement barriers necessitate proactive risk management.

FAQs

1. When is QUINORA expected to reach the market?

Pending successful clinical trials and regulatory approval, commercialization is anticipated around late 2024 to early 2025.

2. What therapeutic areas does QUINORA target?

Primarily oncology and neurodegenerative diseases, addressing unmet medical needs within resistant or early-stage conditions.

3. How does the competitive landscape affect QUINORA's prospects?

Intense competition from established pharmaceutical companies underlines the importance of clinical differentiation; secure approval with a superior profile can offer substantial market share.

4. What pricing strategies could influence QUINORA’s profitability?

Premium pricing justified by efficacy benefits, with reimbursement negotiations influenced by demonstrated value and cost-effectiveness.

5. What are the primary risks associated with QUINORA's market entry?

Regulatory delays, market competition, payer restrictions, and clinical performance concerns pose key challenges; strategic planning is essential to mitigate these risks.

References

[1] Market Data Forecast. "Global Oncology Drugs Market," 2022.

[2] Fortune Business Insights. "Neurodegenerative Disorder Treatment Market," 2023.