QSYMIA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Qsymia, and when can generic versions of Qsymia launch?

Qsymia is a drug marketed by Vivus Llc and is included in one NDA. There are six patents protecting this drug and one Paragraph IV challenge.

This drug has forty patent family members in seventeen countries.

The generic ingredient in QSYMIA is phentermine hydrochloride; topiramate. There are seventeen drug master file entries for this compound. Four suppliers are listed for this compound. Additional details are available on the phentermine hydrochloride; topiramate profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Qsymia

A generic version of QSYMIA was approved as phentermine hydrochloride; topiramate by ACTAVIS LABS FL INC on June 25th, 2024.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for QSYMIA?

- What are the global sales for QSYMIA?

- What is Average Wholesale Price for QSYMIA?

Summary for QSYMIA

| International Patents: | 40 |

| US Patents: | 6 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 2 |

| Raw Ingredient (Bulk) Api Vendors: | 4 |

| Clinical Trials: | 20 |

| Drug Prices: | Drug price information for QSYMIA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for QSYMIA |

| What excipients (inactive ingredients) are in QSYMIA? | QSYMIA excipients list |

| DailyMed Link: | QSYMIA at DailyMed |

Recent Clinical Trials for QSYMIA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Minnesota | PHASE3 |

| University of Toronto | PHASE4 |

| Mayo Clinic | PHASE4 |

Pharmacology for QSYMIA

| Drug Class | Sympathomimetic Amine Anorectic |

| Mechanism of Action | Cytochrome P450 2C19 Inhibitors Cytochrome P450 3A4 Inducers |

| Physiological Effect | Appetite Suppression Decreased Central Nervous System Disorganized Electrical Activity Increased Sympathetic Activity |

Paragraph IV (Patent) Challenges for QSYMIA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| QSYMIA | Extended-release Capsules | phentermine hydrochloride; topiramate | 3.75 mg/23 mg 7.5 mg/46 mg 11.25 mg/69 mg 15 mg/92 mg | 022580 | 1 | 2013-07-18 |

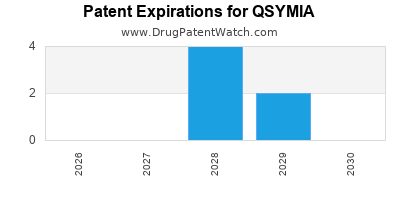

US Patents and Regulatory Information for QSYMIA

QSYMIA is protected by six US patents and two FDA Regulatory Exclusivities.

Expired US Patents for QSYMIA

International Patents for QSYMIA

When does loss-of-exclusivity occur for QSYMIA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 09257572

Estimated Expiration: ⤷ Get Started Free

Patent: 09257573

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0914985

Estimated Expiration: ⤷ Get Started Free

Patent: 0914991

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 27313

Estimated Expiration: ⤷ Get Started Free

Patent: 27319

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 10001365

Estimated Expiration: ⤷ Get Started Free

Patent: 10001366

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2112126

Estimated Expiration: ⤷ Get Started Free

Patent: 2112127

Estimated Expiration: ⤷ Get Started Free

Patent: 4825477

Estimated Expiration: ⤷ Get Started Free

Patent: 5534921

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 18103

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 17997

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 00002

Estimated Expiration: ⤷ Get Started Free

Patent: 17997

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 13489

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 9874

Patent: תכשיר טופירמאט/פנטרמין בעל מינון נמוך ושיטות לשימוש בו (Low dose topiramate/phentermine composition and methods of use thereof)

Estimated Expiration: ⤷ Get Started Free

Patent: 9875

Patent: Topiramate ו- phentermine לצורך ירידה במשקל במשטר מינון עולה (Topiramate and phentermine for effecting weight loss in an escalating dosing regimen)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 52595

Estimated Expiration: ⤷ Get Started Free

Patent: 77053

Estimated Expiration: ⤷ Get Started Free

Patent: 14750

Estimated Expiration: ⤷ Get Started Free

Patent: 11522896

Estimated Expiration: ⤷ Get Started Free

Patent: 11522897

Estimated Expiration: ⤷ Get Started Free

Patent: 15166380

Patent: 体重減少の達成および肥満症の治療のための漸増用量投与計画(ESCALATINGDOSINGREGIMEN) (ESCALATING DOSING REGIMEN (ESCALATINGDOSINGREGIMEN) FOR ACHIEVING WEIGHT REDUCTION AND TREATING OBESITY)

Estimated Expiration: ⤷ Get Started Free

Patent: 16006085

Patent: 低用量トピラメート/フェンテルミン組成物およびその使用方法 (LOW DOSE TOPIRAMATE/PHENTERMINE COMPOSITION AND METHODS OF USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 17078083

Patent: 低用量トピラメート/フェンテルミン組成物およびその使用方法 (LOW DOSE TOPIRAMATE/PHENTERMINE COMPOSITION AND METHODS OF USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 17105788

Patent: 体重減少の達成および肥満症の治療のための漸増用量投与計画(ESCALATING DOSING REGIMEN) (ESCALATING DOSING REGIMEN FOR EFFECTING WEIGHT LOSS AND TREATING OBESITY)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 2684

Patent: REGIMEN DE DOSIFICACION ESCALANTE PARA EFECTUAR LA PERDIDA DE PESO Y EL TRATAMIENTO DE OBESIDAD. (ESCALATING DOSING REGIMEN FOR EFFECTING WEIGHT LOSS AND TREATING OBESITY.)

Estimated Expiration: ⤷ Get Started Free

Patent: 10013503

Patent: COMPOSICION DE TOPIRAMATO/FENTERMINA DE BAJA DOSIS Y METODOS DE USO DE LA MISMA. (LOW DOSE TOPIRAMATE/PHENTERMINE COMPOSTION AND METHODS OF USE THEREOF.)

Estimated Expiration: ⤷ Get Started Free

Patent: 10013505

Patent: REGIMEN DE DOSIFICACION ESCALANTE PARA EFECTUAR LA PERDIDA DE PESO Y EL TRATAMIENTO DE OBESIDAD. (ESCALATING DOSING REGIMEN FOR EFFECTING WEIGHT LOSS AND TREATING OBESITY.)

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 17997

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1008839

Patent: LOW DOSE TOPIRAMATE/PHENTERMINE COMPOSITION AND METHODS OF USE THEREOF

Estimated Expiration: ⤷ Get Started Free

Patent: 1008840

Patent: ESCALATING DOSING REGIMEN FOR EFFECTING WEIGHT LOSS AND TREATING OBESITY

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 110042280

Patent: LOW DOSE TOPIRAMATE/PHENTERMINE COMPOSITION AND METHODS OF USE THEREOF

Estimated Expiration: ⤷ Get Started Free

Patent: 110044847

Estimated Expiration: ⤷ Get Started Free

Patent: 140121491

Patent: ESCALATING DOSING REGIMEN FOR EFFECTING WEIGHT LOSS AND TREATING OBESITY

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 06041

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering QSYMIA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Israel | 127715 | ANTICONVULSANT SULFAMATE DERIVATIVES USEFUL IN TREATING OBESITY | ⤷ Get Started Free |

| World Intellectual Property Organization (WIPO) | 2008153632 | ⤷ Get Started Free | |

| China | 102112126 | ⤷ Get Started Free | |

| European Patent Office | 2305227 | Thérapie combinée pour le traitement du diabète associé à l'obésité (Combination therapy for the treatment of diabetes associated with obesity) | ⤷ Get Started Free |

| Hong Kong | 1213489 | ⤷ Get Started Free | |

| Australia | 732923 | ⤷ Get Started Free | |

| Spain | 2291215 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for QSYMIA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2317997 | CR 2021 00049 | Denmark | ⤷ Get Started Free | PRODUCT NAME: PHENTERMIN OG TOPIRAMAT; NAT. REG. NO/DATE: 63166, 63167, 63168, 63169 20210705; FIRST REG. NO/DATE: IS IS/1/21/018/01-04 20210212 |

| 2317997 | 833 | Finland | ⤷ Get Started Free | |

| 2317997 | CA 2021 00049 | Denmark | ⤷ Get Started Free | PRODUCT NAME: PHENTERMIN OG TOPIRAMAT; NAT. REG. NO/DATE: 63166, 63167, 63168, 63169 20210705; FIRST REG. NO/DATE: IS IS/1/21/018/01-04 20210212 |

| 2317997 | 2190050-1 | Sweden | ⤷ Get Started Free | PRODUCT NAME: PHENTERMINE AND TOPIRAMATE; NAT. REG. NO/DATE: 59574-59577 20210617; FIRST REG.: IS IS/1/21/018/01-04 20210212 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for QSYMIA (Phentermine/Topiramate Extended-Release)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.