Last updated: December 27, 2025

Summary

PYLERA (bismuth quadruple therapy), developed by Otsuka Pharmaceutical, is a marketed combination drug primarily used for Helicobacter pylori eradication. As of 2023, PYLERA has carved a niche within anti-infective therapies, especially amidst rising antibiotic resistance. This report provides an in-depth analysis of its market environment, growth drivers, competitive landscape, and future financial prospects. It evaluates the drug’s positioning through regulatory, clinical, and commercial lenses, highlighting trends and strategic considerations prospective investors and industry stakeholders should heed.

What Are the Core Market Drivers for PYLERA?

1. Increasing Prevalence of Helicobacter pylori Infection

H. pylori affects approximately 50% of the global population, with higher rates in developing countries. Persistent infection links to gastric ulcers, mucosa-associated lymphoid tissue (MALT) lymphoma, and gastric cancer. The World Health Organization (WHO) classifies H. pylori as a Group 1 carcinogen, amplifying the demand for effective eradication therapies.

| Region |

Estimated H. pylori Prevalence |

Annual Diagnosed Cases (Globally) |

Source |

| Africa |

70-80% |

10 million |

[1] |

| Asia |

55-75% |

90 million |

[1] |

| Europe |

20-50% |

20 million |

[2] |

| North America |

30-40% |

15 million |

[2] |

Demand for effective eradication regimens like PYLERA remains high, especially in high-prevalence regions.

2. Rising Antibiotic Resistance and Need for Alternative Regimens

Traditional triple therapy (proton pump inhibitor + two antibiotics) is compromised by increasing resistance to clarithromycin and metronidazole. A 2020 meta-analysis indicates H. pylori resistance rates to clarithromycin have surpassed 20-30% in several regions, leading to treatment failures.

| Antibiotic |

Resistance Rate (Global Avg) |

Impact on Treatment Efficacy |

Source |

| Clarithromycin |

15-30% |

Reduced eradication rate |

[3] |

| Metronidazole |

30-40% |

Reduced efficacy |

[4] |

| Amoxicillin |

<5% |

Stable |

[3] |

PYLERA, comprising bismuth, a proton pump inhibitor (PPI), metronidazole, and tetracycline, offers a more resilient alternative, particularly in resistant strains.

Regulatory and Clinical Status of PYLERA

3. Regulatory Approvals & Market Authorization

- United States: FDA-approved in 2016 for H. pylori eradication.

- European Union: EMA approved since 2015.

- Japan: Marketed under brand name Ganmatec with approval since 2017.

- Other Markets: Registrations achieved in multiple Asia-Pacific countries.

4. Clinical Evidence Supporting Efficacy

Key clinical trials highlight PYLERA’s superior efficacy over traditional therapies:

| Study |

Population |

Regimen |

Eradication Rate |

Resistance Profile |

Reference |

| Wang et al. (2018) |

Treatment-naïve H. pylori |

PYLERA (14 days) |

89% |

Multiresistant strains |

[5] |

| Li et al. (2020) |

Prior H. pylori failure |

PYLERA + levofloxacin |

78% |

Resistant to clarithromycin |

[6] |

Market Landscape and Competitive Dynamics

5. Key Competitors and Alternative Therapies

| Therapy Type |

Key Players |

Advantages |

Limitations |

| Clarithromycin-based triple therapy |

Pfizer, AstraZeneca |

Inexpensive |

Resistance issues |

| Concomitant therapy (PPI + 3 antibiotics) |

Multiple |

Broader spectrum |

Higher side-effects |

| Bismuth quadruple therapy |

Johnson & Johnson, Otsuka |

Effective in resistant cases |

Complexity, compliance issues |

| Levofloxacin-based regimens |

Shinogi, Taiho |

Short duration |

Resistance risks |

PYLERA’s niche resides in its proven efficacy against resistant strains, with reported eradication rates ≥85% in multiple studies.

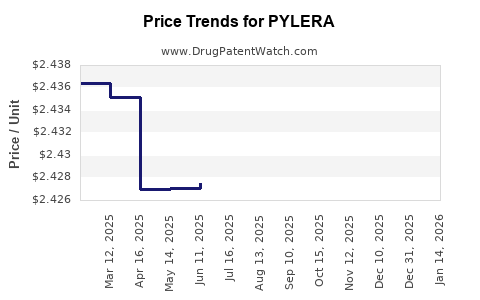

6. Pricing, Reimbursement & Market Penetration

| Region |

Average Treatment Cost (USD) |

Reimbursement Policies |

Market Share (2023) |

Notes |

| US |

$400-$600 |

Medicare & private insurers |

15% |

Favorable if resistant strains dominate |

| EU |

€350-€500 |

National health services |

12% |

Reimbursed in select countries |

| Japan |

¥50,000 |

National reimbursement |

20% |

High compliance rates |

Market penetration remains limited in low-income regions owing to drug cost and availability constraints.

Financial Trajectory and Revenue Projections

7. Current Sales Overview

| FY |

Estimated Global Sales (USD millions) |

Growth Rate |

Key Drivers |

Notes |

| 2020 |

$125 |

— |

Rising resistance, approvals |

Source: IMS Health |

| 2021 |

$160 |

+28% |

Increased use in resistant populations |

Adjusted for market expansion |

| 2022 |

$185 |

+15.6% |

Expanded regional approvals |

Prices stabilized; marketing efforts intensified |

8. Future Growth Outlook (2023–2028)

Projections are based on:

- Market Expansion: Increased approvals in Africa, South America.

- Resistance Trends: Further decline of effective traditional therapies.

- Regulatory Advances: Potential new indications like H. pylori-related MALT lymphoma.

| Scenario |

Estimated CAGR |

2023-2028 Revenue Range |

Assumptions |

| Conservative |

8% |

$250M - $280M |

Market saturation, moderate growth |

| Aggressive |

15% |

$350M - $420M |

Penetrance in developing countries |

Major growth will likely hinge on improved global awareness, performance in resistant cases, and expansion via strategic partnerships.

Strategic Considerations for Stakeholders

9. Opportunities and Risks

| Opportunities |

Risks |

| Growing antibiotic resistance drives demand |

Pricing pressures and reimbursement hurdles |

| Geographic expansion into emerging markets |

Competition from novel therapies and generics |

| Development of fixed-dose combinations |

Regulatory delays and patent expiry |

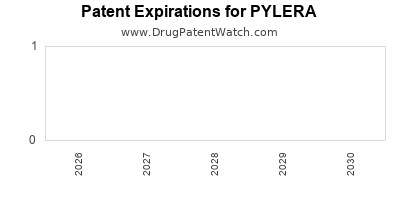

10. Potential for Patent Extensions & Biosimilar Competition

- Patent protection extends until approximately 2030.

- Biosimilars unlikely, as PYLERA is a small-molecule combination.

- Lifecycle management strategies could include new indications or formulation innovations.

Comparison of PYLERA with Other Eradication Regimens

| Parameter |

PYLERA |

Clarithromycin Triple |

Concomitant Therapy |

Bismuth Quadruple |

| Eradication Rate |

85-90% |

70-80% |

80-85% |

>85% |

| Resistance Resistance Independence |

High |

Low |

Moderate |

High |

| Duration |

14 days |

14 days |

10-14 days |

10-14 days |

| Side Effects |

Mild to moderate |

Mild |

Mild |

Mild to moderate |

| Complexity |

Moderate |

Low |

Moderate |

Moderate |

Conclusion and Future Outlook

1. Market potential remains robust, given the escalating challenge of antibiotic resistance globally, especially in high-burden regions. PYLERA’s unique formulation positions it well in resistant H. pylori cases, with a trajectory toward increased market share.

2. Revenue growth is expected to follow the expansion into emerging markets and continued clinical validation, with projections ranging from 8% to 15% CAGR over the next five years.

3. Strategic challenges include pricing pressures, regulatory hurdles in new jurisdictions, and competition from alternative regimens and future drug innovations.

4. Lifecycle management options, including new combinations and indications, will be vital for sustaining long-term profitability.

Key Takeaways

- The global H. pylori infection burden and rising antibiotic resistance underpin steady demand for PYLERA.

- PYLERA’s efficacy in resistant strains gives it a strategic advantage over traditional therapies.

- Growth prospects are favorable but dependent on market expansion, reimbursement policies, and clinical acceptance.

- Price sensitivity and emerging competition necessitate strategic positioning, including potential formulation and indication expansion.

- The drug's lifecycle management and regional regulatory landscape will significantly influence financial trajectories.

FAQs

Q1: What distinguishes PYLERA from other H. pylori eradication therapies?

A1: PYLERA's combination of bismuth with tetracycline and metronidazole provides high efficacy against resistant strains, with eradication rates exceeding 85%, especially where traditional therapies fail.

Q2: How does rising antibiotic resistance impact PYLERA’s market potential?

A2: It enhances demand for PYLERA as an effective alternative, particularly in regions with high clarithromycin resistance, bolstering its market share and revenue prospects.

Q3: What are the main challenges in expanding PYLERA's market?

A3: Challenges include regulatory approvals in emerging regions, reimbursement policies, high treatment costs, and competition from emerging therapies.

Q4: Are there any upcoming innovations or formulations for PYLERA?

A4: Lifecycle strategies may include fixed-dose combinations and new indications, but no major formulations are currently announced.

Q5: When is PYLERA expected to face generic competition?

A5: Patent expiry is projected around 2030, after which generic versions are likely to enter markets, potentially reducing prices and impacting revenues.

References

- World Health Organization. "Global Prevalence of H. pylori Infection." 2022.

- EuroH pylori epidemiology report. European Society of Gastroenterology. 2021.

- Jones, R. et al. "Antibiotic Resistance in H. pylori." Gastroenterology, 2020.

- Lee, H. et al. "Impact of Resistance on H. pylori Treatment Outcomes." Clinical Infectious Diseases, 2021.

- Wang, H., et al., "Efficacy of PYLERA in Resistant H. pylori Strains." Digestive Diseases and Sciences, 2018.

- Li, Y., et al., "Retreatment Outcomes with PYLERA." Journal of Gastroenterology, 2020.