PROMACTA Drug Patent Profile

✉ Email this page to a colleague

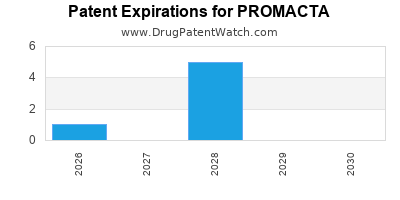

Which patents cover Promacta, and when can generic versions of Promacta launch?

Promacta is a drug marketed by Novartis and is included in two NDAs. There are six patents protecting this drug and two Paragraph IV challenges.

This drug has one hundred and thirty-four patent family members in forty-one countries.

The generic ingredient in PROMACTA is eltrombopag olamine. There are three drug master file entries for this compound. Three suppliers are listed for this compound. Additional details are available on the eltrombopag olamine profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Promacta

A generic version of PROMACTA was approved as eltrombopag olamine by ANNORA PHARMA on April 18th, 2024.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for PROMACTA?

- What are the global sales for PROMACTA?

- What is Average Wholesale Price for PROMACTA?

Summary for PROMACTA

| International Patents: | 134 |

| US Patents: | 6 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 70 |

| Clinical Trials: | 31 |

| Patent Applications: | 671 |

| Drug Prices: | Drug price information for PROMACTA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for PROMACTA |

| What excipients (inactive ingredients) are in PROMACTA? | PROMACTA excipients list |

| DailyMed Link: | PROMACTA at DailyMed |

Recent Clinical Trials for PROMACTA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of California, San Francisco | Phase 1 |

| Food and Drug Administration (FDA) | Phase 1 |

| University of California, Davis | Phase 1 |

Pharmacology for PROMACTA

Paragraph IV (Patent) Challenges for PROMACTA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| PROMACTA | Tablets | eltrombopag olamine | 12.5 mg and 25 mg | 022291 | 1 | 2014-02-04 |

| PROMACTA | Tablets | eltrombopag olamine | 50 mg and 75 mg | 022291 | 1 | 2014-01-07 |

US Patents and Regulatory Information for PROMACTA

PROMACTA is protected by six US patents and one FDA Regulatory Exclusivity.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Novartis | PROMACTA KIT | eltrombopag olamine | FOR SUSPENSION;ORAL | 207027-002 | Sep 27, 2018 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Novartis | PROMACTA | eltrombopag olamine | TABLET;ORAL | 022291-003 | Sep 8, 2009 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Novartis | PROMACTA KIT | eltrombopag olamine | FOR SUSPENSION;ORAL | 207027-001 | Aug 24, 2015 | AB | RX | Yes | Yes | 7,547,719*PED | ⤷ Get Started Free | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for PROMACTA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Novartis | PROMACTA | eltrombopag olamine | TABLET;ORAL | 022291-002 | Nov 20, 2008 | 6,280,959*PED | ⤷ Get Started Free |

| Novartis | PROMACTA | eltrombopag olamine | TABLET;ORAL | 022291-001 | Nov 20, 2008 | 6,280,959*PED | ⤷ Get Started Free |

| Novartis | PROMACTA | eltrombopag olamine | TABLET;ORAL | 022291-003 | Sep 8, 2009 | 6,280,959*PED | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for PROMACTA

When does loss-of-exclusivity occur for PROMACTA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 9656

Estimated Expiration: ⤷ Get Started Free

Patent: 7711

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07352608

Estimated Expiration: ⤷ Get Started Free

Patent: 12201288

Estimated Expiration: ⤷ Get Started Free

Patent: 14202367

Estimated Expiration: ⤷ Get Started Free

Patent: 16202063

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0721651

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 85831

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07002242

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1686930

Estimated Expiration: ⤷ Get Started Free

Patent: 2688207

Estimated Expiration: ⤷ Get Started Free

Patent: 2697745

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 60058

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 143

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0160206

Estimated Expiration: ⤷ Get Started Free

Patent: 0240595

Estimated Expiration: ⤷ Get Started Free

Patent: 0250383

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 17284

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 52237

Estimated Expiration: ⤷ Get Started Free

Patent: 90730

Estimated Expiration: ⤷ Get Started Free

Patent: 18732

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 009000253

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 077628

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 0883

Estimated Expiration: ⤷ Get Started Free

Patent: 4294

Estimated Expiration: ⤷ Get Started Free

Patent: 0971018

Estimated Expiration: ⤷ Get Started Free

Patent: 1400387

Estimated Expiration: ⤷ Get Started Free

Patent: 1991590

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 52237

Estimated Expiration: ⤷ Get Started Free

Patent: 90730

Estimated Expiration: ⤷ Get Started Free

Patent: 18732

Estimated Expiration: ⤷ Get Started Free

Patent: 18733

Estimated Expiration: ⤷ Get Started Free

Patent: 00104

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 90730

Estimated Expiration: ⤷ Get Started Free

Patent: 18732

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 36968

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 27209

Estimated Expiration: ⤷ Get Started Free

Patent: 67736

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 1891

Estimated Expiration: ⤷ Get Started Free

Patent: 8840

Estimated Expiration: ⤷ Get Started Free

Patent: 4602

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 19866

Estimated Expiration: ⤷ Get Started Free

Patent: 35078

Estimated Expiration: ⤷ Get Started Free

Patent: 44713

Estimated Expiration: ⤷ Get Started Free

Patent: 60289

Estimated Expiration: ⤷ Get Started Free

Patent: 42148

Estimated Expiration: ⤷ Get Started Free

Patent: 42149

Estimated Expiration: ⤷ Get Started Free

Patent: 10526140

Estimated Expiration: ⤷ Get Started Free

Patent: 14005302

Estimated Expiration: ⤷ Get Started Free

Patent: 15129195

Estimated Expiration: ⤷ Get Started Free

Patent: 17137343

Estimated Expiration: ⤷ Get Started Free

Patent: 19123747

Estimated Expiration: ⤷ Get Started Free

Patent: 21100968

Estimated Expiration: ⤷ Get Started Free

Patent: 23011888

Estimated Expiration: ⤷ Get Started Free

Patent: 25020367

Estimated Expiration: ⤷ Get Started Free

Patent: 25020368

Estimated Expiration: ⤷ Get Started Free

Patent: 25081605

Estimated Expiration: ⤷ Get Started Free

Jordan

Patent: 43

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 90730

Estimated Expiration: ⤷ Get Started Free

Patent: 18732

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 8072

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09011881

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 236

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 0888

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 080773

Estimated Expiration: ⤷ Get Started Free

Patent: 121407

Estimated Expiration: ⤷ Get Started Free

Patent: 151953

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 52237

Estimated Expiration: ⤷ Get Started Free

Patent: 90730

Estimated Expiration: ⤷ Get Started Free

Patent: 18732

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 52237

Estimated Expiration: ⤷ Get Started Free

Patent: 90730

Estimated Expiration: ⤷ Get Started Free

Patent: 18732

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 52237

Estimated Expiration: ⤷ Get Started Free

Patent: 90730

Estimated Expiration: ⤷ Get Started Free

Patent: 18732

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0907710

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1475971

Estimated Expiration: ⤷ Get Started Free

Patent: 1537200

Estimated Expiration: ⤷ Get Started Free

Patent: 1632851

Estimated Expiration: ⤷ Get Started Free

Patent: 100020456

Estimated Expiration: ⤷ Get Started Free

Patent: 140049086

Estimated Expiration: ⤷ Get Started Free

Patent: 150008513

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 65179

Estimated Expiration: ⤷ Get Started Free

Patent: 81985

Estimated Expiration: ⤷ Get Started Free

Patent: 32244

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 39267

Estimated Expiration: ⤷ Get Started Free

Patent: 38674

Estimated Expiration: ⤷ Get Started Free

Patent: 0843742

Estimated Expiration: ⤷ Get Started Free

Patent: 1410240

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 261

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering PROMACTA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Chile | 2007002242 | ⤷ Get Started Free | |

| Australia | 2016202063 | ⤷ Get Started Free | |

| Slovenia | 1534390 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for PROMACTA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1294378 | C201000022 | Spain | ⤷ Get Started Free | PRODUCT NAME: ELTROMBOPAG; NATIONAL AUTHORISATION NUMBER: EU/1/10/612/001-006; DATE OF AUTHORISATION: 20100315; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/10/612/001-006; DATE OF FIRST AUTHORISATION IN EEA: 20100315 |

| 1534390 | C20100006 | Estonia | ⤷ Get Started Free | PRODUCT NAME: REVOLADE-ELTROMBOPAG; AUTHORISATIN NO.: EMA/CHMP/697489/2018; AUTHORISATION DATE: 20181019 |

| 1534390 | PA2010007 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: ELTROMBOPAGUM OLAMINUM; REGISTRATION NO/DATE: EU/1/10/612/001, 2010 03 11 EU/1/10/612/002, 2010 03 11 EU/1/10/612/003, 2010 03 11 EU/1/10/612/004, 2010 03 11 EU/1/10/612/005, 2010 03 11 EU/1/10/612/006 20100311 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for PROMACTA (Eltrombopag)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.