PROCYSBI Drug Patent Profile

✉ Email this page to a colleague

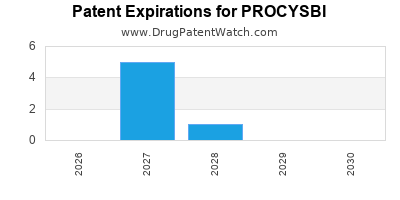

When do Procysbi patents expire, and when can generic versions of Procysbi launch?

Procysbi is a drug marketed by Horizon and is included in two NDAs. There are twelve patents protecting this drug and two Paragraph IV challenges.

This drug has sixty-six patent family members in thirty-four countries.

The generic ingredient in PROCYSBI is cysteamine bitartrate. There are six drug master file entries for this compound. Two suppliers are listed for this compound. Additional details are available on the cysteamine bitartrate profile page.

DrugPatentWatch® Generic Entry Outlook for Procysbi

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be December 17, 2034. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for PROCYSBI?

- What are the global sales for PROCYSBI?

- What is Average Wholesale Price for PROCYSBI?

Summary for PROCYSBI

| International Patents: | 66 |

| US Patents: | 12 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 25 |

| Clinical Trials: | 1 |

| Patent Applications: | 197 |

| Drug Prices: | Drug price information for PROCYSBI |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for PROCYSBI |

| What excipients (inactive ingredients) are in PROCYSBI? | PROCYSBI excipients list |

| DailyMed Link: | PROCYSBI at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for PROCYSBI

Generic Entry Dates for PROCYSBI*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE, DELAYED RELEASE;ORAL |

Generic Entry Dates for PROCYSBI*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

GRANULE, DELAYED RELEASE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for PROCYSBI

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Horizon Pharma USA, Inc. | Phase 3 |

| Raptor Pharmaceuticals Inc. | Phase 3 |

Pharmacology for PROCYSBI

| Drug Class | Cystine Depleting Agent |

| Mechanism of Action | Cystine Disulfide Reduction |

Paragraph IV (Patent) Challenges for PROCYSBI

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| PROCYSBI | Delayed-release Granules | cysteamine bitartrate | 75 mg/Packet and 300 mg/Packet | 213491 | 1 | 2021-12-16 |

| PROCYSBI | Delayed-release Capsules | cysteamine bitartrate | 25 mg and 75 mg | 203389 | 1 | 2020-05-11 |

US Patents and Regulatory Information for PROCYSBI

PROCYSBI is protected by twelve US patents and three FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of PROCYSBI is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Horizon | PROCYSBI | cysteamine bitartrate | GRANULE, DELAYED RELEASE;ORAL | 213491-001 | Feb 14, 2020 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Horizon | PROCYSBI | cysteamine bitartrate | GRANULE, DELAYED RELEASE;ORAL | 213491-001 | Feb 14, 2020 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Horizon | PROCYSBI | cysteamine bitartrate | GRANULE, DELAYED RELEASE;ORAL | 213491-002 | Feb 14, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Horizon | PROCYSBI | cysteamine bitartrate | GRANULE, DELAYED RELEASE;ORAL | 213491-002 | Feb 14, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Horizon | PROCYSBI | cysteamine bitartrate | GRANULE, DELAYED RELEASE;ORAL | 213491-002 | Feb 14, 2020 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for PROCYSBI

When does loss-of-exclusivity occur for PROCYSBI?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 6628

Estimated Expiration: ⤷ Get Started Free

Patent: 8816

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 14281702

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015031417

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 14770

Estimated Expiration: ⤷ Get Started Free

Patent: 38644

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 15003662

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5492000

Patent: Delayed release cysteamine bead formulation

Estimated Expiration: ⤷ Get Started Free

Patent: 0664780

Patent: 延迟释放型半胱胺珠粒调配物,以及其制备及使用方法 (Delayed release cysteamine bead formulation, and method of manufacture and use thereof)

Estimated Expiration: ⤷ Get Started Free

Cuba

Patent: 150178

Patent: FORMULACIÓN EN PERLAS DE CISTEAMINA DE LIBERACIÓN RETARDADA

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1255

Patent: СОСТАВ С ОТСРОЧЕННЫМ ВЫСВОБОЖДЕНИЕМ, СОДЕРЖАЩИЙ ГРАНУЛЫ ЦИСТЕАМИНА, И СПОСОБЫ ЕГО ПОЛУЧЕНИЯ И ПРИМЕНЕНИЯ (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION AND METHODS FOR THE PREPARATION AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 1690036

Patent: СОСТАВ С ОТСРОЧЕННЫМ ВЫСВОБОЖДЕНИЕМ, СОДЕРЖАЩИЙ ГРАНУЛЫ ЦИСТЕАМИНА, И СПОСОБЫ ЕГО ПОЛУЧЕНИЯ И ПРИМЕНЕНИЯ

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 10491

Patent: PRÉPARATION DE BILLES DE CYSTÉAMINE À LIBÉRATION RETARDÉE (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION)

Estimated Expiration: ⤷ Get Started Free

Patent: 39574

Patent: PRÉPARATION DE BILLES DE CYSTÉAMINE À LIBÉRATION RETARDÉE (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 18066

Patent: 延遲釋放型半胱胺珠粒調配物 (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 4823

Patent: פורמולצית bead של ציסטאמין בעל שחרור מושהה, שיטות להכנתה ולשימוש בה (Delayed release cysteamine bead formulation, and methods of making and using same)

Estimated Expiration: ⤷ Get Started Free

Patent: 2141

Patent: פורמולצית bead של ציסטאמין בעל שחרור מושהה, שיטות להכנתה ולשימוש בה (Delayed release cysteamine bead formulation, and methods of making and using same)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 68661

Estimated Expiration: ⤷ Get Started Free

Patent: 16523250

Patent: 遅延放出システアミンビーズ処方、ならびにその作製方法および使用方法

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 5377

Patent: FORMULACIÓN DE PERLAS DE CISTEAMINA DE LIBERACIÓN RETARDADA. (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION)

Estimated Expiration: ⤷ Get Started Free

Patent: 15017366

Patent: FORMULACION DE PERLAS DE CISTEAMINA DE LIBERACION RETARDADA. (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 4517

Patent: Delayed release cysteamine bead formulation

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 1500177

Patent: FORMULACIÓN EN PERLAS DE CISTEAMINA DE LIBERACIÓN RETARDADA

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 015502783

Patent: DELAYED RELEASE CYSTEAMINE BEAD FORMULATION

Estimated Expiration: ⤷ Get Started Free

Patent: 020552266

Patent: DELAYED RELEASE CYSTEAMINE BEAD FORMULATION

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201510126Q

Patent: DELAYED RELEASE CYSTEAMINE BEAD FORMULATION

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1508783

Patent: DELAYED RELEASE CYSTEAMINE BEAD FORMULATION

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2281747

Estimated Expiration: ⤷ Get Started Free

Patent: 2466253

Estimated Expiration: ⤷ Get Started Free

Patent: 160045053

Patent: 서방성 시스테아민 비드 투약 형태 (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION)

Estimated Expiration: ⤷ Get Started Free

Patent: 210094140

Patent: 서방성 시스테아민 비드 투약 형태 (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION)

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 49100

Estimated Expiration: ⤷ Get Started Free

Patent: 1534357

Patent: Delayed release cysteamine bead formulation, and methods of making and using same

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 15000549

Patent: DELAYED RELEASE CYSTEAMINE BEAD FORMULATION

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 7833

Patent: СКЛАД З ВІДСТРОЧЕНИМ ВИВІЛЬНЕННЯМ, ЩО МІСТИТЬ ГРАНУЛИ ЦИСТЕАМІНУ, І СПОСОБИ ЙОГО ОДЕРЖАННЯ ТА ЗАСТОСУВАННЯ (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering PROCYSBI around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Slovenia | 2535044 | ⤷ Get Started Free | |

| Mexico | 2008009647 | CISTEAMINA RECUBIERTA ENTÉRICAMENTE, CISTAMINA Y DERIVADOS DE ELLA. (ENTERICALLY COATED CYSTEAMINE, CYSTAMINE AND DERIVATIVES THEREOF.) | ⤷ Get Started Free |

| Japan | 2016523250 | 遅延放出システアミンビーズ処方、ならびにその作製方法および使用方法 | ⤷ Get Started Free |

| Hong Kong | 1218066 | 延遲釋放型半胱胺珠粒調配物 (DELAYED RELEASE CYSTEAMINE BEAD FORMULATION) | ⤷ Get Started Free |

| South Korea | 102466253 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for PROCYSBI

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1919458 | C300649 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: CYSTEAMINE; REGISTRATION NO/DATE: EU/1/13/861/001-002 20130906 |

| 1919458 | 2014C/018 | Belgium | ⤷ Get Started Free | PRODUCT NAME: CYSTEAMINE; AUTHORISATION NUMBER AND DATE: EU/1/13/861 20130910 |

| 1919458 | 19/2014 | Austria | ⤷ Get Started Free | PRODUCT NAME: CYSTEAMIN; REGISTRATION NO/DATE: EU/1/13/861/001-002 20130910 |

| 1919458 | C 2014 012 | Romania | ⤷ Get Started Free | PRODUCT NAME: CISTEAMINABITARTRAT; NATIONAL AUTHORISATION NUMBER: EU/1/13/861; DATE OF NATIONAL AUTHORISATION: 20130906; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/13/861; DATE OF FIRST AUTHORISATION IN EEA: 20130906 |

| 1919458 | CR 2014 00013 | Denmark | ⤷ Get Started Free | PRODUCT NAME: CYSTEAMIN, HERUNDER MERCAPTAMINBITARTRAT; REG. NO/DATE: EU/1/13/861 20130906 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for PROCYSBI: A Comprehensive Analysis

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.