Last updated: July 29, 2025

Introduction

PROCTOCORT, a topical corticosteroid formulation, has gained traction within the gastrointestinal and dermatological sectors, primarily for its efficacy in managing inflammatory and allergic conditions such as proctitis, eczema, and dermatitis. Its active component, hydrocortisone acetate, offers anti-inflammatory and immunosuppressive benefits, positioning it within a competitive landscape driven by evolving clinical needs, regulatory frameworks, and market trends. This comprehensive analysis explores the current market dynamics influencing PROCTOCORT and projects its future financial trajectory, providing crucial insights for industry stakeholders.

Market Landscape and Product Positioning

Therapeutic Focus and Usage:

PROCTOCORT’s primary indications center on inflammatory bowel conditions, including proctitis and other anorectal inflammations, as well as dermatological conditions like eczema and dermatitis. The topical route ensures targeted therapy with minimized systemic absorption, aligning with patient safety profiles and clinician preferences.

Competitive Environment:

The drug competes within a broad spectrum of corticosteroid-based products. Market entrants include both generic formulations and branded equivalents, with varying potency and delivery mechanisms. Notably, the prevalence of inflammatory conditions and increasing awareness have sustained demand, despite growing competition.

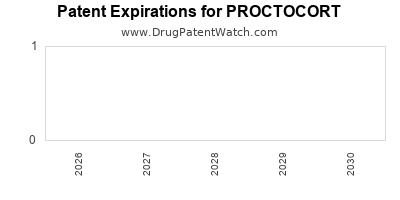

Regulatory and Patent Dynamics:

Though PROCTOCORT faced patent expirations in some markets, strategic patent extensions and formulation innovations have maintained its market exclusivity in specific regions. Regulatory approvals from agencies such as the FDA and EMA further influence its market access.

Market Drivers Influencing PROCTOCORT

Rising Prevalence of Inflammatory Conditions

The global incidence of inflammatory bowel diseases (IBD), including ulcerative colitis and Crohn’s disease, continues to escalate, driven by urbanization, dietary factors, and environmental changes. According to the CDC, IBD affects approximately 3 million Americans, with similar upward trends observed worldwide [1]. Such epidemiological patterns underpin increased demand for corticosteroid therapies like PROCTOCORT.

Growing Aging Population

An aging demographic amplifies the prevalence of chronic inflammatory and dermatological conditions, creating a persistent need for effective topical treatments. The increased healthcare utilization among seniors positions PROCTOCORT favorably within this expanding patient cohort.

Advancements in Formulation Technologies

Innovations in topical drug delivery, such as sustained-release preparations and improved penetrability, enhance drug efficacy and patient adherence. These technological advancements strengthen PROCTOCORT’s competitiveness, especially if aligned with clinicians’ preferences for minimally invasive and tolerable therapies.

Preference for Localized Therapy

Clinicians favor localized anti-inflammatory treatments to mitigate systemic side effects linked with corticosteroids. This operational advantage sustains PROCTOCORT’s relevance, particularly for long-term management of dermatologic and anorectal conditions.

Regulatory and Reimbursement Policies

Stringent regulatory standards and evolving reimbursement policies influence market access strategies. Countries with supportive regulatory environments and active reimbursement pathways present lucrative opportunities for PROCTOCORT’s widespread adoption.

Market Barriers and Risks

Competition from Biosimilars and Generics

Patent expiries in certain jurisdictions open doors for biosimilar and generic counterparts, exerting downward pressure on prices. Manufacturers need to innovate or differentiate through formulation improvements, branding, or clinical evidence.

Safety and Side Effect Profiles

While topical corticosteroids are generally well-tolerated, concerns around skin thinning, hypothalamic-pituitary-adrenal (HPA) axis suppression, and long-term systemic effects may hinder patient adherence and prescriber confidence [2].

Regulatory Challenges

Varied regional approval processes, especially in emerging markets, may delay product launch or restrict formulary inclusion, affecting revenue streams.

Market Saturation

Intense competition and market maturity in developed regions could lead to stagnant revenues unless augmented by geographic expansion or new indications.

Financial Trajectory Analysis

Revenue Projections

Based on current market penetration, epidemiological trends, and demographic shifts, PROCTOCORT’s revenues are projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% over the next five years in developed markets. Emerging regions, including Asia-Pacific and Latin America, exhibit higher growth potentials—estimated at CAGRs of 8-12%—due to expanding healthcare infrastructure and increasing prevalence of target conditions.

Pricing and Market Share Dynamics

Pricing strategies will likely pivot on competitive positioning, with early entrants commanding premium pricing, although generic and biosimilar competition may compress margins. Market share stabilization is anticipated in mature markets; however, growth is expected through regional expansion and new indications.

Investment in R&D and Line Extensions

Industry players will prioritize formulation improvements and combination therapies—such as integrating with antimicrobial agents—to expand usage and enhance value propositions. Investment in clinical trials to demonstrate efficacy in new indications will be crucial to sustain growth.

Impact of Regulatory Changes

Regulatory approvals and policy adjustments influence revenue streams significantly. For example, positive regulatory decisions supporting off-label uses or extended indications could catalyze sales. Conversely, stringent restrictions may curtail growth prospects.

Supply Chain and Manufacturing Costs

Cost efficiencies resulting from optimized manufacturing processes and sourcing can improve profitability. Fluctuations in raw material prices, especially corticosteroid raw compounds, remain a concern impacting margins.

Strategic Opportunities

- Geographic Expansion: Penetration into emerging markets with adjusted pricing models and targeted marketing can bolster revenue.

- Indication Diversification: Exploring new therapeutic indications, including off-label uses supported by clinical data, can unlock additional revenue streams.

- Formulation Innovations: Developing non-steroid or combo formulations that maintain efficacy with fewer side effects can differentiate PROCTOCORT in a crowded market.

- Digital Engagement: Leveraging telemedicine platforms to enhance access and clinician education will be key amid evolving healthcare delivery models.

Key Market Trends and Their Influence

- Personalized Medicine: Tailoring corticosteroid therapy based on genetic, molecular, and phenotypic patient profiles could optimize outcomes and justify premium pricing.

- Patient-Centric Approaches: Emphasizing minimal systemic absorption and reduced side effects aligns with consumer preferences, supporting sustained demand.

- Regulatory Incentives: Accelerated approval pathways and orphan drug statuses in certain markets can expedite revenue inflows.

- Global Health Initiatives: International efforts to manage IBD and dermatological conditions impact drug accessibility and adherence patterns.

Conclusion

PROCTOCORT’s market and financial outlook embodies a blend of stability in developed markets and growth potential in emerging economies. Its sustained relevance hinges on technological innovation, strategic regional expansion, and adaptability to regulatory shifts. While competition and safety concerns pose hurdles, proactive engagement with clinical stakeholders and health authorities can unlock new opportunities.

Key Takeaways

- Epidemiological trends, notably rising IBD and dermatological conditions, underpin sustained demand for PROCTOCORT.

- Market growth is projected at 4-6% CAGR in mature markets and 8-12% in emerging regions, driven by demographic and healthcare infrastructure expansion.

- Competition from generics and biosimilars could pressure prices; differentiation via formulation innovation is essential.

- Regulatory policies and reimbursement schemes significantly influence product accessibility and profitability.

- Investment in new indications, formulations, and regional markets will be pivotal for long-term financial success.

FAQs

1. What are the primary therapeutic indications for PROCTOCORT?

PROCTOCORT is primarily used to treat inflammatory bowel conditions such as proctitis and other anorectal inflammations, along with dermatological conditions including eczema and dermatitis.

2. How does patent expiration affect PROCTOCORT’s market potential?

Patent expirations open opportunities for generic entrants, exerting price competition and reducing market share for the original formulation. Strategic formulation enhancements and new indications help mitigate these impacts.

3. What factors could accelerate PROCTOCORT’s revenue growth?

Expansion into emerging markets, diversification of indications, formulation innovations, and favorable regulatory approvals are key growth drivers.

4. How do safety concerns impact PROCTOCORT’s marketability?

While topical corticosteroids have a favorable safety profile, concerns about skin thinning and systemic absorption can influence prescriber preferences and patient adherence, especially for long-term treatment.

5. What competitive strategies are vital for PROCTOCORT’s sustained market presence?

Differentiation through formulation advancements, clinical trial data supporting novel indications, geographic expansion, and proactive regulatory engagement are critical strategies.

Sources:

[1] Centers for Disease Control and Prevention (CDC). Inflammatory Bowel Disease Data & Statistics. 2022.

[2] European Medicines Agency (EMA). Corticosteroids: Side Effects and Safety Profiles. 2021.