Last updated: July 31, 2025

Introduction

Primaquine, an antimalarial agent discovered in the mid-20th century, remains vital in malaria eradication strategies, particularly for radical cure of Plasmodium vivax and Plasmodium ovale. Its unique role targets dormant liver hypnozoites, preventing relapse. Despite the advent of new therapies, primaquine maintains a niche, prompting a detailed analysis of its market dynamics and financial trajectory.

Market Overview

Global Malaria Burden and Primaquine’s Role

Malaria continues to threaten over 200 million people annually, predominantly in Africa, Southeast Asia, and the Western Pacific [1]. The World Health Organization (WHO) emphasizes primaquine’s indispensable role in eliminating P. vivax malaria due to its efficacy in eradicating hypnozoites. The drug’s inclusion in WHO guidelines cements its relevance, despite availability of newer agents like tafenoquine.

Market Size and Segmentation

The primaquine market primarily serves regions endemic for P. vivax, with an estimated valuation of USD 300-400 million in 2022, driven by government procurement, WHO programs, and humanitarian initiatives [2]. The market is segmented into:

- Generic formulations predominantly produced in India, China, and other low-cost manufacturing hubs.

- Branded or patented formulations supplied by major pharmaceutical firms, often with pediatric and modified-release versions.

Regulatory Landscape

Regulatory approval complexities, especially concerning primaquine’s hemolytic risks in G6PD deficiency patients, influence market growth. Regulatory agencies, including the FDA and EMA, have issued warnings and guidelines, affecting drug labeling and prescribing practices [3].

Market Dynamics Influencing Primaquine

Demand Drivers

- Global Malaria Control Initiatives: The commitment of global health agencies to eradicate P. vivax malaria fuels demand.

- Endemic Region Infrastructure: Expanding healthcare infrastructure in endemic zones increases accessibility.

- Resistance Profile: Primaquine remains effective where resistance to other antimalarials has emerged, reinforcing its importance.

- Policy Endorsements: WHO and national malaria control programs advocate for primaquine use, supporting steady demand.

Challenges and Constraints

- G6PD Deficiency Concerns: Hemolytic anemia risk limits widespread usage, necessitating G6PD testing—a hurdle in resource-limited settings.

- Adverse Event Management: Side effects lead to cautious prescribing, potentially dampening market growth.

- Competition from Tafenoquine: The FDA-approved single-dose tafenoquine (Arakoda®) simplifies treatment but faces regulatory and cost barriers, restricting its immediate market penetration.

Supply Chain and Manufacturing Factors

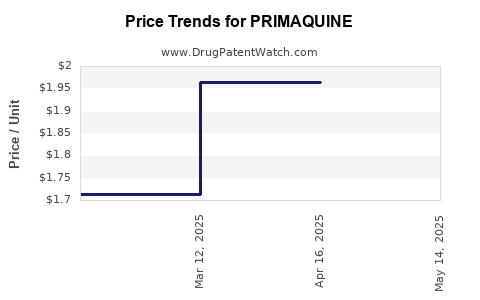

- Generic Production: Dominates the market, with low-cost generics proliferating, exerting downward pressure on prices.

- Supply Chain Disruptions: Manufacturing interruptions, especially in India and China, can impact availability.

- Intellectual Property: Limited patent barriers facilitate market entry for generics, intensifying competition.

Financial Trajectory and Forecast

Historical Trends

From 2015 to 2022, the primaquine market experienced moderate growth, averaging 4-6% annually, propelled by malaria eradication efforts. Price erosion due to generics and competitive pressures have tempered revenue margins for brand-name producers.

Projected Growth (2023–2030)

Analysts anticipate a compound annual growth rate (CAGR) of approximately 3-5%, influenced by:

- Continued endemicity: Sustained malaria burden in Asia-Pacific and parts of Africa.

- Enhanced G6PD Testing: Advances in point-of-care diagnostics could expand safe usage, elevating demand.

- Strategic Procurement: International funding and national programs dedicated to malaria elimination will underpin steady market expansion.

Revenue and Investment Outlook

- Market Revenue: Expected to reach USD 450–500 million by 2030.

- Research & Development: Limited pipeline specifically for primaquine, but interest persists in improved formulations, G6PD testing kits, and combination therapies.

- Manufacturing Investment: Low-margin, high-volume production favors established generic manufacturers over innovator firms.

Emerging Trends and Future Outlook

Innovations and New Formulations

Developments aim to improve patient adherence and safety:

- Pediatric formulations: Liquid or dispersible tablets for children.

- Modified-release agents: To optimize dosing and reduce hemolytic risk.

- Combination therapies: Synergies with other antimalarials to improve efficacy.

Regulatory Evolution

Enhanced diagnostic tools for G6PD deficiency are expected to facilitate widespread primaquine use, potentially expanding the market.

Competitive Landscape

While generic producers dominate, some pharmaceutical companies invest in novel formulations or combination approaches to differentiate offerings, potentially impacting market share dynamics.

Risks and Opportunities

| Risks |

Opportunities |

| Hemolytic risk limiting usage in G6PD deficiency |

Development of safer formulations and diagnostics |

| Regulatory delays or restrictions |

Strengthening global health policies supporting eradication efforts |

| Competition from newer agents (tafenoquine) |

Integration into combination therapies for improved compliance |

Key Takeaways

- Primaquine remains a cornerstone in P. vivax malaria eradication, with a stable, though modest, growth trajectory.

- The market’s growth is supported by global malaria control initiatives; however, regulatory and safety concerns pose ongoing challenges.

- Generic manufacturing predominates, exerting price competition pressure, but innovations in formulation and diagnostics may unlock incremental growth.

- The financial outlook indicates gradual expansion toward USD 500 million by 2030, contingent upon increased adoption in endemic regions integrated with improved G6PD testing.

- Stakeholders should monitor regulatory developments, advancements in diagnostic tools, and the competitive landscape to capitalize on emerging opportunities.

FAQs

1. What factors influence the global demand for primaquine?

Demand depends on malaria prevalence, national eradication policies, availability of diagnostic tools (notably G6PD testing), and competition from newer drugs like tafenoquine.

2. How does G6PD deficiency affect primaquine’s market dynamics?

G6PD deficiency increases the risk of hemolytic anemia, restricting widespread use and necessitating diagnostic testing, which can limit market expansion but also spurs innovation in safe formulations and testing kits.

3. Who are the primary manufacturers of primaquine?

India, China, and Southeast Asian countries dominate generic production, with pharmaceutical giants like GSK historically involved in branded formulations. The market is highly competitive with low margins.

4. What is the impact of emerging therapies on primaquine’s market?

New agents like tafenoquine offer process simplification (single-dose regimens), potentially reducing demand for traditional primaquine, but high costs and G6PD testing requirements temper their immediate market penetration.

5. What are future growth prospects for primaquine in malaria eradication?

Continued efforts, improved safety, and diagnostic advancements could sustain and slightly expand its role, with projections reaching USD 450–500 million by 2030.

References

[1] WHO. (2022). World Malaria Report 2022.

[2] Market Research Future. (2022). Antimalarial Drugs Market Insights.

[3] FDA. (2020). Guidance for Industry: G6PD Deficiency and Primaquine.