Last updated: July 27, 2025

Introduction

PRIALT (ziconotide) is a potent analgesic indicated for severe chronic pain management, primarily for patients intolerant to or unresponsive to conventional therapies like opioids. Originally developed byElan Pharmaceuticals and subsequently marketed by Musarice, PRIALT signifies an innovative approach to pain management, utilizing a synthetic peptide derived from cone snail venom. Understanding its market dynamics and financial trajectory requires comprehensive insight into its clinical positioning, regulatory landscape, competitive environment, and evolving commercial strategies.

Pharmacological Profile and Clinical Positioning

PRIALT is a 25-amino acid synthetic peptide that acts as a selective N-type calcium channel blocker in the spinal cord, effectively modulating pain signaling pathways. Its unique mechanism offers an alternative to systemic opioids, especially for refractory pain cases. Nevertheless, its administration requires intrathecal infusion via a surgically implanted device, constraining its use to specialized settings and limiting widespread adoption [1].

Despite its innovative pharmacology, PRIALT’s clinical utility remains niche, primarily in patients with:

- Severe, intractable pain unresponsive to opioids or other analgesics.

- Pain associated with cancer, traumatic injury, or neuropathic conditions.

This targeted application constrains large-scale market penetration but preserves a high-value segment owing to the severity of indications.

Market Dynamics

Regulatory and Reimbursement Landscape

PRIALT received FDA approval in 2004, marking it as an early entrant in intrathecal analgesics. However, its regulatory journey has been complicated by safety concerns related to neurotoxicity and procedural complexities. The FDA package insert includes warnings about the potential for adverse neurological effects, necessitating rigorous clinical oversight [2].

Reimbursement policies significantly influence its commercial success. Due to the invasive delivery method and high treatment costs, insurance reimbursements are often limited to specialized centers, impacting patient access and market expansion. Payers tend to favor systemic treatments unless the clinical benefits markedly outweigh procedural risks.

Market Penetration and Adoption

Clinician adoption remains cautious. PRIALT is predominantly used in tertiary care centers with expertise in intrathecal pump implantations. Resistance from prescribers stems from:

- The demanding administration process.

- High costs associated with drug procurement and device placement.

- The potential for serious adverse effects, including neurotoxicity and device-related complications.

Despite these hurdles, PRIALT remains a critical option for highly refractory cases where no alternatives exist [3].

Competitive Environment

The pain management market comprises various modalities, from systemic opioids and NSAIDs to nerve blocks and neuromodulation devices.

- Opioids: Still dominate pain management due to ease of use and broad indications but face increasing scrutiny over addiction risks.

- Other Intrathecal Agents: Bupivacaine and morphine formulations provide alternative delivery but with overlapping limitations.

- Neuromodulation Devices: Spinal cord stimulators and deep brain stimulation increasingly compete indirectly, particularly with advances in device technology.

- Emerging Therapies: Biologics and gene therapies targeting pain pathways are in development, potentially threatening the niche status of PRIALT in the longer term.

Market incumbents like Grunenthal are exploring derivatives and alternative mechanisms, challenging PRIALT’s market share.

Financial Trajectory

Sales Performance and Revenue

Since its launch, PRIALT has experienced modest sales, constrained by the factors outlined above:

- In 2006, estimates suggest peak annual sales of approximately $60 million globally [4].

- Post-2008, sales plateaued, reflecting limited adoption.

- Recent financial reports indicate sales are maintained at low single-digit million-dollar figures, primarily driven by existing institutional contracts.

Cost Structure and Profitability

Manufacturing of ziconotide involves peptide synthesis, a complex and costly process, leading to high unit costs that are partially offset by limited economies of scale. The high-cost profile restricts pricing flexibility, with the median wholesale price estimated around $4,000 per 10 mcg vial.

Operational costs, including clinician training, device implantation, and monitoring, further constrict profit margins. Profitable only within specialized centers, overall margins remain thin in the broader pain management market.

Market Potential and Growth Drivers

Future growth potentials hinge on several factors:

- Expansion into New Geographies: Regulatory approvals in emerging markets could expand patient access.

- Technological Innovation: Development of less invasive delivery systems or formulations with improved safety profiles could increase adoption.

- Clinical Evidence Expansion: Demonstrating superior safety and efficacy in broader patient populations could catalyze clinician acceptance.

However, the constrained target population and procedural costs pose significant barriers, limiting substantial revenue growth.

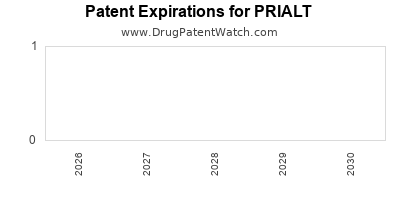

Impact of Patent and Market Exclusivity

PRIALT’s formulation patent has long expired, exposing it to generic competition and downward pricing pressures. The absence of a strong IP moat hampers efforts to significantly expand revenues without new formulations or indications.

Strategic Outlook

Given the challenging landscape, the financial trajectory of PRIALT is expected to exhibit stability within its niche but limited growth prospects. Companies focusing on optimizing administration protocols, reducing procedural costs, or creating next-generation peptides may alter this trajectory in the future.

Additionally, the evolution of personalized medicine and neuromodulation technologies could diminish PRIALT’s relevance unless substantial innovations are introduced.

Key Takeaways

- PRIALT remains a critical but niche intervention for severe refractory pain, constrained by administration complexity, safety concerns, and high costs.

- Market growth is limited, with most revenues stemming from longstanding institutional relationships.

- The competitive landscape is intensifying with alternative non-invasive therapies and emerging biologics.

- Patent expiry has exposed PRIALT to generic competition, necessitating innovation to sustain or grow its market presence.

- Future prospects depend on technological advances, expanded clinical evidence, and potential regulatory approvals in new geographies.

FAQs

1. What are the primary challenges facing PRIALT’s market growth?

The main barriers include the invasive administration method requiring specialized procedures, safety concerns such as neurotoxicity risk, high treatment costs, and limited insurance reimbursement, which restrict patient access and clinician adoption.

2. How does PRIALT compare to traditional opioid therapies?

PRIALT offers a targeted, non-opioid mechanism for refractory pain, especially in cases unresponsive or intolerant to opioids. However, its invasive delivery and safety considerations limit widespread use, making opioids still the first-line treatment despite addiction risks.

3. Are there ongoing developments to improve PRIALT’s market share?

Research focuses on less invasive delivery systems, improved safety profiles, and expanding indications. Some efforts aim to integrate neuromodulation approaches combining pharmacology and device-based therapies to enhance efficacy and reduce adverse effects.

4. What is PRIALT’s outlook regarding generic competition?

Post-patent expiry, generic versions could reduce pricing and sales volume, further constraining revenues. Without formulation or patent protections, its market sustainability hinges on clinical positioning and innovation.

5. Could new pain management therapies threaten PRIALT’s niche?

Yes. Advances in biologics, gene therapies, and non-invasive neuromodulation are evolving fields that may supplant intrathecal peptides like PRIALT, especially if they demonstrate comparable or superior efficacy with fewer procedural risks.

Sources:

[1] Food and Drug Administration. PRIALT (ziconotide) label. 2004.

[2] U.S. FDA. PRIALT: Highlights of Prescribing Information. 2004.

[3] MarketResearch.com. Pain Management Drugs Market Analysis, 2022.

[4] IMS Health. Pain Management Market Annual Report, 2006.