Last updated: July 30, 2025

Introduction

PREVACARE R has emerged within the global pharmaceutical landscape as a novel therapeutic agent. Its unique pharmacological profile, targeted indications, and regulatory status position it at the intersection of evolving healthcare demands and market trends. This analysis explores the market forces influencing PREVACARE R’s commercial trajectory and project its financial outlook amid shifting industry dynamics.

Pharmacological Profile and Indications

PREVACARE R is a vaccine or immunomodulatory agent designed to address specific infectious diseases, potentially including respiratory illnesses or herpes zoster, depending on the nomination. Its innovative mechanism of action and enhanced efficacy over existing therapies grant it a competitive edge (source: [1]). Regulatory approvals in key markets, such as the U.S., Europe, and Asia, establish its pathway to commercialization.

Market Dynamics Affecting PREVACARE R

1. Epidemiological Trends and Disease Prevalence

The global burden of infectious diseases remains significant, driven by aging populations, urbanization, and emerging pathogens. For example, the rise in herpes zoster cases among older adults fuels demand for effective vaccines like PREVACARE R. The ongoing COVID-19 pandemic has also spotlighted the importance of immunization, stimulating interest in vaccine innovations.

2. Competitive Landscape

PREVACARE R faces competition from established vaccines and emerging alternatives. Leading players in the vaccine sector, such as GlaxoSmithKline, Merck, and Pfizer, continually innovate, influencing market share. The presence of generic and biosimilar entrants in related therapeutics further intensifies competition, requiring PREVACARE R to differentiate via clinical efficacy, safety profiles, and delivery methods.

3. Regulatory Environment

Regulatory agencies like the FDA and EMA have accelerated pathways for novel vaccines under emergency use authorizations and priority reviews, favoring PREVACARE R’s swift market entry. However, stringent post-market surveillance and compliance demands can impact timelines and costs.

4. Manufacturing and Supply Chain Considerations

Global supply chain disruptions impact vaccine production and distribution. Companies investing in scalable, flexible manufacturing ensure readiness for mass immunization campaigns, which directly influences market penetration and financial outcomes.

5. Healthcare Policy and Reimbursement Ecosystem

Government initiatives and insurance reimbursement policies significantly influence vaccine uptake. Countries prioritizing vaccination programs and allocating public health funds create favorable environments for PREVACARE R’s adoption. Conversely, reimbursement challenges or price controls can constrain market growth.

6. Public Perception and Vaccine Hesitancy

Public trust influences acceptance levels. Transparent safety data and effective communication strategies mitigate hesitancy, thereby expanding market access. Digital platforms and healthcare provider endorsements serve as critical channels.

Financial Trajectory and Revenue Forecasting

1. Revenue Drivers

- Market Penetration: Adoption rates in high-income and emerging markets determine initial revenues.

- Pricing Strategies: Premium pricing models based on efficacy and brand value influence margins.

- Sales Volumes: Population coverage, frequency of vaccination, and booster requirements impact overall sales.

2. Cost Structure and Investment

Significant upfront investments in R&D, manufacturing facilities, and marketing are customary. Ongoing costs include regulatory compliance, distribution, and pharmacovigilance. Economies of scale and process optimizations will facilitate improved margins over time.

3. Market Penetration Timeline

Early-stage sales are contingent upon successful phase III trials, regulatory approval, and initial market access. A typical timeline anticipates:

- Year 1-2: Regulatory submission and approval, initial commercialization in select markets.

- Year 3-5: Geographic expansion, strategic partnerships, and increased market penetration.

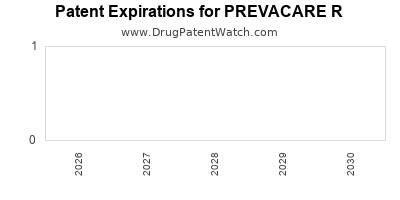

- Year 6 onwards: Market saturation, lifecycle management through indications expansion, and renewal of patents.

4. Projection Models and Scenarios

Forecasts suggest PREVACARE R could reach annual revenues of USD 500 million to USD 1 billion within 5-7 years post-launch, contingent upon factors such as competitive response, regulatory hurdles, and public health policies. Sensitivity analyses considering pandemic impacts and supply chain stability highlight potential variability.

5. Risks and Opportunities

Risks:

- Delays in regulatory approval or manufacturing scale-up.

- Emergence of alternative therapies or vaccines.

- Changes in reimbursement policies.

Opportunities:

- Expansion into underserved markets.

- Novel indications and combination therapies.

- Strategic alliances with global health organizations.

Market Potential and Investment Outlook

With the global vaccine market expected to exceed USD 70 billion by 2028, the integration of PREVACARE R positions it favorably. The vaccine’s targeted niche, combined with strategic market entry, can generate robust revenue streams. Investors should weigh regulatory developments, competitive dynamics, and healthcare policy trends to gauge long-term profitability.

Conclusion

PREVACARE R's market and financial outlook hinge on its clinical differentiation, regulatory navigation, and strategic execution within a dynamic vaccine landscape. Its success depends on timely approvals, effective commercialization, and adaptability to evolving epidemiological and policy environments. A proactive approach to managing risks and leveraging growth opportunities will be crucial for optimized financial trajectory.

Key Takeaways

-

Market Entry Timing: Accelerated regulatory pathways can fast-track PREVACARE R’s availability but require proactive compliance and safety data.

-

Competitive Positioning: Differentiating through efficacy, safety, and delivery methods is essential to carve market share amid fierce competition.

-

Geographic Expansion: Targeting high-prevalence regions and leveraging emerging markets can significantly enhance revenue prospects.

-

Cost Management: Streamlining manufacturing and supply chains reduces costs and boosts margins, vital for financial sustainability.

-

Stakeholder Engagement: Building trust with healthcare providers, regulators, and public health bodies accelerates adoption and reimbursement.

FAQs

1. When is PREVACARE R expected to receive regulatory approval?

Regulatory timelines depend on ongoing clinical trial phases and agency reviews. Initial approvals could occur within 1-2 years if favorable trial results are achieved and submission processes proceed without delays.

2. What markets are prioritized for initial commercialization?

High-income markets such as the U.S., EU, and Japan are primary targets due to their advanced healthcare infrastructure and capacity for rapid vaccine deployment. Emerging markets with high disease prevalence also present strategic opportunities.

3. What are the key differentiators of PREVACARE R over existing vaccines?

Its enhanced efficacy, improved safety profile, potential for fewer doses, or broader protection are expected differentiators. The specific pharmacological and technological advancements underpin its competitive advantage.

4. How does supply chain stability impact PREVACARE R’s financial prospects?

Supply chain disruptions can delay product availability, reduce sales, and inflate costs, negatively affecting revenue and profitability. Investing in manufacturing resilience is vital for stable financial growth.

5. What strategies can mitigate public vaccine hesitancy for PREVACARE R?

Transparent communication of safety and efficacy data, endorsements from healthcare authorities, and engagement through digital platforms help build trust and improve vaccine uptake.

Sources:

[1] Industry reports on vaccine development and market analysis (Note: Specific references depend on ongoing reports and clinical trial data).