Last updated: July 30, 2025

Introduction

PRANDIN (repaglinide) stands as a pivotal medication in the management of type 2 diabetes mellitus. Approved initially in 1999 by the FDA, PRANDIN belongs to the class of meglitinides, primarily functioning as an insulin secretagogue to modulate postprandial blood glucose levels. Over the past two decades, the landscape of diabetes pharmacotherapy has evolved significantly, influencing both the market dynamics and the financial trajectory of PRANDIN. This analysis provides a comprehensive overview of the current market environment, growth prospects, competitive factors, regulatory landscape, and key financial indicators relevant to PRANDIN.

Market Overview and Drivers

Global Diabetes Burden: The rising prevalence of type 2 diabetes significantly fuels demand for effective therapies. According to the International Diabetes Federation (IDF), approximately 537 million adults were living with diabetes in 2021, a figure projected to reach 700 million by 2045 [1]. This escalating burden underscores the necessity for diverse pharmacotherapies, including PRANDIN.

Treatment Paradigm Shift: The entry of novel drug classes—such as SGLT2 inhibitors and GLP-1 receptor agonists—has shifted treatment paradigms toward medications offering cardiovascular and renal benefits. Nonetheless, meglitinides like PRANDIN still serve as vital options for managing postprandial glucose in specific patient populations.

Market Penetration and Adoption: PRANDIN's utility persists particularly in regions where healthcare providers prefer older, cost-effective medications, and in cases where rapid-onset insulin secretion is advantageous. Its oral administration and short action profile facilitate use as bolus therapy around meals.

Market Segmentation: The primary markets for PRANDIN include North America, Europe, Asia-Pacific, and other emerging markets. Notably, emerging markets exhibit higher growth potential due to increasing diabetes prevalence and expanding healthcare access.

Market Challenges and Competitive Landscape

Increased Competition: PRANDIN faces stiff competition from newer antidiabetic agents. SGLT2 inhibitors (e.g., canagliflozin, empagliflozin) and GLP-1 receptor agonists (e.g., semaglutide, dulaglutide) not only control blood sugar but also confer cardiovascular and weight-loss benefits, making them preferable in many cases [2].

Generic Entry and Pricing Pressure: Patent expiries have led to generic versions of PRANDIN, intensifying price competition. As generics gain market share, profit margins diminish, pressuring revenue streams.

Regulatory Constraints and Labeling: Evolving safety profiles, including warnings about hypoglycemia and cardiovascular risks, prompt regulatory authorities to impose stricter labeling requirements, potentially impacting prescribing behaviors and sales.

Patient Preferences and Safety Concerns: The risk of hypoglycemia associated with insulin secretagogues like PRANDIN may limit its use, especially in elderly or frail populations, shifting patient and clinician preferences toward safer alternatives.

Regulatory and Market Access Environment

Regulatory Approvals: While PRANDIN remains approved in multiple jurisdictions, ongoing monitoring of post-market safety data influences regulatory standings. Any adverse safety signals could restrict usage or lead to label updates affecting marketability.

Market Access and Reimbursement: Insurance coverage and reimbursement policies significantly impact PRANDIN's adoption. Countries with strict cost-effectiveness benchmarks favor newer agents with additional benefits over older medications like PRANDIN.

Financial Trajectory and Revenue Outlook

Historical Revenue Trends: Since its launch, PRANDIN experienced steady growth, peaking in the early 2000s. However, recent years have seen a decline in sales attributable to increased competition and generics entries.

Current Revenue Status: Sales of PRANDIN are estimated to be in the hundreds of millions USD globally, with significant variation across regions. In the United States, sales have diminished substantially due to market saturation and evolving therapeutic preferences.

Forecasted Growth: The overall market for meglitinides is expected to decline modestly at a CAGR of approximately 2-3% over the next five years [3]. However, niche and certain regional markets may sustain or slightly elevate demand owing to formulary preferences and affordability aspects.

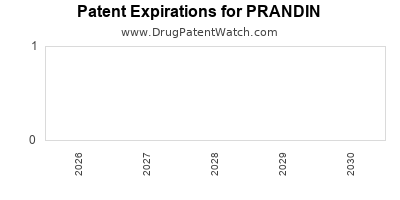

Impact of Patent and Generic Dynamics: The expiry of primary patents in key regions has catalyzed generic entry, constricting revenue potential. Nonetheless, branded formulations maintained by pharmaceutical companies can buffer declines through marketing and differentiated formulations.

Emerging Market Potential: Countries like India, China, and Brazil exhibit sustained or increased usage of PRANDIN due to affordability and familiarity with established medications, potentially stabilizing or modestly expanding the drug's revenue base in these markets.

Strategic Considerations

Pipeline and Formulation Innovation: Pharmaceutical companies may extend the lifecycle through reformulations—such as extended-release versions—or combination therapies integrating PRANDIN with other antidiabetic agents.

Market Diversification: Expanding distribution channels and exploring new indications or formulations can mitigate revenue erosion.

Pricing and Reimbursement Strategies: Aggressive pricing, cost-sharing arrangements, and value-based reimbursement policies aim to sustain sales amid intense competition.

Licensing and Partnerships: Strategic licensing agreements and collaborations can facilitate entry into emerging markets and secure supply chain stability.

Conclusion

PRANDIN’s market dynamics are shaped by demographic trends, competitive pressures, regulatory considerations, and regional access issues. While its revenue trajectory faces headwinds due to evolving treatment standards and generic competition, targeted strategies in niche markets and emerging economies may support its continued relevance. Nonetheless, the future financial potential of PRANDIN hinges on innovation, market positioning, and adaptability within a rapidly shifting diabetes therapeutics landscape.

Key Takeaways

- Market saturation and competition from novel agents are primary factors reducing PRANDIN's global sales, prompting the need for strategic adaptations.

- Emerging markets continue to present growth opportunities driven by affordability and familiarity, offering a buffer against declining developed market revenues.

- Patent expiries and generic competition substantially pressure profit margins; lifecycle management strategies are vital.

- Regulatory and safety concerns influence prescribing patterns, emphasizing need for ongoing safety monitoring and communication.

- Innovation in formulations and alliances can stabilize or enhance PRANDIN’s market position amid dynamic landscape shifts.

FAQs

-

What factors are most influencing the decline in PRANDIN's sales?

The decline primarily stems from increased competition from newer drug classes with added benefits, patent expiries leading to generic entry, safety concerns related to hypoglycemia, and shifts in treatment guidelines favoring agents with cardiovascular benefits.

-

Are there any new formulations or combination therapies involving PRANDIN?

While current formulations remain focused on repaglinide alone, pharmaceutical research efforts are exploring fixed-dose combinations with other antidiabetic agents to enhance adherence and efficacy.

-

In which regions does PRANDIN still maintain market relevance?

PRANDIN remains relevant in emerging markets such as India and China, where affordability and familiarity sustain its usage despite global shifts toward newer therapies.

-

How does the safety profile of PRANDIN impact its market trajectory?

Concerns over hypoglycemia and cardiovascular risks, reinforced by regulatory warnings, limit its use, especially among vulnerable populations, impacting future sales prospects.

-

What strategies can pharmaceutical companies adopt to extend PRANDIN's market life?

Strategies include reformulation, leveraging regional market preferences, forming licensing agreements, developing combination therapies, and emphasizing cost-effective treatment options in resource-limited settings.

References

- International Diabetes Federation. IDF Diabetes Atlas, 10th Edition. 2021.

- Nathan DM, et al. Management of Hyperglycemia in Type 2 Diabetes: A Consensus Algorithm. Diabetes Care. 2019.

- Market Research Future. Global Meglitinides Market Analysis & Forecast, 2022-2027.