Last updated: July 28, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: PLAN B

Introduction

PLAN B, an emergency contraceptive pill, has established itself as a cornerstone product within reproductive health. Its market performance and financial prospects are influenced by a confluence of regulatory, demographic, and socio-economic factors. As both a consumer health item and a catalyst for ongoing contraceptive innovation, understanding its market dynamics and projected financial pathway is essential for stakeholders. This report offers an in-depth analysis of the current landscape, future growth drivers, and potential risks associated with PLAN B.

Regulatory Environment and Market Access

The regulatory landscape fundamentally shapes PLAN B’s commercial viability. Agencies like the FDA in the U.S. and EMA in Europe have progressively eased restrictions, broadening consumer access. Notably, in 2013, the FDA approved over-the-counter (OTC) sales of PLAN B for consumers aged 15 and older, a shift that markedly expanded its potential market. However, regulatory nuances persist, such as age restrictions in certain jurisdictions or labeling requirements that influence product availability and consumer perception.

Recent policy trends favor increased accessibility, driven by advocacy groups and public health priorities to combat unintended pregnancies. Conversely, regulatory hurdles in emerging markets or regions with conservative reproductive health policies constrain expansion, demanding tailored strategic approaches for multinational companies.

Market Demographics and Consumer Behavior

Demand for PLAN B is strongly correlated with demographic factors, including age, socio-economic status, and education levels. The core consumer base comprises sexually active adolescents and young adults, generally aged 15-30. Rising awareness, improved sexual health education, and changing social attitudes have contributed to increased utilization.

Global shifts in reproductive rights and gender equality bolster demand, especially in areas where contraception remains stigmatized or restricted. The proliferation of digital health platforms and telemedicine further facilitates access, particularly among younger, more tech-savvy populations.

Consumer behavior also reflects an increased expectation for convenience and discreetness, spurring innovation in packaging and distribution. Health providers and pharmacies now regularly stock PLAN B alongside other OTC medications, facilitating timely access during critical moments.

Competitive Landscape

While PLAN B holds a dominant position in the emergency contraceptive segment, competition persists from both brands and alternative drug delivery mechanisms. In North America and Europe, brands such as Ella (ulipristal acetate) prevail, offering different efficacy profiles and duration of action. In emerging markets, generic formulations and locally produced equivalents challenge the brand’s market share, often at a lower price point.

Innovations such as reduced dosing regimens, extended window of use, and combination contraceptives could impact market share dynamics. Moreover, digital and telehealth offerings are transforming how consumers access emergency contraception, potentially disrupting traditional retail channels.

Market Drivers and Growth Opportunities

Key factors propelling PLAN B’s market growth include:

- Growing awareness and destigmatization: Enhanced public dialogue around reproductive rights expands the consumer base.

- Policy liberalization: Regulatory easing enhances access, particularly in underpenetrated markets.

- Technological innovation: Development of more discreet, user-friendly packaging and delivery systems attracts consumers seeking convenience.

- Digital health integration: Telemedicine consultations reduce barriers, enabling rapid access during urgent needs.

Emerging markets such as Asia-Pacific and Latin America present significant expansion opportunities due to increasing urbanization, rising disposable incomes, and evolving reproductive health policies. Corporations that tailor strategies to local cultures and partnering with healthcare providers will be positioned for sustained growth.

Financial Trajectory and Market Projections

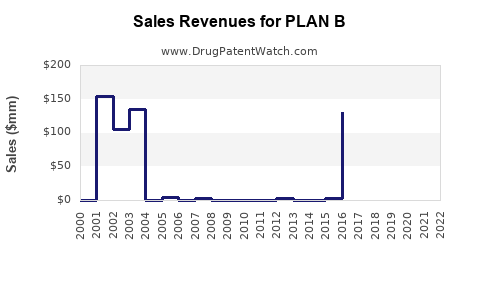

The global emergency contraceptives market, with PLAN B as a key product, is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% over the next five years[1]. This growth is driven by increased demand in emerging markets, continued awareness campaigns, and regulatory improvements.

In 2022, the market value was estimated at USD 1.2 billion, with North America accounting for nearly 50% share due to high regulatory acceptance and demand. Europe follows, with fast-growing markets in Asia-Pacific and Latin America. By 2028, industry analysts forecast a valuation surpassing USD 2 billion, assuming steady regulatory progress and consumer acceptance.

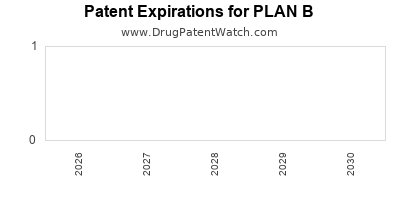

Profit margins for PLAN B formulations remain robust, supported by patent expirations on branded versions, which encourages generic competition that fuels volume growth but potentially compresses margins. Innovation in formulations and strategic collaborations are expected to be key levers to sustain profitability.

Risks and Challenges

Several risks could impede market prospects:

- Regulatory shifts: Reversal of access liberalization policies or increased restrictions could curb sales.

- Cultural resistance: Societal attitudes toward contraception vary, affecting market penetration.

- Price competition: Generics and regional manufacturers may lead to aggressive pricing strategies, pressuring profit margins.

- Alternatives and innovations: Advances such as long-acting reversible contraceptives (LARCs) or dual-use medications could supplant emergency pills in some markets.

Conclusion

The future of PLAN B rests on a dynamic interplay of regulatory initiatives, demographic trends, technological advancements, and competitive strategies. While the product continues to enjoy a strong growth outlook, especially in expanding markets, stakeholders must navigate a complex environment of policy, social attitudes, and innovation to capitalize on its full potential.

Key Takeaways

- Regulatory liberalization remains a pivotal driver for PLAN B's market expansion, especially in emerging economies.

- Demographic shifts favor increased use among young adults, supported by digital health platforms that enhance accessibility.

- Competition from generics and alternative contraceptive methods warrants ongoing innovation and strategic positioning.

- The market is projected to grow at a CAGR of approximately 6-8%, reaching USD 2 billion by 2028.

- Risks include regulatory reversals, cultural resistance, and disruptive innovations, emphasizing the need for agility in strategy.

FAQs

Q1. How do regulatory changes impact PLAN B’s market growth?

Regulatory policies directly influence consumer access. Liberalization and OTC approvals expand the market, while restrictions or age limits narrow it, making regulatory environment a critical factor for growth strategies.

Q2. What demographic segments are the primary consumers of PLAN B?

Young adults aged 15-30, adolescents, and women in reproductive age groups constitute the primary consumer segments, with growth driven by increased awareness and social acceptance.

Q3. How is digital health transforming access to emergency contraception?

Telemedicine and online pharmacies facilitate discreet, immediate access, reducing barriers posed by geographic, social, or logistical factors, thereby expanding consumer reach.

Q4. What competitive pressures does generic competition pose to PLAN B?

Generics offer lower prices, intensifying price competition, which can compress margins but also increase overall market volume, benefiting companies adopting volume-driven models.

Q5. What are the emerging opportunities for growth in the PLAN B market?

Opportunities include expanding into underserved markets, leveraging technological innovations for user convenience, and strategic partnerships with healthcare providers and payers to improve access.

Sources:

[1] Global Emergency Contraceptive Market Analysis, 2023-2028.

[2] Regulatory Updates on OTC Contraceptives, FDA Website.

[3] Consumer Behavior Trends in Reproductive Health, World Health Organization.