PHEXXI Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Phexxi, and when can generic versions of Phexxi launch?

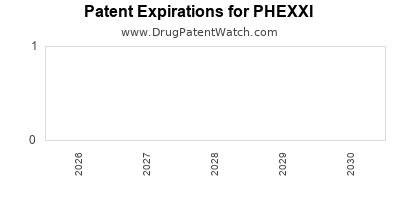

Phexxi is a drug marketed by Evofem Inc and is included in one NDA. There are four patents protecting this drug and one Paragraph IV challenge.

This drug has forty-six patent family members in eighteen countries.

The generic ingredient in PHEXXI is citric acid; lactic acid; potassium bitartrate. There are five drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the citric acid; lactic acid; potassium bitartrate profile page.

DrugPatentWatch® Generic Entry Outlook for Phexxi

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be March 15, 2033. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for PHEXXI?

- What are the global sales for PHEXXI?

- What is Average Wholesale Price for PHEXXI?

Summary for PHEXXI

| International Patents: | 46 |

| US Patents: | 4 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Clinical Trials: | 3 |

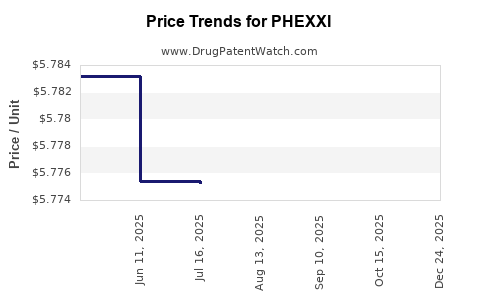

| Drug Prices: | Drug price information for PHEXXI |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for PHEXXI |

| What excipients (inactive ingredients) are in PHEXXI? | PHEXXI excipients list |

| DailyMed Link: | PHEXXI at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for PHEXXI

Generic Entry Date for PHEXXI*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

GEL;VAGINAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for PHEXXI

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Queen's Medical Center | Early Phase 1 |

| University of Hawaii Foundation | Early Phase 1 |

| Parexel | Phase 3 |

Pharmacology for PHEXXI

| Drug Class | Anti-coagulant Calculi Dissolution Agent |

| Mechanism of Action | Acidifying Activity Calcium Chelating Activity |

| Physiological Effect | Decreased Coagulation Factor Activity |

Paragraph IV (Patent) Challenges for PHEXXI

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| PHEXXI | Vaginal Gel | citric acid; lactic acid; potassium bitartrate | 1.8%/1%/0.4% | 208352 | 1 | 2023-02-28 |

US Patents and Regulatory Information for PHEXXI

PHEXXI is protected by four US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of PHEXXI is ⤷ Get Started Free.

This potential generic entry date is based on patent 11,337,989.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Evofem Inc | PHEXXI | citric acid; lactic acid; potassium bitartrate | GEL;VAGINAL | 208352-001 | May 22, 2020 | RX | Yes | Yes | 11,337,989 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Evofem Inc | PHEXXI | citric acid; lactic acid; potassium bitartrate | GEL;VAGINAL | 208352-001 | May 22, 2020 | RX | Yes | Yes | 11,439,610 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Evofem Inc | PHEXXI | citric acid; lactic acid; potassium bitartrate | GEL;VAGINAL | 208352-001 | May 22, 2020 | RX | Yes | Yes | 11,992,472 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Evofem Inc | PHEXXI | citric acid; lactic acid; potassium bitartrate | GEL;VAGINAL | 208352-001 | May 22, 2020 | RX | Yes | Yes | 10,568,855 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for PHEXXI

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Evofem Inc | PHEXXI | citric acid; lactic acid; potassium bitartrate | GEL;VAGINAL | 208352-001 | May 22, 2020 | 6,706,276 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for PHEXXI

When does loss-of-exclusivity occur for PHEXXI?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 14368971

Estimated Expiration: ⤷ Get Started Free

Patent: 20202835

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2016014506

Estimated Expiration: ⤷ Get Started Free

China

Patent: 6029078

Estimated Expiration: ⤷ Get Started Free

Patent: 4452298

Patent: 使用基于藻酸的抗微生物化合物抑制炎症和疾病的组合物和方法 (Compositions and methods for inhibiting inflammation and diseases using alginic acid-based antimicrobial compounds)

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 82826

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 82826

Patent: COMPOSITIONS ET MÉTHODES POUR L'INHIBITION D'UNE INFLAMMATION ET DE MALADIES À L'AIDE D'UN COMPOSÉ ANTIMICROBIEN À BASE D'ACIDE ALGINIQUE (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND)

Estimated Expiration: ⤷ Get Started Free

Patent: 35966

Patent: COMPOSITIONS ET MÉTHODES POUR L'INHIBITION D'UNE INFLAMMATION ET DE MALADIES À L'AIDE D'UN COMPOSÉ ANTIMICROBIEN À BASE D'ACIDE ALGINIQUE (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6146

Patent: תכשירים מווסתי חומציות למניעת הריון, באמצעות תרכובת אנטי מיקרוביאלית מבוססת חומצה אלגינית (Acid buffering contraceptive compositions using an alginic acid-based antimicrobial compound)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 17501227

Patent: アルギン酸をベースとする抗菌性化合物を使用して炎症と疾患を阻害するための組成物及び方法

Estimated Expiration: ⤷ Get Started Free

Patent: 20125298

Patent: アルギン酸をベースとする抗菌性化合物を使用して炎症と疾患を阻害するための組成物及び方法 (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES BY USING ALGINIC ACID-BASED ANTIMICROBIAL COMPOUNDS)

Estimated Expiration: ⤷ Get Started Free

Patent: 22070924

Patent: アルギン酸をベースとする抗菌性化合物を使用して炎症と疾患を阻害するための組成物及び方法

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 16008023

Patent: COMPOSICIONES Y METODOS PARA INHIBIR LA INFLAMACION Y LAS ENFERMEDADES UTILIZANDO UN COMPUESTO ANTIMICROBIANO CON BASE EN ACIDO ALGINICO. (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND.)

Estimated Expiration: ⤷ Get Started Free

Patent: 21001742

Patent: COMPOSICIONES Y METODOS PARA INHIBIR LA INFLAMACION Y LAS ENFERMEDADES UTILIZANDO UN COMPUESTO ANTIMICROBIANO CON BASE EN ACIDO ALGINICO. (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 2215

Patent: Compositions and methods for inhibiting inflammation and diseases using an alginic acid-based antimicrobial compound

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 91950

Patent: КОМПОЗИЦИИ И СПОСОБЫ ИНГИБИРОВАНИЯ ВОСПАЛЕНИЯ И ЗАБОЛЕВАНИЙ С ПРИМЕНЕНИЕМ АНТИМИКРОБНОГО СОЕДИНЕНИЯ НА ОСНОВЕ АЛЬГИНОВОЙ КИСЛОТЫ (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND)

Estimated Expiration: ⤷ Get Started Free

Patent: 16129069

Patent: КОМПОЗИЦИИ И СПОСОБЫ ИНГИБИРОВАНИЯ ВОСПАЛЕНИЯ И ЗАБОЛЕВАНИЙ С ПРИМЕНЕНИЕМ АНТИМИКРОБНОГО СОЕДИНЕНИЯ НА ОСНОВЕ АЛЬГИНОВОЙ КИСЛОТЫ

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1604862

Patent: COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2407408

Estimated Expiration: ⤷ Get Started Free

Patent: 160103036

Patent: 알긴산계 항균성 화합물을 사용하는 염증 및 질병을 억제하기 위한 조성물 및 방법 (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 90703

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering PHEXXI around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| World Intellectual Property Organization (WIPO) | 2013187984 | ⤷ Get Started Free | |

| Ukraine | 115876 | КОМПОЗИЦІЯ І СПОСІБ ПІДВИЩЕННЯ ЕФЕКТИВНОСТІ БАКТЕРИЦИДНИХ ЗАСОБІВ КОНТРАЦЕПЦІЇ (COMPOSITIONS AND METHODS FOR ENHANCING THE EFFICACY OF CONTRACEPTIVE MICROBICIDES) | ⤷ Get Started Free |

| Mexico | 2021001742 | COMPOSICIONES Y METODOS PARA INHIBIR LA INFLAMACION Y LAS ENFERMEDADES UTILIZANDO UN COMPUESTO ANTIMICROBIANO CON BASE EN ACIDO ALGINICO. (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND.) | ⤷ Get Started Free |

| Mexico | 2016008023 | COMPOSICIONES Y METODOS PARA INHIBIR LA INFLAMACION Y LAS ENFERMEDADES UTILIZANDO UN COMPUESTO ANTIMICROBIANO CON BASE EN ACIDO ALGINICO. (COMPOSITIONS AND METHODS FOR INHIBITING INFLAMMATION AND DISEASES USING AN ALGINIC ACID-BASED ANTIMICROBIAL COMPOUND.) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for PHEXXI: A Comprehensive Analysis

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.