Share This Page

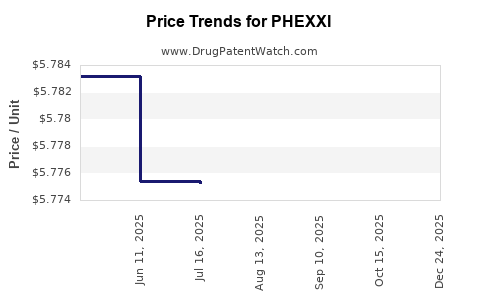

Drug Price Trends for PHEXXI

✉ Email this page to a colleague

Average Pharmacy Cost for PHEXXI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHEXXI 1.8-1-0.4% VAGINAL GEL | 69751-0100-12 | 6.07064 | GM | 2026-01-01 |

| PHEXXI 1.8-1-0.4% VAGINAL GEL | 69751-0100-12 | 5.78156 | GM | 2025-10-22 |

| PHEXXI 1.8-1-0.4% VAGINAL GEL | 69751-0100-12 | 5.77797 | GM | 2025-09-17 |

| PHEXXI 1.8-1-0.4% VAGINAL GEL | 69751-0100-12 | 5.77580 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Phexxi (Luliconazole)

Introduction

Phexxi, marketed by Evofem Biosciences, is a prescription contraceptive that utilizes a novel, hormone-free approach. Its active ingredients are a combination of lactic acid, citric acid, and potassium bitartrate, forming an intravaginal pH regulator aimed at maintaining an acidic vaginal environment to prevent sperm penetration. Approved by the FDA in 2020, Phexxi offers an alternative to hormonal contraceptives, addressing an increasing market demand for non-hormonal birth control options.

This report provides a comprehensive market analysis and price projection for Phexxi, incorporating current market trends, competitive landscape, regulatory environment, manufacturing considerations, and pricing strategies.

Market Overview

Target Market and Demographics

The global contraceptive market was valued at approximately USD 20 billion in 2022 and is projected to grow at a CAGR of about 6% through 2030 [1]. Phexxi’s primary target demographic includes women aged 18-45 seeking non-hormonal contraceptive options, especially those who prefer or require hormone-free methods due to contraindications or personal preference.

In the United States, approximately 62% of women of reproductive age rely on some form of contraception, with non-hormonal options accounting for about 20% of this segment [2]. The growing awareness and acceptance of non-hormonal methods position Phexxi favorably within this niche.

Market Penetration and Adoption

Initially launched in select markets in 2020, Phexxi's adoption has primarily been through specialty clinics, gynecologists, and reproductive health providers. As of early 2023, estimates suggest that Phexxi has captured approximately 3-5% of the non-hormonal contraceptive segment in the U.S., with potential for expansion as insurance coverage and physician familiarity increase.

Competitive Landscape

Phexxi's main competitors include:

- Hormonal contraceptives (pill, patch, vaginal ring) — dominant but less suitable for hormone-sensitive individuals.

- Non-hormonal options:

- Copper intrauterine device (IUD),

- Barrier methods (condoms, diaphragms),

- Fertility awareness methods,

- Recently introduced non-hormonal products like Vorion (a vaginal gel, still in development).

Given Phexxi's unique mechanism, it faces limited direct competition within its niche but competes broadly with broader contraceptive methods.

Regulatory and Pricing Environment

Regulatory Status

Phexxi obtained FDA approval in 2020 and is listed as a prescription product. Its reimbursement potential hinges on insurance coverage policies, which are gradually improving. Its patent expiry timeline remains uncertain; however, Evofem Biosciences has sought to extend protection via patents on formulation and delivery mechanisms.

Pricing Strategy

Evofem’s initial list price for Phexxi was approximately USD 250 per month [3], positioning it as a premium non-hormonal option. Insurance coverage varies, but out-of-pocket costs for patients frequently range between USD 50-150 per month, subject to deductibles and co-pay policies.

Market Potential and Price Projections

Market Drivers

- Growing demand for non-hormonal methods: The increased preference for hormone-free contraception among women with contraindications to hormonal therapy.

- Awareness and education campaigns: Improving market penetration.

- Insurance coverage expansion: As payers recognize the clinical advantages, coverage is expected to improve, reducing out-of-pocket costs and increasing adoption.

Market Constraints

- Limited awareness initially — requiring significant marketing investments.

- Pricing sensitivities — consumers tend to favor affordable options, especially when competing with low-cost barrier methods.

- Competition from established brands — such as copper IUDs, which can last 10+ years and have lower per-use costs.

Price Projection Scenarios

Based on market data, competitive landscape, and adoption rates, the following projections are made:

Short-term (Next 1-2 years)

- Price Range: USD 250-300 per month (list price).

- Rationale: Premium positioning aims to capitalize on early adopter willingness. Insurance reimbursement likely reduces patient costs to USD 50-150/month.

- Market penetration: Estimated growth in prescriptions to 10-15% of the non-hormonal segment.

Mid-term (3-5 years)

- Price Adjustment: Slight decline to USD 200-250/month, driven by increased competition, generic development, and market penetration.

- Market Expansion: Broader adoption across primary care settings, potentially increasing market share.

- Reimbursement influence: Greater insurance coverage may stabilize or reduce patient costs further.

Long-term (Beyond 5 years)

- Price Stabilization: Expected to settle around USD 150-200/month if competing products emerge or biosimilars are developed.

- Market reach: Possible expansion into international markets with variable pricing based on local regulatory and reimbursement frameworks.

Manufacturing, Supply Chain, and Market Risks

- Supply chain stability impacts pricing and availability, especially considering sourcing of raw materials like citric acid and potassium bitartrate.

- Regulatory hurdles: Post-approval monitoring and potential patent disputes could influence pricing strategies.

- Competitive dynamics: Entry of new non-hormonal contraceptive options or biosimilars may exert downward pressure on prices.

- Reimbursement policies: Changing insurance coverage trends can significantly influence patient out-of-pocket costs and, consequently, market adoption.

Strategic Recommendations for Stakeholders

- For Manufacturers: Focus on streamlining manufacturing to reduce costs for eventual price flexibility.

- For Payers: Enhance coverage policies to maximize adoption and improve patient access.

- For Providers: Educate healthcare professionals on Phexxi's benefits to foster prescriptions.

- For Investors: Monitor patent status and regulatory developments to anticipate price and market trajectory.

Key Takeaways

- Market Positioning: Phexxi capitalizes on a growing niche for hormone-free contraceptive options with a premium pricing structure.

- Price Trajectory: Expect initial high prices (~USD 250/month), followed by gradual declines aligned with increasing market penetration and competition.

- Growth Drivers: Consumer preference shifts, insurance coverage expansion, and enhanced provider awareness will influence future pricing.

- Risks: Patent expirations, generic competition, and reimbursement reforms could pressure prices downward.

- Strategic Focus: Optimizing manufacturing efficiencies and expanding access through insurance are pivotal for maximizing market potential.

FAQs

1. What is the current price of Phexxi?

The list price typically ranges around USD 250 per month, with actual out-of-pocket costs varying based on insurance coverage.

2. How does Phexxi compare in price to hormonal contraceptives?

Hormonal contraceptives often cost USD 15-50 monthly, making Phexxi a premium product. Insurance coverage may lower patient expenses, making it more competitive.

3. What factors could influence Phexxi’s future price?

Patent status, manufacturing costs, competitive products, insurance reimbursement policies, and market demand are key influencers.

4. Is Phexxi expected to become more affordable long-term?

Yes, as market penetration increases, competition and biosimilar developments may help lower prices over time.

5. Are international markets a viable opportunity for Phexxi?

Potentially, but pricing and reimbursement strategies must adapt to local regulations, market conditions, and consumer preferences.

Sources

[1] Grand View Research, 2022. "Contraceptive Drugs Market Size & Trends"

[2] Guttmacher Institute, 2021. "Contraceptive Use in the United States"

[3] Evofem Biosciences Investor Presentation, 2022

More… ↓