Last updated: July 27, 2025

rket Dynamics and Financial Trajectory for Penicillin V Potassium

Introduction

Penicillin V potassium, also known as phenoxymethylpenicillin, remains a cornerstone antibiotic in the treatment of various bacterial infections. Despite the advent of newer antibiotics, penicillin V maintains a significant role due to its proven efficacy, safety profile, and cost-effectiveness. This report examines the current market landscape, growth drivers, challenges, and financial outlook of penicillin V potassium within the global pharmaceutical sector.

Market Overview and Historical Context

Penicillin V potassium was first introduced in the 1950s as an oral penicillin formulation, offering a practical alternative to injectable penicillin. Over decades, it became a first-line treatment for infections caused by streptococci, pneumococci, and other susceptible bacteria. The antibiotic’s widespread adoption 구축abab—driven by clinical guidelines and antimicrobial stewardship—solidified its position in both developed and emerging markets.

However, the landscape has evolved with increasing antimicrobial resistance (AMR), pressing the pharmaceutical industry to adapt. Despite this, penicillin V’s low manufacturing costs and extensive clinical history preserve its relevance, especially in resource-constrained settings where alternatives may be cost-prohibitive.

Market Dynamics

1. Drivers of Market Stable Growth

- Clinical Efficacy and Safety Profile: The extensive clinical data supporting penicillin V’s efficacy reinforce confidence among prescribers. Its safety profile, characterized by minimal adverse effects, sustains its utilization across age groups.

- Cost-Effectiveness: The low production costs and availability as a generic medication contribute to its affordability, making it accessible in low-to-middle-income economies.

- Guideline Recommendations: Many national treatment guidelines favor penicillin V for streptococcal throat infections and other bacterial conditions, maintaining steady demand.

- Antimicrobial Stewardship and Resistance Trends: While resistance is a concern, penicillin V continues to show effectiveness against susceptible strains, particularly in countries with stewardship programs limiting broad-spectrum antibiotic overuse.

2. Challenges and Market Constraints

- Antimicrobial Resistance (AMR): Increasing resistance, notably among pneumococci and other critical pathogens, restricts the drug’s spectrum, prompting healthcare providers to pivot to broader-spectrum alternatives.

- Emerging Resistance and Limited New Formulations: Resistance development discourages extended use, potentially leading to declining market shares over time, especially in regions with high antibiotic resistance rates.

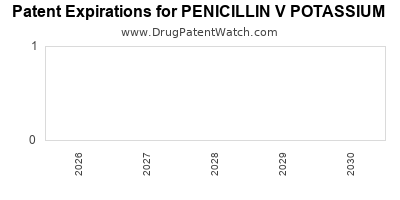

- Regulatory Hurdles and Patent Limitations: As a long-established generic, penicillin V faces limited innovation avenues; however, patent protections are expired, creating a competitive, saturated market landscape.

- Supply Chain Dynamics: Price pressures and manufacturing consolidation influence procurement and availability, notably in developing countries dependent on international suppliers.

Financial Trajectory and Market Forecasts

1. Current Market Size and Revenue Trends

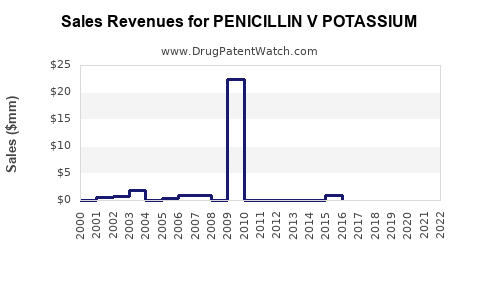

The global penicillin V market is estimated to be valued at approximately USD 200 million as of 2022, with moderate growth projections over the next five years. Key markets include North America, Europe, Asia-Pacific, and Africa, with emerging economies exhibiting increased consumption driven by infectious disease burdens and antibiotic access enhancements.

2. Growth Outlook and Segmental Dynamics

- Geographic Diversification: In developed nations, the demand remains steady, primarily due to clinical guidelines. However, in low- and middle-income countries, the market is expected to grow at a compound annual growth rate (CAGR) of 3-5%, reflecting improved healthcare infrastructure and antibiotic provisioning.

- Product Launches and Formulation Innovations: Limited innovation in formulations keeps growth steady but subdued. The emphasis is on maintaining existing formulations and supply chains.

- Market Penetration of Generics: The influx of generics has fueled price competition, constraining profit margins but ensuring broad access. The sustainability of revenue growth hinges on regional healthcare policies and resistance patterns.

3. Future Growth Drivers

- Public Health Initiatives: Programs aimed at combating infectious diseases and promoting antibiotics stewardship in developing regions are likely to sustain demand.

- Resistance Management Strategies: Surveillance and susceptibility testing may sustain region-specific use of penicillin V, preventing obsolescence.

- Strategic Partnerships and Supply Chain Optimization: Collaborations with local manufacturers and supply chain enhancements could stabilize margins and ensure uninterrupted availability.

4. Risk Factors and Market Challenges

- Emerging Resistance: Resistance genes such as pbp mutations hinder efficacy, necessitating shifts to alternative treatments.

- Regulatory Limitations: Stringent approval processes and evolving clinical standards may impede rapid product adaptation or new formulations.

- Competition: Broader-spectrum antibiotics (e.g., amoxicillin-clavulanate, cephalosporins) threaten market share, especially for complicated infections.

Conclusion: Financial Outlook and Strategic Implications

The outlook for penicillin V potassium remains cautiously optimistic, shaped by its enduring clinical utility, affordability, and strategic importance in antimicrobial stewardship. While growth rates may be modest, steady demand, especially from low- and middle-income countries, sustains a resilient revenue base. The key to maximizing financial trajectory involves focusing on regional market nuances, resistance management, and ensuring supply chain robustness.

Key Takeaways

- Steady Demand: Penicillin V remains vital for uncomplicated bacterial infections, especially in resource-limited settings.

- Resistance Challenges: Increasing resistance limits broad use but sustains demand in susceptible populations.

- Market Saturation: A mature, generic-driven market limits pricing power but ensures wide accessibility.

- Growth Opportunities: Expanding healthcare infrastructure and antimicrobial stewardship programs in emerging markets underpin future growth.

- Strategic Focus: Maintaining supply chain integrity, surveillance on resistance, and regional market adaptation are essential for financial stability.

FAQs

Q1: How does antimicrobial resistance impact the future market for penicillin V potassium?

A1: Resistance diminishes the drug’s efficacy against certain pathogens, reducing its use in resistant infections and constraining overall market growth. Continuous surveillance and susceptibility testing are essential to sustain its application for susceptible strains.

Q2: Are there developments in formulations or formulations improvements for penicillin V?

A2: Currently, innovations are limited. Most formulations remain as traditional oral tablets or suspensions, with efforts focused on maintaining stability and bioavailability. Novel delivery systems are not prominent in the short term.

Q3: Which regions offer the most growth potential for penicillin V potassium?

A3: Emerging economies in Asia, Africa, and Latin America present the highest growth potential due to increasing healthcare access, infectious disease burdens, and expanding antibiotic markets.

Q4: How do generic manufacturing trends influence penicillin V market revenues?

A4: Generics drive price competition and widen access but typically suppress profit margins. Their proliferation stabilizes demand but limits revenue growth in mature markets.

Q5: What are the primary strategic considerations for pharmaceutical companies in this market?

A5: Focus areas include ensuring supply chain resilience, monitoring resistance patterns, engaging in stewardship initiatives, and tailoring regional market strategies to optimize growth opportunities while managing regulatory and competitive pressures.

References:

[1] World Health Organization. Antimicrobial resistance factsheet. 2022.

[2] IQVIA Institute. The Global Use of Medicines 2022.

[3] MarketWatch. Penicillin Market Size, Share & Trends Analysis Report, 2023.