Last updated: July 29, 2025

Introduction

Penciclovir, a nucleoside analogue antiviral agent, has maintained a niche yet significant position within the pharmaceutical landscape, primarily targeting viral infections such as herpes labialis. As global demand for effective antiviral therapies escalates, understanding the evolving market dynamics and financial trajectory surrounding penciclovir offers vital insights for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Pharmacological Overview

Developed in the 1980s, penciclovir functions by inhibiting viral DNA polymerase, impeding viral replication. It shares structural similarities with acyclovir but is distinguished by its higher intracellular active triphosphate concentration, which enhances its antiviral efficacy. Topical formulations, notably Denavir (approved in 1991), remain its primary marketed form, treating herpes simplex labialis. Despite its proven clinical effectiveness, penciclovir's market penetration is limited by factors such as competition, formulation challenges, and regulatory nuances.

Market Landscape and Competitive Environment

1. Market Size and Segmentation

The global antiviral market, consistently growing at a compound annual growth rate (CAGR) of approximately 3-5%, exceeds USD 40 billion as of 2023 [1]. Penciclovir’s core application—herpes labialis—captures a noteworthy segment within topical antiviral drugs, which constitute an estimated USD 2-4 billion. The localized nature of herpes labialis treatments constrains the overall market scale but allows for high margins.

2. Competitive Agents and Alternatives

-

Acyclovir: Dominates with extensive patent maturity and generic availability, offering cost-effective options for herpes labialis.

-

Valacyclovir and Famciclovir: Oral agents with broader systemic applications, overshadowing penciclovir in terms of convenience and systemic efficacy.

-

Docosanol (Abreva): An over-the-counter topical agent competing directly with penciclovir formulations, offering ease of access and comparable efficacy.

-

Emerging Therapies: Advances in DNA-encoded immune therapies and topical formulations with enhanced bioavailability threaten the current position of penciclovir.

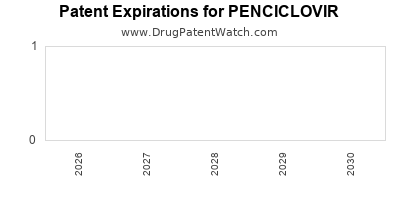

3. Regulatory and Patent Environment

Penciclovir’s patent protections for initial formulations have expired or are approaching expiry in several jurisdictions, leading to increased generic competition. This erodes pricing power and profit margins but may stimulate market volume expansion through lower-priced generics.

Market Dynamics Influencing Penciclovir

Innovation and Formulation Development

The pharmaceutical industry’s focus shifts towards improving drug delivery systems and improving patient compliance. Novel topical formulations such as liposomal encapsulations or combined antivirals could redefine penciclovir’s market relevance.

Regulatory Trends

Stringent regulatory pathways for new formulations and biosimilar entries influence market entry strategies. Approval delays or denials can hinder revenue projections but may also open opportunities for formulation enhancements.

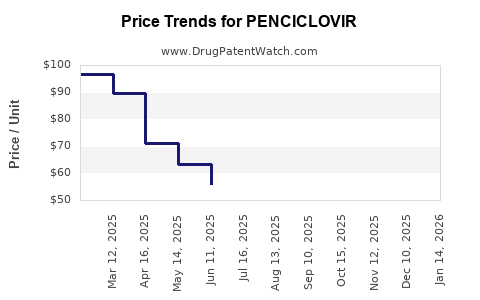

Pricing and Reimbursement Policies

Healthcare payers’ evolving reimbursement frameworks increasingly favor cost-effective generics over brand-name drugs, impacting penciclovir’s sales potential. However, high treatment efficacy and patient adherence could maintain its value proposition.

Market Penetration and Geographic Trends

Developed markets (North America and Europe) present mature but saturated markets, limiting growth. Emerging markets (Asia-Pacific, Latin America) exhibit rising herpes prevalence and increasing prescription rates, offering expansion opportunities, especially for generic versions.

Patent Strategies and Lifecycle Management

Companies adopting patent extensions through formulation improvements or combination therapies can prolong penciclovir’s market exclusivity, positively influencing revenue trajectories.

Financial Trajectory and Investment Outlook

Current Revenue Streams

Topical penciclovir formulations, primarily Denavir, generated estimated sales of USD 100-200 million annually before generic erosion. The decline has been gradual, with some markets witnessing sharp reductions post-patent expiry.

Future Revenue Projections

-

Short-term (1-3 years): Revenues are expected to decline marginally due to generic competition but stabilize via strategic formulation innovations and geographic expansion.

-

Mid-term (4-7 years): Introduction of improved formulations or combination treatments may rejuvenate sales. Significant growth hinges on regulatory approvals and successful marketing.

-

Long-term (8+ years): Market saturation and demographic shifts may result in plateauing or declining revenues unless new indications or delivery methods are discovered.

Investment Considerations

Investors should monitor:

-

Patent sunset timelines and patent extensions.

-

Pipeline developments for novel formulations or indications.

-

Competitive landscapes, especially entry of biosimilars or emerging antiviral agents.

-

Regulatory approval statuses in high-growth geographies.

-

Potential for partnership or licensing agreements to expand market reach.

Emerging Trends and Growth Drivers

1. Increasing Prevalence of Herpes Infections

Global herpes simplex virus (HSV) prevalence continues to grow, especially in immunocompromised populations. The World Health Organization estimates over 3.7 billion people aged 0-49 harbor HSV-1 [2], augmenting demand for effective topical therapies like penciclovir.

2. Focus on Patient-Centric Formulations

Development of fast-acting, less irritating topical formulations enhances patient adherence, fostering sustained demand.

3. Digital and Telehealth Expansion

Telemedicine facilitates easier prescription of topical antivirals, potentially increasing access and utilization of penciclovir.

4. Strategic Collaborations

Partnerships between pharmaceutical firms and biotech companies for novel delivery systems could augment penciclovir’s utility, thereby impacting its financial trajectory positively.

Challenges and Risks

-

Pricing Pressure: Increased generic competition leads to reduced profit margins.

-

Market Saturation: Limited scope for growth in mature markets.

-

Regulatory Barriers: Stringent approval processes for new formulations or combination therapies.

-

Emergence of Resistance: Viral mutations may compromise drug efficacy, necessitating reformulation or combination strategies.

Conclusion

Penciclovir’s market exists within a mature but evolving antiviral landscape characterized by intense competition and rapid innovation. Its financial trajectory depends on strategic formulation enhancements, geographic expansion, and adaptation to regulatory and market pressures. While short-term revenue declines are probable due to patent expirations, long-term growth potential remains if stakeholders innovate around its core technology, exploit unmet medical needs, and penetrate emerging markets.

Key Takeaways

-

The penciclovir market is constrained by generic competition but benefits from a dedicated patient base and effective antiviral properties.

-

Market growth hinges on innovative formulations and geographic expansion into emerging regions with rising herpes prevalence.

-

Patent expiries challenge revenue stability; however, lifecycle management strategies can sustain profitability.

-

Advances in delivery systems and combination therapies offer promising avenues for revitalizing penciclovir’s market potential.

-

Stakeholders must balance cost pressures with clinical efficacy and patient preferences to optimize economic outcomes.

FAQs

-

What is the primary clinical application of penciclovir?

Penciclovir is mainly used topically to treat herpes labialis (cold sores) caused by herpes simplex virus type 1 (HSV-1).

-

How does penciclovir compare to acyclovir?

Penciclovir exhibits higher intracellular levels of active metabolite, potentially offering superior antiviral activity, especially in topical formulations, though acyclovir remains more widely used due to longer market presence and lower cost.

-

What facing challenges does penciclovir currently encounter?

Major challenges include patent expirations leading to generic competition, limited systemic application, and competition from over-the-counter agents like docosanol.

-

Are there ongoing developments to enhance penciclovir’s market viability?

Yes, research focuses on improved topical delivery systems, combination therapies, and expanding indications to include other herpes-related infections.

-

What is the outlook for penciclovir’s future in the global market?

While facing short-term revenue declines, prospects for mid- to long-term growth depend on innovation, geographic expansion, and effective lifecycle management strategies.

Sources:

[1] MarketsandMarkets. "Antiviral Drugs Market by Route of Administration, Type, Application, and Region – Global Forecast to 2028."

[2] World Health Organization. "Herpes simplex virus prevalence data."