PARSABIV Drug Patent Profile

✉ Email this page to a colleague

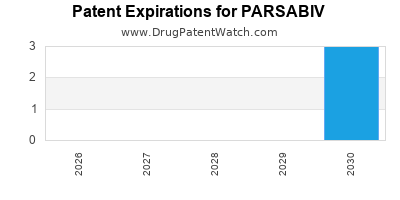

When do Parsabiv patents expire, and when can generic versions of Parsabiv launch?

Parsabiv is a drug marketed by Kai Pharms Inc and is included in one NDA. There are eight patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and five patent family members in forty-four countries.

The generic ingredient in PARSABIV is etelcalcetide. One supplier is listed for this compound. Additional details are available on the etelcalcetide profile page.

DrugPatentWatch® Generic Entry Outlook for Parsabiv

Parsabiv was eligible for patent challenges on February 7, 2021.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be June 27, 2034. This may change due to patent challenges or generic licensing.

There have been six patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for PARSABIV?

- What are the global sales for PARSABIV?

- What is Average Wholesale Price for PARSABIV?

Summary for PARSABIV

| International Patents: | 105 |

| US Patents: | 8 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 24 |

| Clinical Trials: | 4 |

| Drug Prices: | Drug price information for PARSABIV |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for PARSABIV |

| What excipients (inactive ingredients) are in PARSABIV? | PARSABIV excipients list |

| DailyMed Link: | PARSABIV at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for PARSABIV

Generic Entry Date for PARSABIV*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SOLUTION;INTRAVENOUS |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for PARSABIV

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Prim. Priv. Doz. Dr. Daniel Cejka | Phase 2 |

| Amgen | Phase 2 |

| Amgen | Phase 3 |

Pharmacology for PARSABIV

| Drug Class | Calcium-sensing Receptor Agonist |

| Mechanism of Action | Increased Calcium-sensing Receptor Sensitivity |

Paragraph IV (Patent) Challenges for PARSABIV

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| PARSABIV | Injection | etelcalcetide | 2.5 mg/0.5 mL 5 mg/mL 10 mg/2 mL | 208325 | 2 | 2021-02-08 |

US Patents and Regulatory Information for PARSABIV

PARSABIV is protected by eight US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of PARSABIV is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Kai Pharms Inc | PARSABIV | etelcalcetide | SOLUTION;INTRAVENOUS | 208325-001 | Feb 7, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Kai Pharms Inc | PARSABIV | etelcalcetide | SOLUTION;INTRAVENOUS | 208325-003 | Feb 7, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Kai Pharms Inc | PARSABIV | etelcalcetide | SOLUTION;INTRAVENOUS | 208325-003 | Feb 7, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Kai Pharms Inc | PARSABIV | etelcalcetide | SOLUTION;INTRAVENOUS | 208325-001 | Feb 7, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Kai Pharms Inc | PARSABIV | etelcalcetide | SOLUTION;INTRAVENOUS | 208325-001 | Feb 7, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for PARSABIV

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Amgen Europe B.V. | Parsabiv | etelcalcetide | EMEA/H/C/003995Parsabiv is indicated for the treatment of secondary hyperparathyroidism (SHPT) in adult patients with chronic kidney disease (CKD) on haemodialysis therapy. | Authorised | no | no | no | 2016-11-11 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for PARSABIV

When does loss-of-exclusivity occur for PARSABIV?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 6773

Patent: FORMULACIÓN LÍQUIDA ESTABLE

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 14302122

Patent: Stable liquid formulation of AMG 416 (Velcalcetide)

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2015032615

Patent: formulação líquida estável de amg 416 (velcalcetida)

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 16222

Patent: FORMULATION LIQUIDE STABLE D'AMG 416 (VELCALCETIDE) (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 15003738

Patent: Formulación líquida estable de amg-416 (velcalcetida)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 5764487

Patent: AMG 416(VELCALCETIDE)的稳定的液体制剂 (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Patent: 4376970

Patent: Etelcalcetide (AMG 416)的稳定的液体制剂 (Stable liquid formulations of Etelcalcetide (AMG 416))

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 160002

Patent: FORMULACIÓN ESTABLE LÍQUIDA DE ETELCALCETIDE (AMG 461)

Estimated Expiration: ⤷ Get Started Free

Patent: 160061

Patent: FORMULACIÓN ESTABLE LÍQUIDA DE ETELCALCETIDE (AMG 461)

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0171092

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 20811

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 13318

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 0220

Patent: УСТОЙЧИВАЯ ЖИДКАЯ КОМПОЗИЦИЯ, СОДЕРЖАЩАЯ AMG-416 (ЭТЕЛКАЛЦЕТИД) (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Patent: 1690099

Patent: УСТОЙЧИВАЯ ЖИДКАЯ КОМПОЗИЦИЯ, СОДЕРЖАЩАЯ AMG-416 (ВЕЛКАЛЬЦЕТИД)

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 13318

Patent: FORMULATION LIQUIDE STABLE D'AMG 416 (VELCALCÉTIDE) (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Patent: 46017

Patent: FORMULATION LIQUIDE STABLE D'AMG 416 HCL (ETELCALCETIDE) (STABLE LIQUID FORMULATION OF AMG 416 HCL (ETELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Patent: 78433

Patent: FORMULATION LIQUIDE STABLE D'AGONISTES PEPTIDIQUES DE SENSIBILISATEUR DE RECEPTEUR DE CALCIUM (STABLE LIQUID FORMULATION OF CALCIUM SENSING RECEPTOR PEPTIDE AGONISTS)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 22557

Patent: 的穩定的液體製劑 (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE) AMG 416(VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 34209

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 3210

Patent: פורמולציה רוקחית יציבה של amg416(וולקלצטיד) (Stable liquid formulation of amg 416(velcalcetide))

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 27708

Estimated Expiration: ⤷ Get Started Free

Patent: 16523916

Patent: 安定な液体製剤

Estimated Expiration: ⤷ Get Started Free

Jordan

Patent: 17

Patent: تركيبة سائلة مستقرة ل " AMG 416 " (فيلكالسيتيد) (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 13318

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 0276

Patent: STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 15017952

Patent: FORMULACION LIQUIDA ESTABLE DE AMG 416 (VELCALCETIDA). (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE).)

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 818

Patent: STAB ILNA TEČNA FORMULACIJA AMG 416 (VELKALCETIDA) (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 724

Patent: Formulation liquide stable d'amg 416 (velcalcétide)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5403

Patent: Stable liquid formulation of amg 416 (velcalcetide)

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 160549

Patent: FORMULACION LIQUIDA ESTABLE DE ETELCALCETIDA (AMG 416)

Estimated Expiration: ⤷ Get Started Free

Patent: 210413

Patent: FORMULACION LIQUIDA ESTABLE QUE COMPRENDE ETELCALCETIDA (AMG416), UN AGENTE TAMPONANTE Y AGENTE DE TONICIDAD

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 015502816

Patent: STABLE LIQUID FORMULATION OF ETELCALCETIDE (AMG 416)

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 13318

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 13318

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 01700401

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 238

Patent: STABILNA TEČNA FORMULACIJA AMG 416 (VELKALCETIDA) (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201510647T

Patent: STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 13318

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1600238

Patent: STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE)

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2231957

Estimated Expiration: ⤷ Get Started Free

Patent: 160043954

Patent: 에텔칼세타이드(AMG 416)의 안정한 액체 제형 (STABLE LIQUID FORMULATION OF AMG 416(VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 33989

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 35874

Estimated Expiration: ⤷ Get Started Free

Patent: 1542239

Patent: Stable liquid formulation

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 15000569

Patent: STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE)

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 5373

Patent: СТАБІЛЬНИЙ РІДКИЙ СКЛАД AMG 416 (ВЕЛКАЛСЕТИДУ) (STABLE LIQUID FORMULATION OF AMG 416 (VELCALCETIDE))

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 636

Patent: FORMULACIÓN LÍQUIDA ESTABLE

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering PARSABIV around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 2016523916 | ⤷ Get Started Free | |

| Taiwan | 201116290 | Therapeutic agents for reducing parathyroid hormone levels | ⤷ Get Started Free |

| Peru | 20160549 | FORMULACION LIQUIDA ESTABLE DE ETELCALCETIDA (AMG 416) | ⤷ Get Started Free |

| European Patent Office | 3539555 | ⤷ Get Started Free | |

| Taiwan | 201542239 | Stable liquid formulation | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for PARSABIV

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2459208 | SPC/GB17/018 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: ETELCALCETIDE, OR A SALT THEROF, INCLUDING ETELCALCETIDE HYDROCHLORIDE; REGISTERED: UK EU/1/16/1142/001-012 20161115; UK PLGB 13832/0039 20161115; UK PLGB 13832/0040 20161115; UK PLGB 13832/0041 20161115 |

| 2459208 | 122017000021 | Germany | ⤷ Get Started Free | PRODUCT NAME: ETELCALCETID ODER EIN SALZ DAVON; REGISTRATION NO/DATE: EU/1/16/1142 20161111 |

| 2459208 | CA 2017 00006 | Denmark | ⤷ Get Started Free | PRODUCT NAME: ETELCALCETID ELLER ET SALT DERAF, INKLUSIV ETELCALCETIDHYDROCHLORID; REG. NO/DATE: EU/1/16/1142/001-012 20161115 |

| 2459208 | CR 2017 00006 | Denmark | ⤷ Get Started Free | PRODUCT NAME: ETELCALCETID ELLER ET SALT DERAF, INKLUSIV ETELCALCETIDHYDROCHLORID; REG. NO/DATE: EU/1/16/1142/001-012 20161115 |

| 2459208 | LUC00008 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: ETELCALCETIDE, OU UN SEL EQUIVALENT, Y COMPRIS LE CHLORHYDRATE D'ETELCALCETIDE (PARSABIV); AUTHORISATION NUMBER AND DATE: EU/1/16/1142 20161115 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for PARSABIV

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.