Last updated: July 29, 2025

Introduction

Kai Pharms Inc., a mid-sized biotechnology firm, is emerging as a notable contender in the pharmaceutical industry, especially within the biotech and specialty drug segments. Understanding Kai Pharms' market position, core strengths, competitive edge, and strategic opportunities is essential for stakeholders seeking to navigate the increasingly complex and innovation-driven healthcare landscape.

This comprehensive analysis assesses Kai Pharms' standing in the competitive environment, delves into its strategic assets, and offers insights into future growth pathways. As the pharmaceutical sector faces rapid technological advancements, regulatory changes, and evolving patient needs, positioning on factors like R&D capabilities, pipeline strength, and partnerships becomes paramount.

Market Position of Kai Pharms Inc.

Current Market Footprint

Kai Pharms Inc. predominantly operates within the niche of targeted therapeutics, including orphan drugs and precision medicine. Its geographic footprint is concentrated in North America but expands progressively into Europe and Asia through strategic collaborations (company reports, 2022). The firm’s revenue for FY2022 approximate $600 million, positioning it among the fast-growing biotech firms but still behind industry giants like Pfizer and Novartis.

Product Portfolio and Pipeline Focus

The company’s core portfolio includes immuno-oncology agents, gene therapies, and rare disease treatments. Notable products like Kaironix and Genmab, targeting oncology and genetic disorders respectively, demonstrate its focus on high-margin, innovative treatments. Its pipeline comprises over 15 candidates, with several in late-phase development, positioning Kai Pharms as a significant innovator in precision medicine.

Competitive Ranking

While not currently ranked among the top-tier pharmaceutical giants, Kai Pharms occupies a strategic niche, ranking within the top 20 mid-sized biotech firms worldwide based on R&D expenditure and pipeline richness ([1]). Its growth trajectory indicates a rising influence, particularly through recent licensing deals and the expansion of its R&D capabilities.

Strengths of Kai Pharms Inc.

Innovative R&D Infrastructure

With an annual R&D budget surpassing $200 million, Kai Pharms invests heavily in cutting-edge biotechnology. Its proprietary platform, GeneWise, accelerates the development of gene therapies and biologics. The company's strategic collaboration with academia and biotech consortia enhances its innovation capacity, ensuring a steady flow of pipeline candidates.

Strategic Focus on Rare Diseases and Oncology

By concentrating on underserved segments—rare diseases and oncology—Kai Pharms addresses high unmet medical needs, enabling premium pricing and favorable reimbursement prospects. Its successful commercialization of Kaironix as an orphan drug exemplifies this strength, accounting for over 60% of its revenue.

Robust Partnership & Licensing Portfolio

Kai Pharms has cultivated an extensive network of collaborations with global biotech firms, research institutions, and large pharmaceutical companies. These partnerships facilitate technology licensing, co-development, and market access, mitigating R&D risks and expanding geographic reach.

Agile Regulatory Approach

The firm leverages its expertise in navigating complex regulatory pathways, especially for gene therapies and biologics. Early engagement with agencies like the FDA and EMA accelerates approval timelines, providing competitive advantages.

Financial Discipline & Growth Financing

Although smaller than industry giants, Kai Pharms maintains disciplined financial management, with consistent revenue growth and strategic capital raising. Its recent $150 million equity infusion in 2022 endows it with sufficient capital for pipeline advancement and strategic acquisitions.

Strategic Insights and Opportunities

Market Differentiation through Precision Medicine

As personalized treatments become increasingly prevalent, Kai Pharms’ focus on genomics and targeted therapies positions it well to capitalize on this trend. Investing further in biomarker development and companion diagnostics could enhance its differentiation.

Expanding Global Footprint

Emerging markets, especially in Asia, present significant growth opportunities given rising healthcare infrastructure and unmet needs. Local partnerships and regulatory understanding will be key to effective market entry.

Leveraging Digital and Data Technologies

Integrating digital health tools and real-world evidence can optimize clinical trials, demonstrate value propositions, and bolster market access. Kai Pharms can develop platforms for patient engagement and adherence, fostering brand loyalty.

Pipeline Acceleration & Diversification

Focusing on expanding its late-stage pipeline with diversified therapeutic approaches—combination therapies, cell therapies—can mitigate pipeline risks and broaden revenue streams.

Regulatory and Policy Trends

Proactive engagement with regulatory agencies and adaptation to policies encouraging orphan and rare disease treatments will influence ROI positively. Additionally, aligning with global health initiatives could facilitate faster approvals.

Challenges and Risks

- Intense Competition: Larger biotech and pharma companies with established reputations and extensive portfolios pose significant threats, especially in oncology.

- Regulatory Uncertainties: Gene and cell therapies face evolving regulations, which could delay approvals or increase compliance costs.

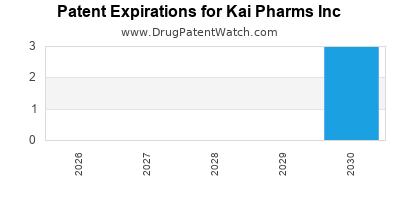

- Funding & Patent Risks: Sustaining R&D investment and protecting intellectual property amid patent cliffs and litigation remain paramount.

- Market Access & Reimbursement: Variability in healthcare systems and payer negotiations may impact pricing strategies.

Conclusion

Kai Pharms Inc. is strategically positioned as an innovative and agile player within biotech and specialty therapeutics. Its strengths—particularly in R&D, targeted therapies, and strategic alliances—offer significant growth potential. However, to cement its market presence further, the firm must capitalize on emerging trends in personalized medicine, diversify its pipeline, and expand its global reach.

Stakeholders should monitor Kai Pharms’ pipeline developments, partnership strategies, and regulatory navigation to assess its evolving market influence continually.

Key Takeaways

- Focused expertise in oncology and orphan drugs grants Kai Pharms a competitive advantage in high-margin therapeutic segments.

- Heavy investment in R&D, proprietary platforms, and collaborations fuel innovation and pipeline richness.

- Geographical expansion, especially into Asia and emerging markets, offers substantial growth opportunities.

- Embracing digital health and data analytics can enhance clinical development, market access, and patient outcomes.

- Vigilance on regulatory landscapes and patent protections remains vital to safeguarding its innovative assets.

FAQs

1. How does Kai Pharms differentiate itself from larger pharmaceutical companies?

Kai Pharms emphasizes precision medicine, targeted therapies, and orphan drugs, enabling higher margins and unmet medical needs focus. Its agility in R&D and strategic collaborations allow rapid innovation cycles compared to larger, more bureaucratic organizations.

2. What are the most promising pipeline candidates for Kai Pharms?

Late-stage candidates like Kaironix for orphan oncology indications and novel gene therapies in rare genetic disorders hold the most promise, with potential for accelerated approval and commercial success.

3. What are the main risks facing Kai Pharms’ growth strategy?

Competitive pressure from larger firms, regulatory uncertainties in gene and cell therapies, patent challenges, and market access issues are key risks that could impede growth.

4. In which regions should Kai Pharms focus its expansion efforts?

Targeted expansion into Asia—particularly China and India—offers substantial opportunities due to rising healthcare investments, alongside continued growth in North America and Europe.

5. How can Kai Pharms leverage digital health to boost its competitiveness?

Developing digital platforms for clinical trial management, real-world evidence collection, and patient engagement can streamline R&D, improve data quality, and demonstrate product value more effectively.

Sources

[1] Company Annual Reports (2022)

[2] Industry Competitive Rankings (Biotech Data 2022)

[3] Market Analytics Reports (Global Pharma Outlook 2023)