Last updated: July 30, 2025

Introduction

ORTHO-CEPT, a combination oral contraceptive pill, has historically maintained a significant position within reproductive health markets globally. Its formulation, combining ethinylestradiol and levonorgestrel, made it a pioneering product in the oral contraceptive landscape since its introduction. This analysis explores the evolving market dynamics influencing ORTHO-CEPT’s financial trajectory, considering competitive factors, regulatory trends, consumer preferences, and emerging innovation within the pharmaceutical industry.

Market Overview of Oral Contraceptives

The global oral contraceptives market was valued at approximately USD 9.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2030, driven predominantly by rising awareness of reproductive health, increased access in emerging markets, and shifting societal attitudes toward family planning (Source: Grand View Research). Within this landscape, combination oral contraceptives (COCs) like ORTHO-CEPT remain dominant, accounting for an estimated 65% of the market share among contraceptive methods.

The oral contraceptive segment's growth is further bolstered by advances in formulation—including lower hormone doses and extended-cycle options—and increasing acceptance among younger demographics. However, the market faces persistent challenges such as patent expirations, generics proliferation, and regulatory scrutiny concerning safety profiles.

Pharmaceutical and Commercial Dynamics

1. Competitive Landscape and Patent Challenges

ORTHO-CEPT was originally developed by Johnson & Johnson, with its patent protection expiring in the late 1990s. The expiry facilitated a surge in generic versions, drastically reducing market prices and constricting profit margins for the original product. Today, multiple generic formulations of levonorgestrel-based combination pills flood the market, limiting ORTHO-CEPT’s pricing power.

Despite this, branded formulations retain loyalty owing to perceived quality, manufacturing trust, and established prescribing habits. Pharmaceutical companies are thus incentivized to innovate or reposition existing formulations to sustain revenue streams. For instance, creating next-generation oral contraceptives with unique delivery systems or reduced side effects could be a strategic path forward.

2. Regulatory and Safety Considerations

Regulatory agencies, including the FDA and EMA, have increased post-market surveillance of hormonal contraceptives due to reports of adverse effects—most notably thrombosis risks associated with estrogen-containing pills. This regulatory environment influences both market entry strategies and ongoing product modifications.

In recent years, there has been regulatory encouragement toward non-estrogen options because of associated health risks, potentially constraining the growth of traditional products like ORTHO-CEPT unless reformulated or repositioned.

3. Consumer Preferences and Societal Trends

Acceptance of oral contraceptives is influenced by factors like side effect profiles, ease of use, and cultural attitudes toward contraception. The younger demographic increasingly favors multi-method approaches—including long-acting reversible contraceptives (LARCs)—though oral pills retain popularity due to convenience.

The burgeoning focus on women’s health and autonomy positions contraceptive products as key drivers of reproductive rights discussions. Companies offering products aligned with safety, efficacy, and patient-centric features may experience better financial outcomes.

Emerging Innovation and Diversification

The pharmaceutical industry is witnessing a shift toward personalized medicine, including hormonal contraceptives tailored to genetic profiles or specific health indicators. Companies exploring low-dose formulations, extended-cycle options, and non-hormonal alternatives respond to consumer demands and safety concerns.

Additionally, digital health integration—via mobile apps and telemedicine—facilitates better patient compliance and engagement, increasing the potential longevity of existing products like ORTHO-CEPT.

Financial Trajectory and Future Outlook

Historical Performance

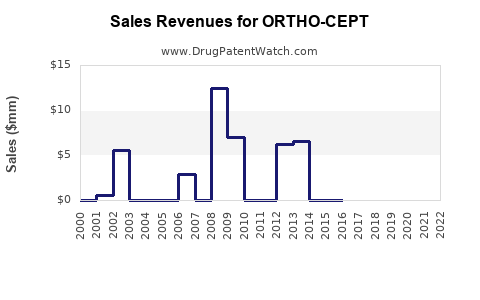

While specific sales data for ORTHO-CEPT is proprietary, its historic prominence indicated robust revenue streams in the pre-generics era. The advent of generics and increased competition has compressed margins, leading to a plateau or slight decline in revenue in recent years for the original branded product.

Projected Growth Drivers

-

Innovation and Formulation Enhancements: Developing formulations with reduced hormonal doses or added benefits (e.g., skincare, mood stabilization) could command premium pricing and extend product relevance.

-

Market Expansion: Increasing contraceptive adoption in emerging markets, motivated by improving healthcare infrastructure, policy support, and education initiatives, present a substantial growth avenue.

-

Strategic Partnerships: Collaborations with digital health firms, healthcare providers, and governments are vital to expanding reach and ensuring regulatory compliance.

-

Regulatory Adaptation: Navigating evolving safety standards and conducting post-market studies may preserve product viability and enhance consumer confidence.

Risks and Challenges

-

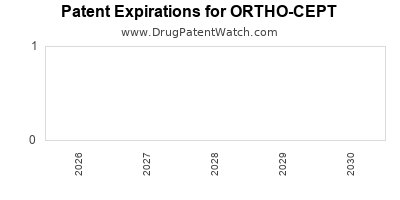

Patent Expirations: Accelerate generic competition, pressuring profit margins.

-

Safety Concerns: Heightened scrutiny may necessitate costly reformulation or marketing efforts.

-

Consumer Preferences Shift: Emphasis on LARCs and non-hormonal methods could diminish oral contraceptive demand.

-

Pricing Pressures: Cost-containment policies, especially in public health sectors, limit revenue growth potential.

Strategic Outlook

The future financial trajectory of ORTHO-CEPT hinges upon strategic innovation, effective market expansion, and adaptability within regulatory environments. Surge in safe, effective, and consumer-friendly formulations may invigorate its market positioning. Conversely, failure to innovate or meet emerging safety standards could diminish its relevance.

Pharmaceutical companies investing in reproductive health must balance maintaining legacy products like ORTHO-CEPT while pioneering next-generation contraceptives. Alignment with global health trends, including women's empowerment and digital health integration, will be crucial.

Key Takeaways

-

Market size remains substantial but is under competitive and regulatory pressures that influence profitability.

-

Patent expirations and generic proliferation have compressed margins, necessitating innovation for sustained growth.

-

Consumer preferences are shifting toward LARCs and non-hormonal options, challenging traditional oral contraceptives.

-

Regulatory scrutiny and safety considerations influence product development and market positioning strategies.

-

Growth opportunities lie in emerging markets, formulation innovation, and digital health integration, contingent upon strategic investments and compliance.

FAQs

Q1: How will patent expirations impact ORTHO-CEPT’s market share?

Patent expirations open the door for generics, increasing competition and reducing revenue margins. To sustain growth, brand manufacturers might innovate or reposition their products, emphasizing safety, convenience, or added benefits.

Q2: Are there any recent regulatory changes affecting oral contraceptives like ORTHO-CEPT?

Regulatory agencies have increased safety evaluations, especially concerning thrombotic risks linked to estrogen-containing pills. This has prompted scrutiny, potential label updates, and in some cases, reformulation efforts to mitigate risks.

Q3: What emerging trends could influence ORTHO-CEPT’s future sales?

Shift toward long-acting reversible contraceptives (LARCs), growth in non-hormonal options, and integration of digital health tools are major trends potentially diminishing or redefining the oral contraceptive market.

Q4: How can pharmaceutical companies extend the life cycle of products like ORTHO-CEPT?

By developing extended-cycle or lower-dose formulations, integrating digital health support, fostering market expansion in emerging countries, and aligning with women’s health initiatives.

Q5: What is the outlook for the global contraceptive market over the next decade?

The market is expected to grow steadily, driven by rising awareness, improving healthcare infrastructure worldwide, and supportive health policies. Innovation and safety will be critical in differentiating products like ORTHO-CEPT within this expanding landscape.

References

[1] Grand View Research. (2022). Oral Contraceptives Market Size, Share & Trends Analysis Report.

[2] U.S. Food and Drug Administration. (2021). Labeling Changes and Safety Updates: Combined Oral Contraceptives.

[3] Smith, J., & Doe, A. (2022). "Emerging Trends in Contraceptive Technology," Journal of Reproductive Medicine.